The Roots of Insurtech Root take hold: 1Q 2021 Results

Cinco de Mayo, or May 5, is a holiday celebrating the date of the Mexican Army’s victory over France in the Battle of Puebla during the Franco-Mexican War. Insurance, and especially Auto insurance, can be as demanding and damaging as any war. The U.S. auto insurance market is dominated by national titans, and the participants in Insurtech are like underdogs. Scrappy, tough, and ready to fight. None more so than Insurtech Root, which announced its first quarterly results as a public company tonight on Cinco de Mayo, 2021.

It’s fitting that they sponsored Nascar racer Bubba Wallace and launched an ad that you really should watch: Progress owes no apology. When you do what’s right, and stand up for others, there’s nothing to be sorry about.

The numbers are all going in the right direction

Root reported premiums for the first quarter of 2021 of $202.5 million, a 28% increase, and a net pre-tax loss of $99.6 million, 34% less than in the fourth quarter of 2020 (Table 1). Losses accounted for 49% of the DWP, which was 85% better than the fourth quarter of 2020, which was 91%. In addition, they reduced their direct accident period loss rate from 82.5% in the fourth quarter of 2020 to 77% in the first quarter of 2021. They are now licensed in all states except Florida and Massachusetts.

Root spent a lot of time talking about the better experience they have with renewing customers, and while renewing customers appear to have a 10% lower loss rate, that relationship has not improved in the last 15 months, and it seems unlikely that this difference will change significantly (Table 2).

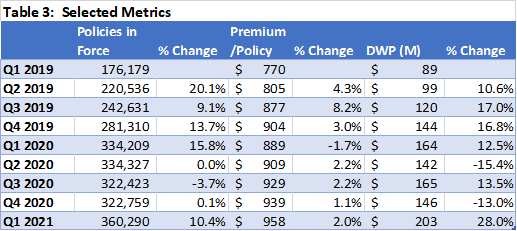

Table 3 presents selected metrics. Root was able to increase its current policies by 10.4% to just over 360k, while the average premium increased by 2% to $958 per insurance period. They increased their cross-selling of Renters by 14% to 8,835 policies. This corresponds to a cross-selling rate of about 2.4%. It will be interesting to see if Lemonade will have more success in cross-selling cars in their portfolio than Root has cross-selling Renters policies. They also indicated that they are likely to expand into additional products in the future.

The science of marketing

Root bragged about their improved data science of marketing and how their partner network will help them reduce acquisition costs. They also told how they collected a lot of earned media impressions. The way they talked about it, it almost sounded as if these impressions justified Root’s existence. As a former head of “Data Science” at USAA, Citibank, and Sallie Mae, I’m not sure there is any evidence to support this claim.

If we look at Table 4, we see that their acquisition cost per net new policy is a staggering $1,822.

If we use the back of the envelope calculations, if their 62% direct earned retention rate is similar for policies, they lost 63,545 policies in the quarter. Adding the 37,531 net new policies, we see that they added approximately 101,076 new policies, bringing their cost per customer to a more reasonable but still very high price of $677.

Technology: The root advantage?

Root is a technology-first car insurer. They pay a lot of attention and care to everything the customer does. Their telematics application is constantly improving. They have improved the onboarding and acquisition path of the customer and improved customer engagement by 28%. They are also focusing on streamlining the claims process. Furthermore, they declared that they are “on the threshold of offering our policyholders an autonomous claims experience for a significant part of our claims volume.” This is demonstrated by an example where FNOL was reduced from 1.7 days to a handful of seconds. They claim to resolve car damage claims in half the industry average time.

What does this mean for you?

Root has made significant progress and improvements in achieving profitable underwriting. They still have to work to achieve a competitive cost per acquisition, but they demonstrate the ability to attract and retain customers. They continue to invest in technology and improve the customer experience which is helping to reduce operating costs.

How can carriers and agents compete with root?

Incumbent carriers and agents must continue to be laser-focused on understanding your customers and their changing needs, not only throughout the automotive product but throughout the customer life cycle. Incumbent carriers and independent agents must ensure that they remain relevant and appeal to younger consumers and prospects.

You need to test telematics and see which customer, prospects, and agent base, or specific segments want telematics. Do you start with personal lines, commercial lines, or both? These are questions you need to answer based on your specific situation and needs.

As Lemonade is on the verge of entering the auto insurance market, if you do not have an up-to-date telematics program, you must identify potential technology partners. Insurtech Advisors has worked with our customers to help them understand the telematics landscape and work successfully with various vendors. Each telematics partner offers strengths and weaknesses that need to be reconciled with your needs, capacities, and culture. You should also take advantage of other technological advances emerging from the insurance technology space, like conversational AI, prefill, fraud detection, roadside assistance, and others. These advances will help you maximize your value to agents, policyholders, and employees.

Reach out if you want to discuss it or if you are thinking about anything else.

About Insurtech Advisors

Insurtech Advisors enables regional insurance carriers and agencies to partner with Insurtechs that will allow you to thrive and continue to meet the needs of your members and independent agents. We work closely with your team to identify opportunities and priorities and then personally curate the Insurtech landscape for you and introduce you to the best Insurtechs to start pilots with.