DealerPolicy collaborates with JM&A Group and Darwin

Polly has formed a strategic alliance with JM&A Group , a provider of finance and insurance (F&I) products to automotive dealers, and with Darwin Automotive , a J.D. Power subsidiary providing software and analytics services to automotive dealers. The three companies will work to deliver F&I solutions to dealers nationwide.

Founded in 2015, DealerPolicy is a Williston, VT-based insurance agency and a team of around 148 people. It primarily works with the automotive retail sector and as of earlier this month, it reached a network of over 800 dealers that pass on insurance leads to the agency.

Now – through JM&A Group – it will enjoy access to over 3,800 dealers, expanding its reach while incorporating personal insurance into JM&A Group’s process for presenting and selling service contracts and other vehicle protection products.

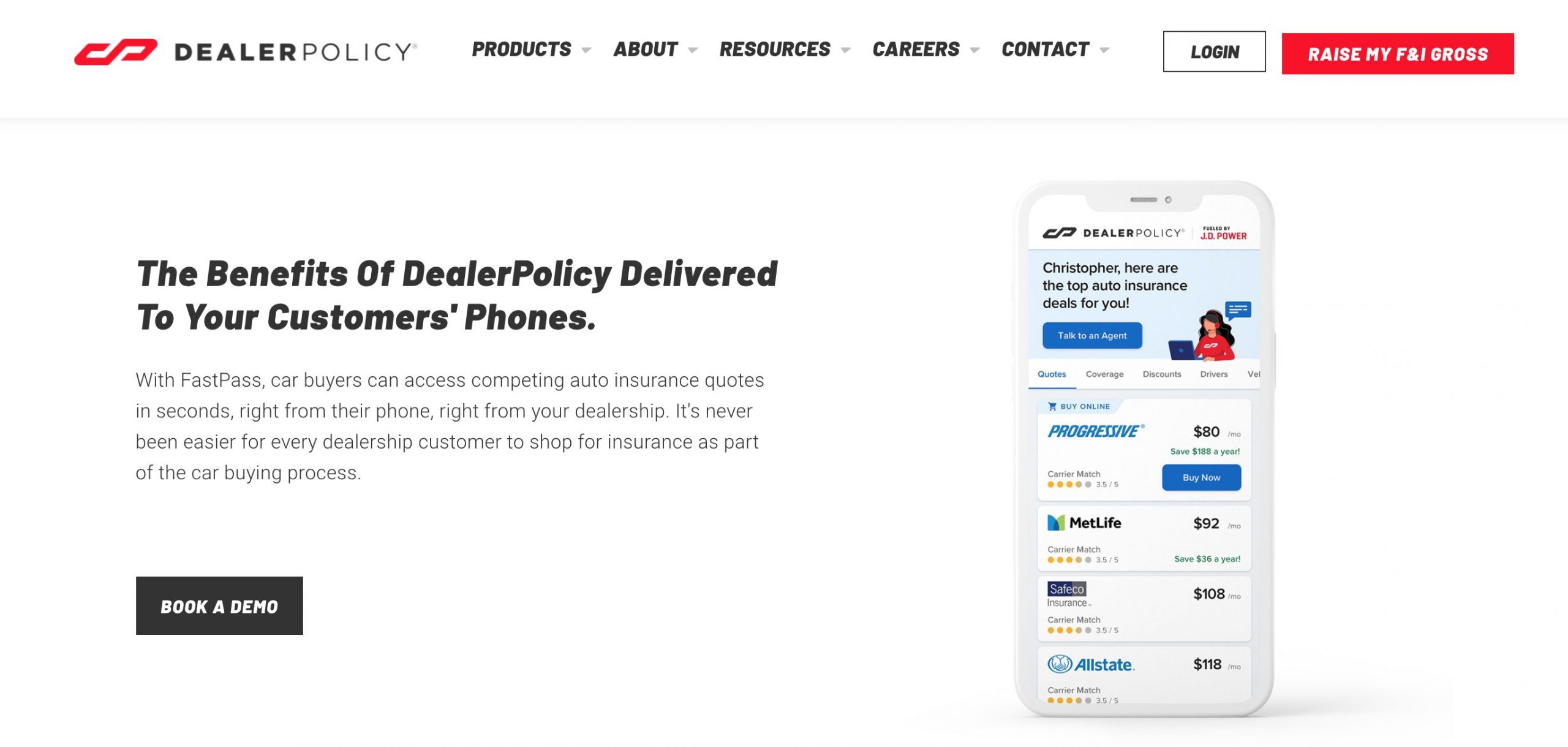

Also, DealerPolicy’s insurance solution – FastPass – will be integrated into Darwin Automotive’s menu used to present F&I products to consumers.

“With all of our product offerings through JM&A Group including Fidelity Warranty Services and Fidelity Insurance Agency, we want to maximize the value we bring to our dealer partners across the country. We immediately recognized DealerPolicy as one of those opportunities that perfectly aligns with our value proposition. DealerPolicy is leading this new and exciting category and providing tangible value to both dealers and consumers alike.” – Elliot Schor, Vice President of Sales Operations at JM&A Group.

“The real value that DealerPolicy brings to its dealer partners is their extensive knowledge of automotive retailing. Their ability to consistently convert insurance savings and customer buying power into incremental back-end profit has been a tremendous help to our business.” – Michael Fader, Vice President at MileOne Autogroup.

“Darwin Automotive is first and foremost an automotive technology company, and anything we can do to streamline a natural step in the process for dealers and customers is something we get really excited about. Seamlessly integrating DealerPolicy’s choice-based insurance solution, FastPass™, into the F&I menu drives meaningful value for our collective dealers and customers. We are thrilled to be a part of this collaboration that will enable the future of how people buy cars and insurance.” - Phil Battista, President of Dealer Technologies at J.D Power.

With DealerPolicy, personal insurance is available alongside traditional F&I products. On average, DealerPolicy Insurance customers, who report savings, save car buyers $64 per month on their automotive insurance, in addition to offering homeowner, renter, marine, RV, motorcycle, and powersports coverage.