Betterview and Synpulse Announce Partnership to Accelerate the P&C Underwriting Cycle by Integrating Betterview’s Predictive Analytics into In-House and Third-Party Underwriting Systems

SAN FRANCISCO, CA – September 17, 2019 – Betterview, which is quickly becoming the platform essential to every transaction around buildings and properties, today announced it has partnered with Synpulse, a management consulting firm that focuses on accelerating underwriting processes for P&C insurers. Synpulse will provide consulting and implementation services for Betterview’s API in the United States for interested Betterview customers.

Synpulse, founded in 1996, is headquartered in Zurich, Switzerland, with branch offices in Germany, USA, Hong Kong, and the United Kingdom. Synpulse works with insurance carriers along the entire value chain, from the development of strategies and their operational realization, all the way to the technical implementation and handover. In addition, Synpulse also works with P&C insurers on vendor selection, target model definition, digital transformation, and various integration initiatives.

“After spending time with the Betterview team and reviewing their predictive analytics for commercial and residential buildings and roofs, we saw first hand how their solution could generate value throughout the entire underwriting chain,” said Marc Kirchhofer, Manager, Synpulse. “In a recent survey of global risk engineering executives that we conducted, expedited risk assessment through a third-party data integration ranked second in importance. One of the more challenging data pre-fill elements has always been roof information, which until now required boots on the ground inspections, reviewing aerial imagery manually, or asking customers about their roofs. Synpulse can now pre-fill Betterview’s predictive roof score and characteristics into in-house or third-party systems like Loss Control 360 or Guidewire to help insurers accelerate their underwriting decisions and enhance straight-through processing of submissions,” said Kirchhofer.

Through its team that has deep roots in the insurance industry, Betterview understands that every carrier faces IT burdens to getting their software solutions off the ground. Betterview may be implemented as a stand-alone solution or integrated into underwriting process via:

- API: Betterview’s REST API can receive and return results for a truly automated workflow by integrating into in-house or third-party systems.

- Guidewire Integration: With direct Guidewire integration, mutual clients can leverage Betterview’s capabilities through the Guidewire Marketplace.

- Batch Processing: Betterview can accept CSV files for large renewal books and recently bound new business. This requires no integration and allows carriers to take immediate actions by filtering policies by risk score.

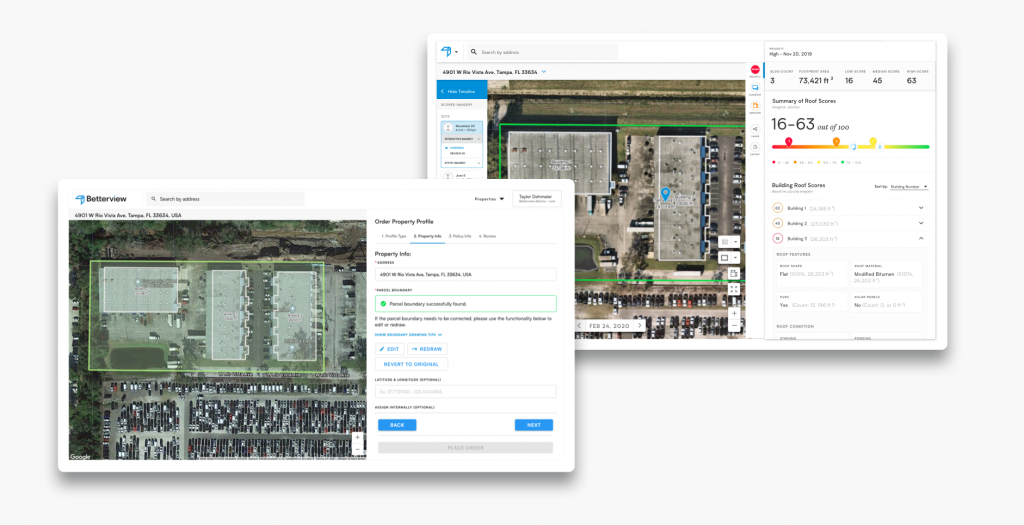

- Web-based Interface: Betterview can set up access for underwriting teams, allowing them to investigate properties that need further review.

“In order to accelerate the underwriting cycle, it’s vital to have as much relevant information as possible in the early stages of underwriting,” said Dave Tobias, COO & Co-Founder, Betterview. “The combination of Betterview’s predictive analytics, along with Synpulse’s expertise in embedding data into in-house and third-party underwriting systems, will allow insurance underwriting teams to improve decision making by quickly approving, denying, or identifying policies that need a closer look,” added Tobias.

For more information about this announcement, please contact Paul Ptashnick at paul@betterview.com or Marc Kirchhofer, Manager, Synpulse at marc.kirchhofer@synpulse.com.

About Betterview

Betterview provides property insight and workflow tools for Insurance companies to improve the customer experience by accelerating decisions and improving risk at every point of the life cycle. For more information about Betterview, visit: https://www.betterview.com

About Synpulse

Synpulse is an internationally established management consulting company and a valued partner of many of the world’s largest financial services companies. Since its formation in 1996, Synpulse has supported banks and insurance companies along the entire value chain, from the development of strategies and their operational realization through to technical implementation and handover. Synpulse stands out due to its profound industry know-how as well as the passion and commitment of its more than 450 employees. Synpulse is represented i.a. with offices in New York, Zurich, Geneva, Dusseldorf, Frankfurt, Ulm, Bratislava, Vienna, London, Singapore, Hong Kong, Manila and Sydney. For more information about Synpulse, visit: https://www.synpulse.com/en_ny