The Day Lucky Lady Luck Ran Out

By Adam Nunes, Director of Sales, Betterview

On July 15th, the roof of the Lucky Lady Casino partially collapsed, injuring 11 people. According to news reports, the section that collapsed was located just above the casino lobby and was supporting two commercial HVAC units. Fortunately, early reports indicated that nobody was badly injured or killed. We wish the victims a speedy recovery.

When the Betterview team heard about the collapse, we immediately looked it up in our risk management platform to learn more about the condition and history of this roof.

Left: Betterview detection image; Right: Image taken by news cameras post-collapse

Left: Betterview detection image; Right: Image taken by news cameras post-collapse

Since we are a company that focuses on risk management and predictive analytics, our team was hot on the case to decipher the cause of loss. We applied our data and scoring algorithm to assess the condition of the roof before it collapsed.

After assessing the data, we can confidently say that a large contributing factor to the collapse of this roof was due to poor condition and maintenance of the roof itself.

The Betterview team used our proprietary technology and scoring algorithms to assess the condition. We then assigned a score of 28 out of 100 to Lucky Lady’s roof. In a typical commercial property portfolio, a score of 28 would be in the riskiest 9th percentile. Insurance carriers using the Betterview score typically have a score threshold for taking a second look at any property coming up for underwriting or renewal. This threshold is selected so as to maximize the opportunity to review properties destined to have claims while minimizing false-positives (the needless scrutinizing of properties not destined to have a claim in the policy period).

The actual threshold is driven by insurer portfolio decisions. However, a score of 28 is indicative of such a high risk that even a very laid back insurer, willing to take a second look at no more than the riskiest 10% of properties, would have scrutinized Lucky Lady Casino. When Betterview looked at some analogous portfolios of commercial properties, we found that a whopping 45% of structures that scored 28 or less generated a loss claim within the very next policy period.

Had Betterview’s data been leveraged by the casino’s insurance carrier, this property likely would not have been written without exclusions or endorsements, if at all. Perhaps the owner would have been forced, as an insurance condition, to replace the roof and thus the entire calamity could have been avoided.

The Betterview Use Case

Betterview uses machine learning and computer vision to pinpoint roof attributes and score the roof condition of each property.

With over 50 years of combined insurance and inspection knowledge and hundreds of thousands of roofs inspected in our lifetimes, we know a bad roof when we see one.

We’ve applied our knowledge and created a proprietary predictive score to assess roof condition in a digestible format. This allows insurance carriers to better understand, mitigate, and triage risk.

A roof is a building’s last line of defense from external perils. A roof ensures the safety of the lives and contents within. However, bad roofs are a massive problem for insurance carriers. Not only can they lead to a costly property claim, but also liability and business continuity claims.

Now, let’s go to the tape:

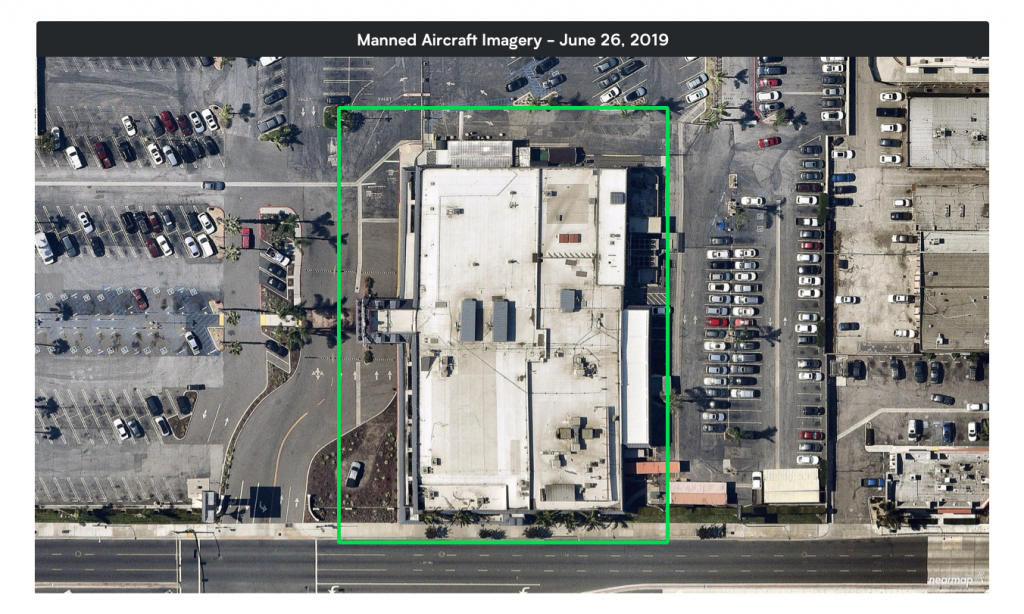

Photo as of June 26th, 2019

When we entered the casino’s address into our risk management platform, it automatically identified the parcel boundary and aggregated aerial imagery from several of our partners.

For this location, we were able to retrieve manned aircraft imagery from June 26, 2019, along with historical imagery (manned aircraft, satellite & oblique) that dates back to 2014.

While this may appear to be an ordinary roof and acceptable risk, images appear differently through the Betterview lens. We prefer to focus on the condition attributes which detail the overall life, longevity, and stability of the roof.

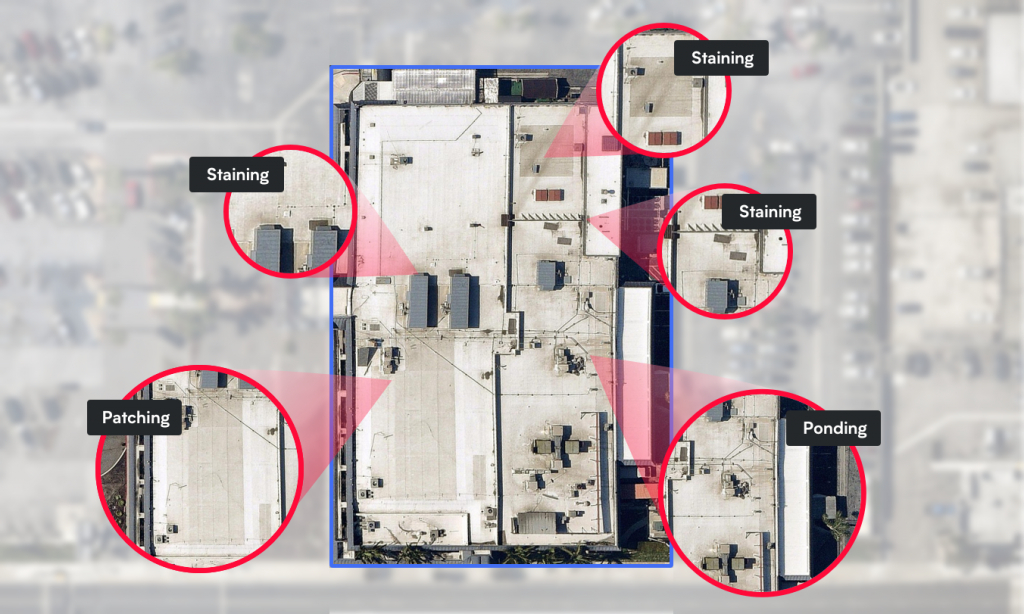

Betterview’s computer vision recognized that this roof had prevalent patching, water ponding, staining, and debris. While each of these attributes on its own is not a problem, our scoring algorithm assigns a much lower score when all of these attributes are present.

Patching

The first attribute we see is prevalent patching running horizontally along the roof. Betterview’s computer vision classified this patching as “prevalent.” The abundant and widespread patching indicates that the roof is likely near (or past) the end of its useful life. Furthermore, of equal importance, is the concern over any previous moisture intrusion that may or may not have been properly addressed.

Water Ponding

It is not uncommon for flat roofs such as Lucky Lady Casino to show signs of water ponding. Although the ponding on this roof was moderate, it is a signal that there was at one time standing water on the roof.

Standing water for a prolonged period of time leads to moisture exposure. When roofs are exposed to moisture and standing water, it manifests into leaks and cracks across the material. When the roof material develops weak spots, it spreads over time and turns into a bigger issue down the road.

Staining

We also witnessed staining of the roof. While roof staining by itself is not problematic, it can be interpreted as a signal of age and exposure to weather or materials. This factors into our scoring algorithms and allows insurance carriers to understand the actual condition of the roof.

While some companies may use staining or discoloration as a proxy for damage, there is an important distinction to make here.

Damage is more concerning. When damage is present, wind and weather events will likely damage the roof further. Weather will not have an effect on staining, save for cosmetic purposes.

Permit, Natural Hazard Perils and Man-Made Risks

While the visual analysis of this roof shows that this roof was in poor condition prior to a loss, there’s more data we can apply to form to a well-founded conclusion.

When you enter an address into our platform, we not only tell you about the roof, we also pull natural and man-made data, as well as building permits so users can dig deeper.

The first data set we’re going to look at is municipal building permits. While permit data coverage varies county by county (some counties keep exceptional records, others may not), casinos are kept under close supervision for all renovation, maintenance, and repair work.

Betterview has access to digital permit libraries. Dating back to 1995, Lucky Lady casino applied for 99 permits. Throughout the 24 year history of permits, only one permit was applied for and successfully issued for roof work. However, this permit did not apply for a full replacement of the roof. Instead, the casino elected to replace damaged planks and install cap-sheet over the areas.

While cap-sheet is indeed useful material and very durable, by electing to not replace the roof entirely, this acted as the proverbial band-aid on a bullet hole. This type of repair only delays the inevitable… a full roof replacement. Since the roof was likely near the end of its 25-year shelf life, it compounded matters.

Overlaying cap-sheet rather than electing for a full tear-off and replacement creates another problem: More weight.

More weight on a commercial roof is not a bad thing. However, the very next year Lucky Lady casino installed three new industrial AC units. These units were installed adjacent to the newly laid patching. The new patching likely was not as strong as the original TPO material and in turn did not support the weight of the AC units.

In addition, to permit data, another piece of data we look at are the natural hazard perils and man-made risks. In this instance, our platform identified a high earthquake threat for the area.

While the investigation into the Lucky Lady Casino roof collapse is still ongoing, on July 4th, Los Angeles witnessed its largest earthquake in two decades. This 6.4 magnitude earthquake was felt as far as 470 miles away in Reno.

This creates a perfect storm. Now we have a roof that shows patching, staining, debris, water ponding, and poor maintenance. Add earthquake reverberations that hadn’t been felt in decades to the mix and you have the recipe for a roof collapse.

Note: One other piece of data that could have explained the poor maintenance of the building is the change in ownership. In June of 2017, the building was sold for $23,500,000.

If the buyer, or their insurance carrier, had the benefit of the Betterview score, it is likely that a roof replacement would have factored into the overall transaction.

Key Takeaways

This claim will surely cost Lucky Lady’s insurance carrier millions of dollars. It is not only a large loss on the property itself, but the 11 patrons who suffered injuries will likely be seeking damages from injuries. The carrier is also likely on the hook for extended business interruption expenses during repairs.

Betterview’s score of 28 would cause an insurance carrier to investigate the property further and apply appropriate underwriting actions, such as:

- Educate the insured about their roof issues and provide detailed documentation as to why they need to replace their roof

- Apply an ACV endorsement to the roof

- Exclude the roof from the policy

- Non-renew the policy at its anniversary

While we cannot definitively say that this roof collapsed precisely for these reasons, we can say one thing for certain: Betterview’s ability to predict loss is not new.

The Betterview score could have also foreseen or prevented other recent headline-generating roof collapses including the fatal collapse of the Nebraska Animal Medical Emergency Center on July 15 and the Lee Middle and High School in Michigan in early June. The roofs in these two instances, prior to their collapse, scored 20 and 7, respectively; indicating an even higher level of risk than the Lucky Lady Casino.

Betterview recently analyzed historical claims of one of our partners and found that the lowest 15% of scores accounted for 56% of all loss dollars paid out. This is a constant theme we see within our data.

Betterview’s proprietary score, coupled with our intimate knowledge of roofs and property condition, allows our customers to better understand high propensity risks hidden in their book of business and take appropriate action.

While Lucky Lady wasn’t so lucky on that fateful day, there are likely thousands of roofs in similar condition across the US today. Bad roofs are everywhere. Betterview is on a mission to find and elevate them for our partners.

For more information about Betterview, contact Adam Nunes at anunes@betterview.com