Venture-backed Insurtech Foresight Poised to Shake Up Workers Compensation

Foresight offers an innovative workers’ compensation program for safety-critical verticals

Foresight recently announced its technology-first workers’ compensation program for brokers serving businesses in historically hazardous industries, making it the first commercial insurtech MGU to focus on the middle market. To date, Foresight has raised $20.5 million from industrial technology venture capital firms, led by Brick and Mortar Ventures and Builders VC (investors in Oscar Health).

Foresight is shaking up the traditional workers’ compensation model by wrapping risk management technology and services into every policy. Where lowering workers’ compensation premiums generally takes at least three years, Foresight monitors safety engagement and rewards proactive insureds sooner.

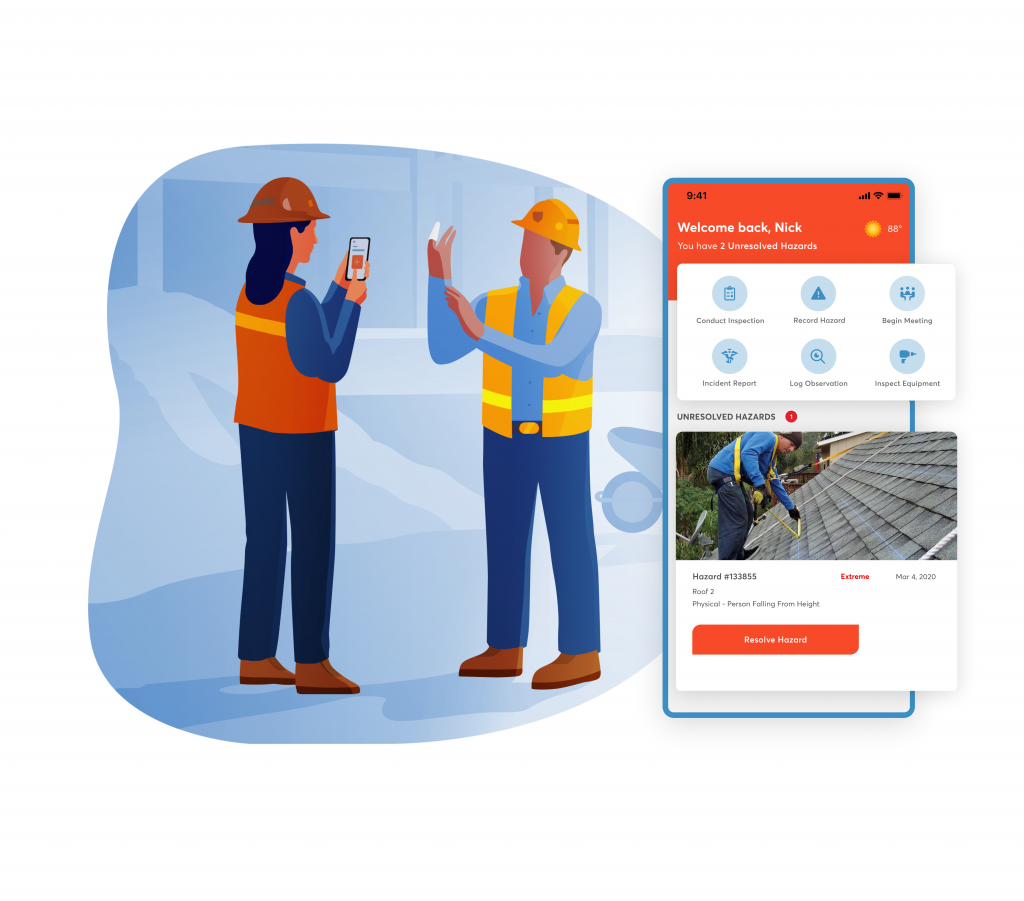

Developed over six years and with the help of multimillion-dollar private investment funds, Foresight’s proprietary technology streamlines risk management for brokers and insureds. All safety data captured using the software is private to the insured except for the safety score, a machine learning-based metric that measures overall safety engagement against industry best practices and company history. Foresight uses the safety score to credit the insured and lower their premiums faster.

“It’s common for middle-market, blue-collar businesses to invest heavily in safety improvements while also paying high workers compensation premiums,” says David Fontain, founder and CEO of Foresight. “We’re using technology to strengthen the correlation between safety and lowered premiums so that industry in the US is more profitable and safer overall.”

In addition to providing technology for the insured, appointed brokers do business digitally on the Foresight platform as well. Features like in-app risk submission, compliance reporting, and claims management streamline client support processes.

“Our risk management technology has been evaluated by a top actuarial firm and found to consistently reduce incident frequency by up to 57%,” says Emilio Figueroa, Foresight’s Chief Insurance Officer. “Because our technology is effective, we’re able to offer competitive rates for hundreds of class codes spanning the construction, manufacturing, logistics, light industrial, and agriculture verticals.”

Foresight is now appointing a group of founding broker partners specializing in middle-market business in Texas, California, Arizona, New Mexico, Louisiana, Arkansas, Nevada, and Oklahoma. Foresight expects to launch workers’ compensation in the eastern US later this year and a general liability line in early 2021.

Contact hello@getforesight.com or visit getforesight.com to learn more.