Introducing Life Benefit by Wysh

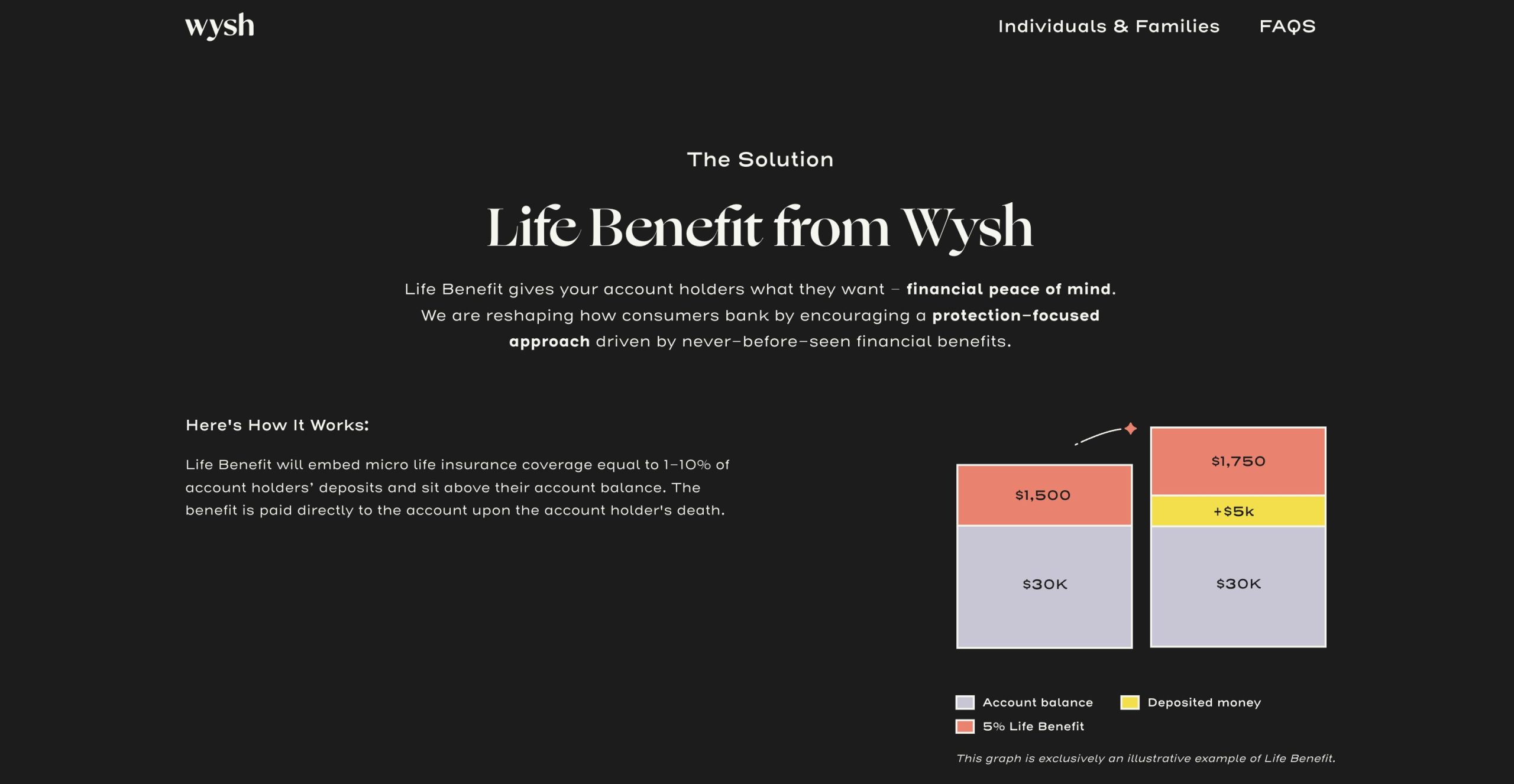

In an effort to ride the embedded insurance wave, Northwestern Mutual is using its direct-to-consumer insurance brand to offer Life Benefit. The product is geared towards financial companies and banking organizations and is a relatively simple concept: it’s essentially life insurance baked right into a deposit account. Financial institutions can opt to purchase Life Benefit policies, and upon doing so, they designate specific types of accounts—whether savings, checking, brokerage, or CDs—to come with this built-in insurance perk.

Once the bank or financial institution incorporates Life Benefit into designated accounts, the holder automatically qualifies for this coverage just by opening and maintaining one of these accounts – without the need of a medical exam. Anyone aged between 18 and 79 is eligible for this added protection.

If the account holder has a joint account, he is still eligible for Life Benefit, but there’s a catch. The coverage will only apply to the death of the account holder whose social security number is used for reporting the account’s taxable income.

The product is offered by Wysh Life and Health Insurance Company , an A- rated insurance carrier owned by Northwestern Mutual as of 2021. The policy is reinsured by Gen Re.

Bottom Line: Swiss Re runs iptiQ, Northwestern Mutual is the parent company of Wysh, and although MassMutual owns Haven Life, it has diverted resources ineffectively towards Haven Technologies.