On Socks & Starling Bank

Starling Bank, a mobile-only UK challenger bank, recently added Aviva-backed online investment service Wealthify to its marketplace to provide users access to a variety of digital financial services.

“This partnership with Starling marks a key milestone in our business growth. We couldn’t be more excited to associate ourselves with a company like Starling who, for us, represent the future of banking. Starling’s simple and transparent approach sits perfectly alongside our mission to make investing accessible to everybody by breaking down the common barriers holding people back, such as lack of confidence, the belief that only wealthy people can invest, that investing is too expensive, or that it’s too risky to invest.” – Chief Investment Office at Wealthify, Michelle Pearce.

Refresher: Cardiff-based Wealthify is a low cost robo-investment service that launched back in April 2016 to attract millennials and those who are new to investment – users can start investing in one of five diversified investment plans through ISAs and general investment accounts starting with £1. Late last year, it was announced that Aviva has agreed to acquire the company, which has raised a total of ~$2.3M since its inception.

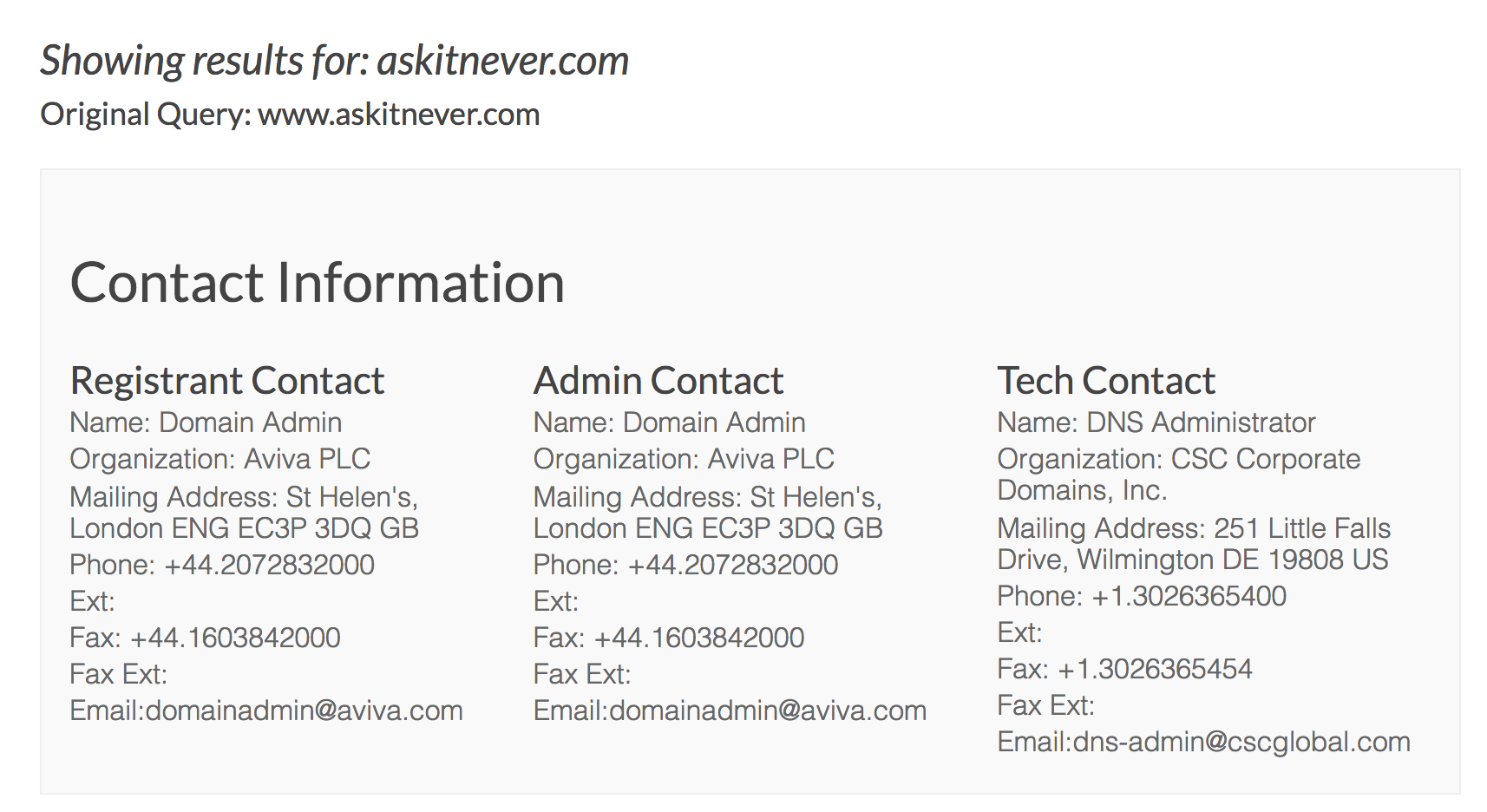

PS. Same Aviva that owns domain name ‘askitnever.com’.

PPS. Spotted socks, and more socks:

Came across @StarlingBank socks this morning and read the label (as one does) and had a nice chuckle pic.twitter.com/2wWnKlwcIE

— Stacey Harris (@StaceyAnnotates) April 25, 2018

https://twitter.com/danielschooler/status/988284475124736000