Insurers in the U.S. lose $2.9 billion due to garaging misrepresentation every year

A policyholder’s garaging location might not be the first thing that comes to mind when thinking about personal auto insurance pricing and underwriting. However, American insurance providers lose $2.9 billion every year due to garaging misrepresentation. Today, we’ll explore what garaging misrepresentation is and how insurers can prevent it.

What is garaging misrepresentation?

Garaging misrepresentation happens when a policyholder misstates their vehicle’s garaging address on their policy. The garaging address is the location where a policyholder’s car is usually parked at night.

There reasons for why a policyholder would misstate their garaging address range from unintentional mistakes to intentional garaging fraud. For example, policyholders might forget to update their garaging address after moving. Students might state their parents’ home address instead of their college dorm address. Some policyholders state a wrong address in order to get charged a lower rate. In a few cases, insurance agents even encourage policyholders to do so.

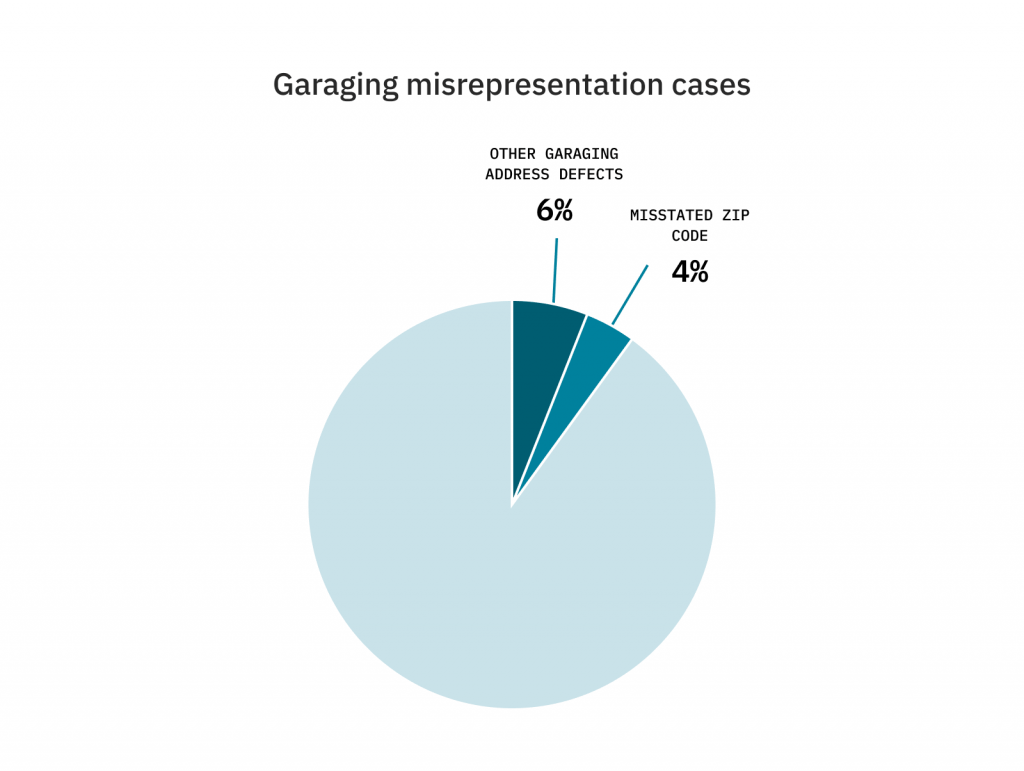

Garaging misrepresentation happens more frequently than most of us think. More than 10% of personal auto insurance policies have verifiable garaging address defects, and 4% even have a misstated ZIP code.

The impact of garaging misrepresentation

The price of an insurance premium heavily depends on the policyholder’s garaging address. Depending on the county, ZIP code, and factors like the area’s crime rate, insurers evaluate whether the car is garaged in a high- or low-risk area and adjust the policyholder’s premium accordingly.

When the stated garaging address is incorrect, this can result in a highly incorrect insurance premium price. For example, a policyholder who lives in Chicago but reports a garaging address in Gary, Indiana can end up paying 35% less for their insurance premium. Overall, insurers in the U.S. lose $2.9 billion due to garaging misrepresentation every year.

How to avoid garaging misrepresentation

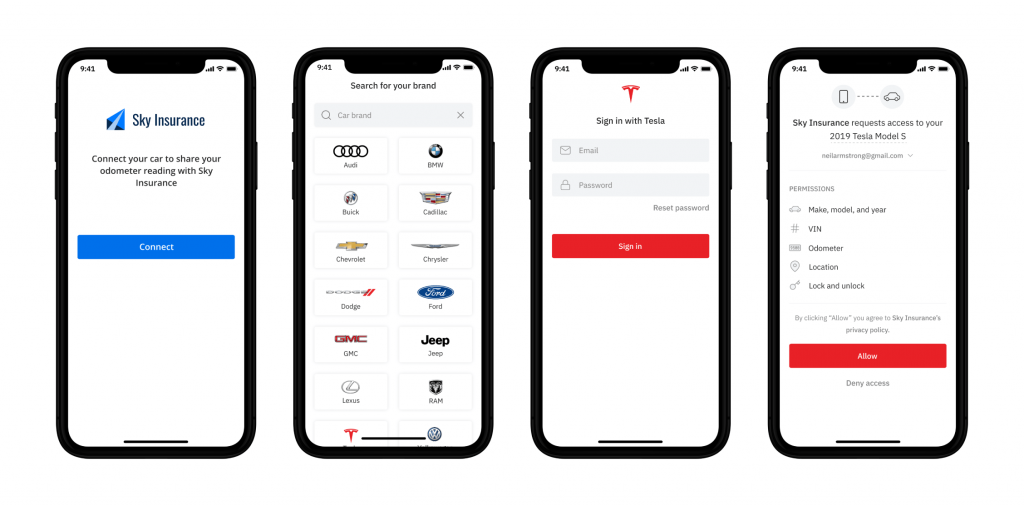

Luckily, garaging misrepresentation can easily be avoided. Car APIs like Smartcar allow insurers to effortlessly verify their policyholders’ garaging locations to address a $2.9 billion problem while respecting vehicle owner privacy and improving customer retention.

The Smartcar API allows policyholders to link their vehicle to their insurer’s application and to share specific vehicle telemetry with the insurer. Smartcar Connect flow makes this as easy as three clicks from any mobile or web app. Policyholders can review and consent to a list of specific permissions (e.g. read odometer, read location) that explains how the insurer will use this information.

Once the policyholder’s car is linked, the insurance provider can use Smartcar webhooks to automatically verify the vehicle’s location every few days or weeks during night-time hours. Smartcar’s technology integrates directly with each vehicle’s cellular modem and retrieves the vehicle’s actual location without needing access to the policyholder’s phone or any other third-party devices. This makes Smartcar’s solution instant, accurate, and easy to use, and privacy-focused.

Insurers that use Smartcar to verify their policyholders’ garaging locations have been able to uncover accidental misreporting, reduce garaging fraud, and calculate rates more accurately. They have also been able to improve their customer retention thanks to our transparent and user-friendly onboarding process.

Garaging misrepresentation is difficult to detect, which makes it especially difficult to prevent for personal auto insurers. Smartcar’s simple, instant, and user-friendly garaging location verification solution helps insurers solve this $2.9 billion annual problem easily and efficiently.