Chase rolls out free identity monitoring

In 2017, Chase rolled out Chase Credit Journey, a free service for account holders that provides access to credit score information and identity protection. The bank offers this service in partnership with Experian while the up to $1 million identity theft insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company.

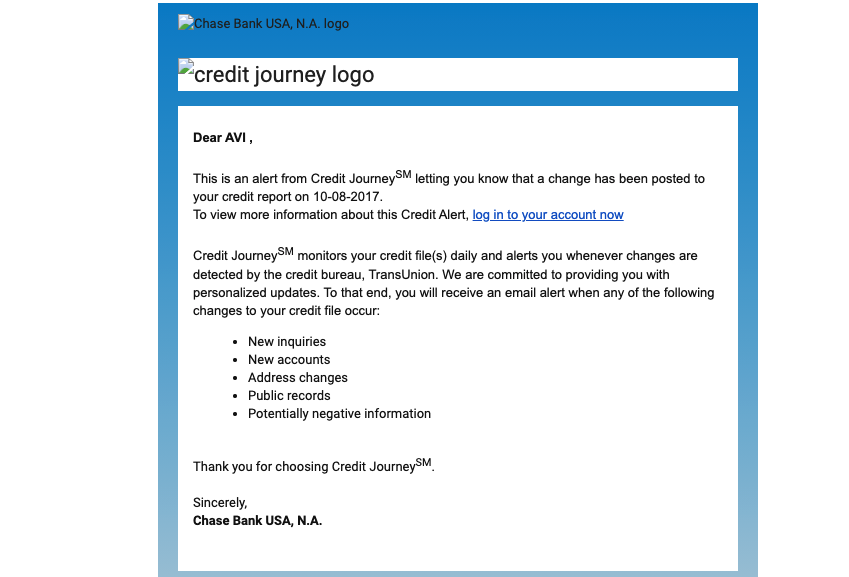

The service evolved over the years to include credit report monitoring where the Chase alerts users whenever there’s new activity. Here’s an example:

Now, Chase is adding a new free feature – identity monitoring – which tracks suspicious websites and activities and alerts users when any new activity has been detected, so they can stay on top of fraud. The key areas that will be monitored include the dark web, data breaches (alerting users if their data has been compromised), and identity verification by lenders (when a user applies for a loan). The service will also show users names and addresses linked to their social security numbers.

Identity protection is a product offered by a variety of insurers such as GEICO, Progressive, and Farmers, and in 2018, Allstate went on to acquire a company in this space for $525 million and it now offers identity protection services to businesses and individuals. But unlike Chase Credit Journey, the identity protection products offered by insurers aren’t free.

Bottom Line: We covered the free v. fee angle in our Identity Protection report.