Peak Concentration

The term ‘concentrate’ is both a positive and a negative. For instance, juice from concentrate is considered bad while juice not from concentrate is considered good. Lemonade chose to name itself after a juice (there’s a debate whether lemonade is actually a juice) and the juicy judgement is that Lemonade is bad because it’s heavily concentrated.

During its investor day from earlier this week, the company shared that it had discontinued its direct home insurance business in the state of California since it wasn’t able to obtain approval for its rate increase request. Lemonade submitted a rate revision filing with the state of California in March, disclosing that 433,825 policyholders would be affected by the proposed rate increase, if approved. In the filing, Lemonade provided a breakdown of its home/renters/condo book of business – 382,958 (88.2%) are renters policies, 37,343 (8.6%) are homeowners policies, and 13,524 (3.1%) are condo policies. If you think this is Lemonade’s peak concentration, then have a look at Texas. In a rate revision filing from June, Lemonade disclosed 293,268 policyholders – nearly 95% of those are renters policies.

There’s more, of course.

54% of Lemonade’s written premiums as of September 30, 2022 are concentrated in just three states – California, Texas, and New York – which are known for their high number of renters. And 70% of Lemonade’s written premiums come from a total of seven states with the additions of Illinois, New Jersey, Colorado and Pennsylvania – also renter-heavy states.

When you are this concentrated, you are exposed. Fortunately, Lemonade isn’t exposed from an insurance perspective as the company relies heavily on reinsurance while doing its best to not sell home and car insurance. However, Lemonade is exposed from a business strategy perspective. For years, Lemonade mentioned ‘graduation’ as a key theme of its strategy, and this hasn’t changed since the company wants investors to concentrate on the future, not the past or present. “Take our loss ratio, for example. It tells you a lot about the business we sold 2 years ago, but it doesn’t tell you a lot about the business and policies we sold just 2 days ago. You’re investors. What if I told you that you need to manage your own portfolio today, deciding which stocks to buy and sell, using only the information available from the Wall Street Journal of January 2021?,” Lemonade’s chief business officer Maya Prosor beautifully said this week.

Back to ‘graduation.’

During the company’s investor day, Prosor mentioned the graduation component, which relies exclusively on renters. “We launched renters 6 years ago. And the short gist of it, it’s doing great. It’s profitable. We’ve been growing this product for the past 6 years consistently. And according to Google, we now have 9% market share. We’ve sold $223 million of IFP, which is exciting. But compared to our aspirations, the more exciting number is 1.4 million customers. As Daniel talked about, these are customers who are first-time insurance buyers, never purchased insurance before, and these are future homeowners insurance buyers, life insurance buyers, car insurance buyers. All of them are going to graduate into those products with 0 additional cost of acquisition.” Prosor mentioned this point again during her presentation. “Homeowners insurance is one of the cornerstones of personal lines. This is the product that our 1.4 million renters are going to graduate into.”

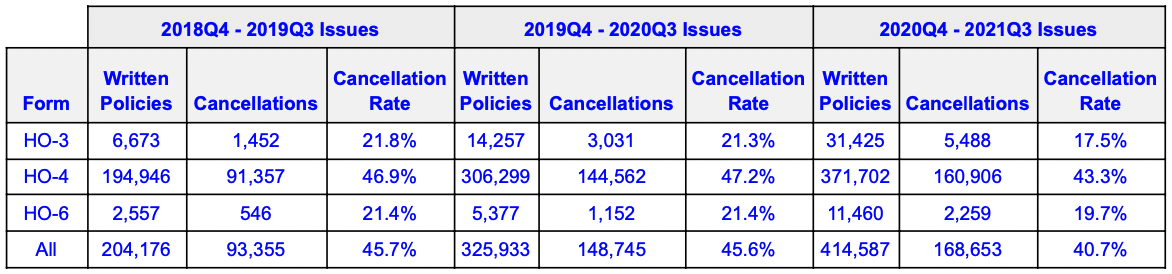

The housing market, inflation, mortgage rates, and common sense all suggest that Lemonade is likely to experience very few graduations. But what’s really alarming for a company that talks a lot about graduation is their high number of dropouts. The table below summarizes Lemonade’s cancellation rate over the last three complete years, which was included in the California state filing. (The total number of written policies in each year is compared to the number of cancellations for that cohort a year from the last issue to calculate a cancellation rate).

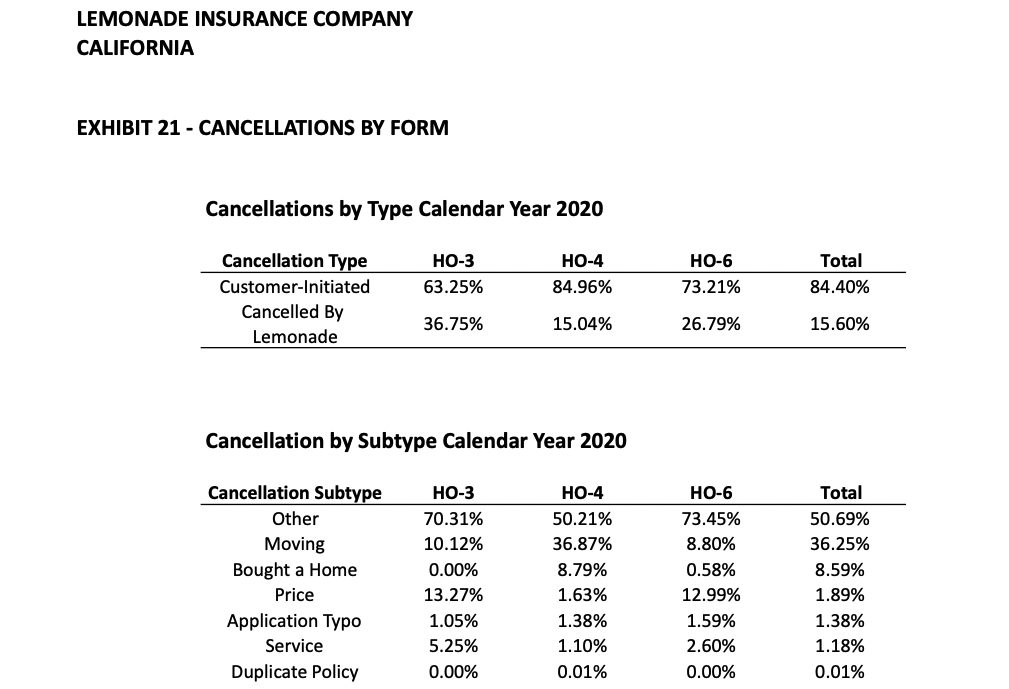

85% of these cancellations were customer initiated, which is not surprising considering the nature of renters and insurance. “Our overall cancellation rate is driven by the fact that the composition of our book is primarily renters (HO-4). Renters are more transient which lead to a naturally higher rate of customer-initiated cancellations. Renters may decide they no longer need the coverage or may move to a new location that requires cancellation of their existing policy,” Lemonade writes.

What is surprising, especially for a data-driven, AI-powered, machine learning-smart company, is the fact that the reason for 50% of the renters cancellations was ‘other.’ Also, notice the high company-initiated cancellation rate for homeowners insurance.

The good news for Lemonade is that most investors don’t read labels. The bad news, for many insurance startups looking to be like or better than Lemonade, is that they missed an important lesson of peak concentration. While Lemonade has ~$1B in cash, Root had to take out a $300M loan, go through two rounds of layoffs this year, and change its strategy from direct to embedded, to now see its top embedded partner go through another round of layoffs. The list goes on – Clearcover’s original strategy has changed, FOXO didn’t have a strategy, Loop thinks it has a strategy, Ethos is all over the place, and Bestow is becoming a tech vendor that happens to own a carrier.

Lemonade’s concentration on renters insurance isn’t driven by its graduation strategy. It is driven by graduation anxiety – going from simple insurance lines to more complex ones and the public exposure that comes with it. And yet, you have to appreciate this level of dedication and concentration.