nSurely raises €535,000

Irish insurance startup Inaza closed a €535,000 pre-seed funding round.

Founded in 2020 and still in ’emerging mode’, the company plans to help insurers calculate car insurance premiums based on vehicle data including mileage and driving behavior.

The team of ~7 is led by founder and CEO Aravind Ravi. “Usage-based insurance will help insurers better manage risk while giving consumers the ability to pay lower premiums that more accurately reflect their specific driving habits.” Following the fundraising round, the team hopes to grow and will launch pilot projects in a number of European nations, including Ireland and the UK, next year.

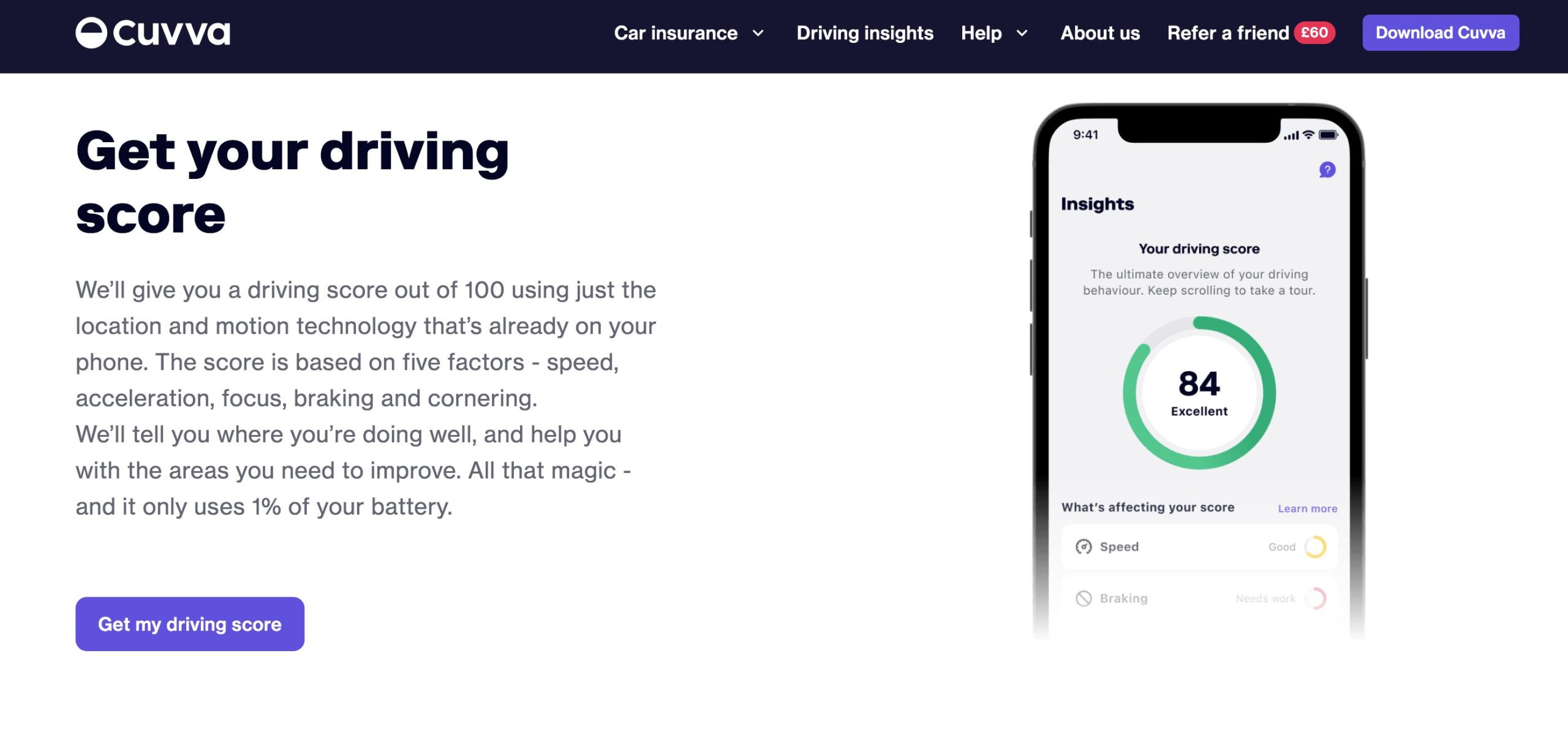

Staying on the subject of usage-based car insurance, London-based car insurance broker Cuvva recently introduced “Smart Pricing,” a fairer insurance pricing scheme that’s based on actual driving using mobile telematics. Smart Pricing pulls driving data that pertains to speed, braking, cornering, distraction, and accelerating to later generate a driving score out of 100. “We need you to drive 125 miles to make sure your score is reliable – but to tide you over, we’ll give you 10% off as soon as you sign up.”

As a refresher, Cuvva is mainly known for its hourly car insurance offering. It attempted to grow into other product lines in the past, such as travel insurance and taxi insurance, but these products were discontinued.

Finally, a job post uploaded by Subaru highlights the automaker’s plans to do more around insurance. Specifically, it is looking to “develop new insurance products including usage-based insurance, First Notice of Loss (FNOL) notifications, stolen vehicle tracking and other in-vehicle notifications with Liberty Mutual and other insurance companies.” Subaru has been a Liberty Mutual partner for at least 5 years, and the OEM encourages vehicle insurance shoppers to visit Liberty Mutual. It also had a deeper relationship at one point, when Subaru STARLINK customers could connect their cars to the Liberty app to track their driving behaviors.