Allstate Acquires Identity Protection Company for $525M

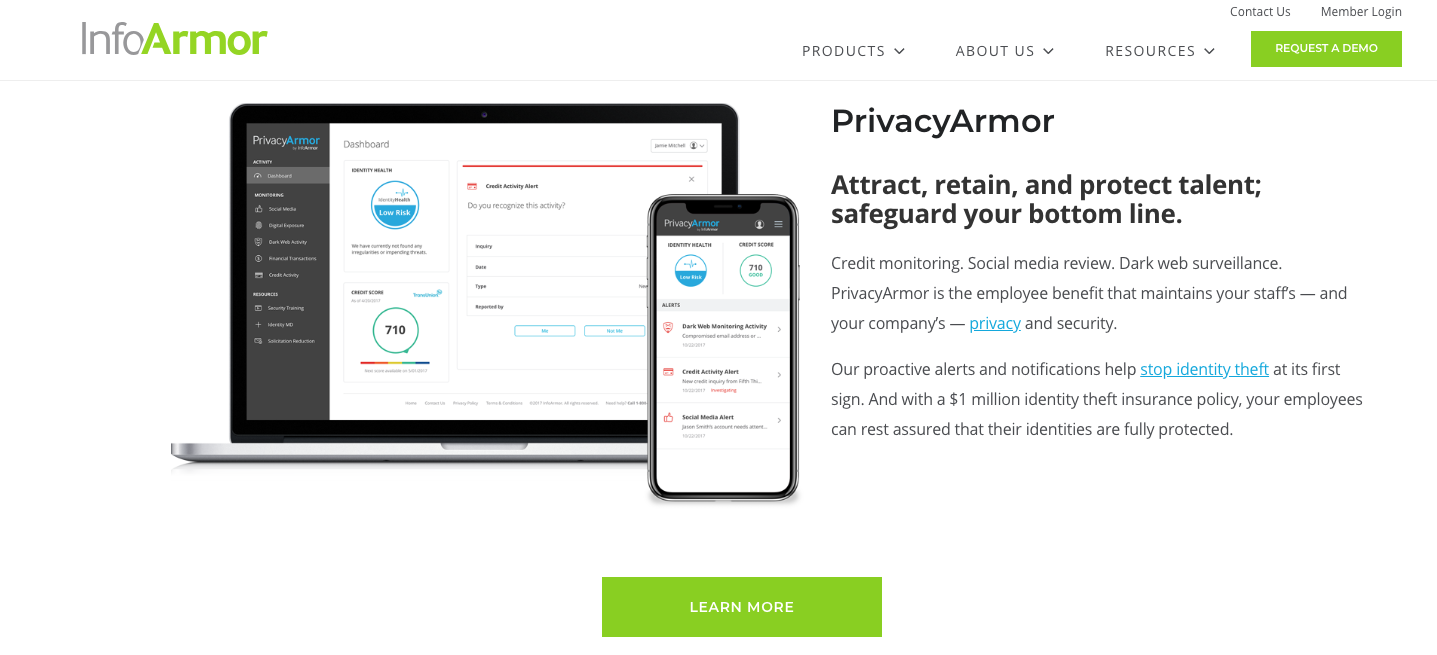

Established in 2007, InfoArmor offers identity protection products primarily through the employee benefits channel to ~1m employees. Its flagship product is an intelligence platform that monitors misuse of personal information (features include full identity monitoring, immediate, proactive alerts, digital exposure reporting, ID theft reimbursement and full-service restoration). The company operates in the space of LifeLock, IDShield, ID Watchdog, Credit Karma and credit bureaus. Last, the acquisition is strategically aligned with Allstate’s consumer protection focus.

“Consumers are increasingly at risk of having their digital identities compromised. Last year there were over 16 million victims of identity fraud, which resulted in over $16 billion of losses. With the acquisition of InfoArmor, Allstate will protect more customers from this risk and help rebuild their lives after they have been hacked. InfoArmor is the go-to identity protection company in the employee benefits market, providing an opportunity to expand the Allstate Benefits business now serving over 4 million employees.” – Chairman, President and CEO of Allstate, Tom Wilson.

“InfoArmor and Allstate are an unbeatable combination in providing identity protection to employees through voluntary benefit programs. Our relationships with top benefit brokers and over 1,000 companies will be enhanced by Allstate’s capabilities and access to the Allstate Benefits distribution network.” – CEO of InfoArmor, John Schreiber.

Bottom Line: InfoArmor will be a new Allstate market-facing business; existing management team to remain in place.

Source: Investor Presentation