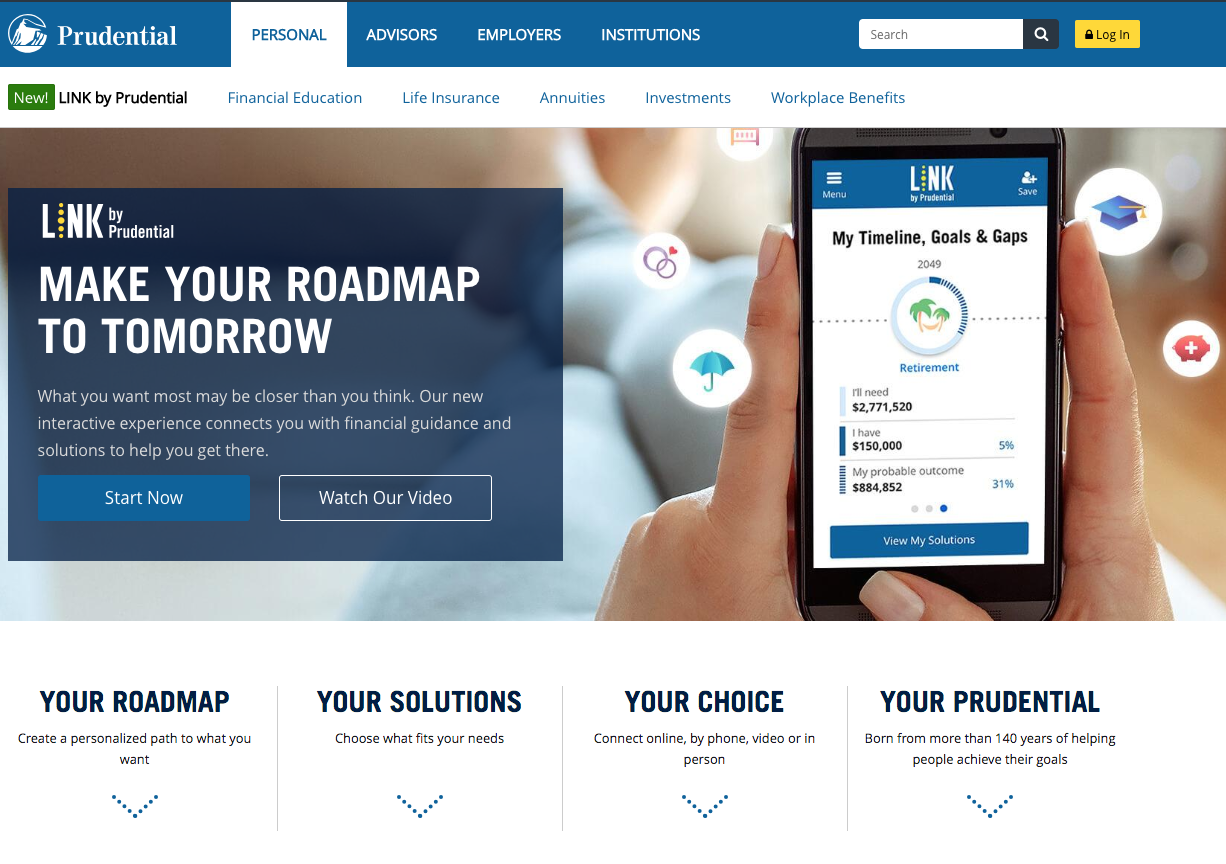

Introducing LINK by Prudential

Prudential, the 143-year-old company which has traditionally sold its products through advisors and employers, has launched LINK by Prudential, its first direct-to-consumer offering.

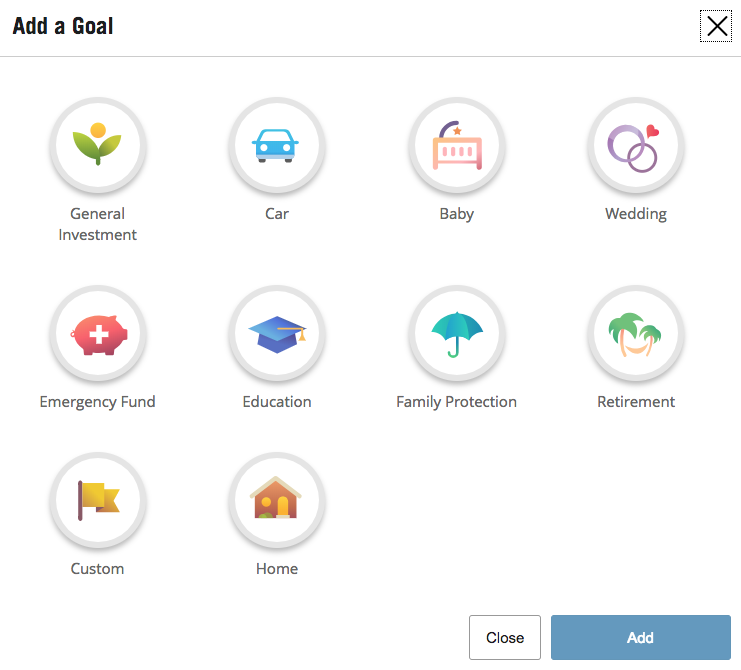

The new “interactive experience” allows people to plan for their financial future by building a profile – users answer basic questions about themselves and their financial goals from buying a home to saving money for retirement.

Once a profile has been created, Prudential will offer solutions based on one’s needs such as life insurance, annuities and investments. Get a feel for the flow below:

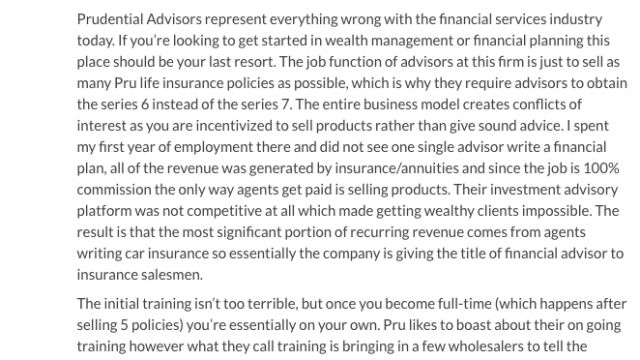

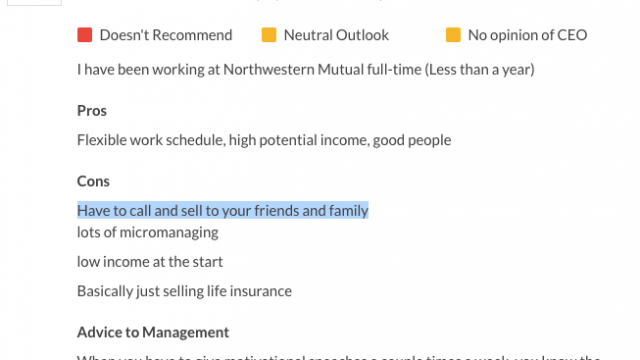

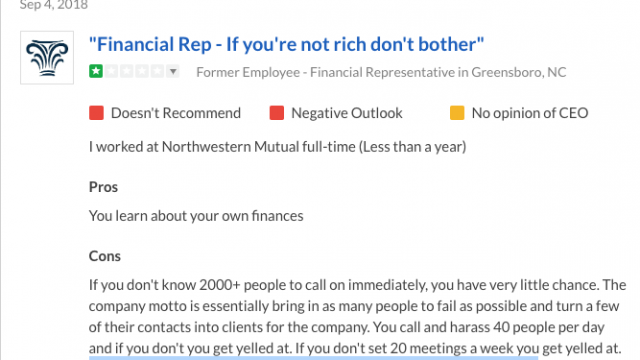

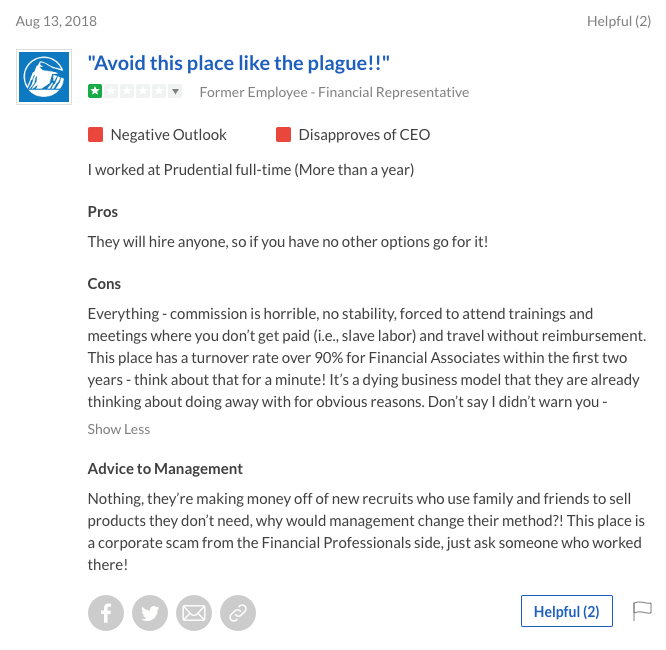

Note: Some insurance products were not designed to be sold online. Back when people were nice and answered their phones, and back when businesses relied on their accountants for payroll services, companies like Prudential thrived. But the world is not what it used to be – people don’t answer their phone, and businesses rely on platforms like ADP, Gusto, Zenefits and Justworks for all their payroll, HR and benefits needs. People like to talk about the window of opportunity – the reality is that we live in a very cold world where the window is just slightly open, leaving many companies with difficult products out in the cold. We talk a lot about customer acquisition – but acquiring an interested customer is one thing, and getting customers interested is another .

What’s good about today’s world is that it can be measured. With data and statistics, you’re able to find facts quickly, like this one: only 5,400 people search on Google each month for the term “save for retirement.” There’s the famous saying that insurance is sold, not bought – this is where determined sales agents come in handy. But, financial advisors and insurance agents are struggling with today’s consumers, and while there are 1,000 ways to sell insurance – this isn’t one of them.

Now, there’s another saying that people love to buy, but hate being sold. When you compare this with “insurance is sold, not bought” you understand why the traditional way of selling insurance is difficult in today’s world where consumers are in control. At the end of the day, technology alone won’t advance your traditional way of doing things.