BriteBee launches new response-tracking bot

The launch of the maintenance-free Bee Responsive bot caters to insurance professionals and aims to earn them more insurance conversions via the digital space.

The Oklahoma City insurtech startup, BriteBee, is gaining traction with the release of the new Bee Responsive response-tracking bot as the company continues to innovate the independent insurance model. The new bot is being offered free of charge to insurance agents on the BriteBee platform. It is specially designed to be consumer-centric, providing insurance shoppers the transparency to quickly compare how agents respond to their contact via telephone. CEO and Co-founder, Keagan Henson, says, “This is how we revolutionize the insurance industry. We’re not just here to improve agencies’ digital exposure, but also to change how agents and consumers talk to each other.”

Now introducing the Bee Responsive Response-Tracking Bot.

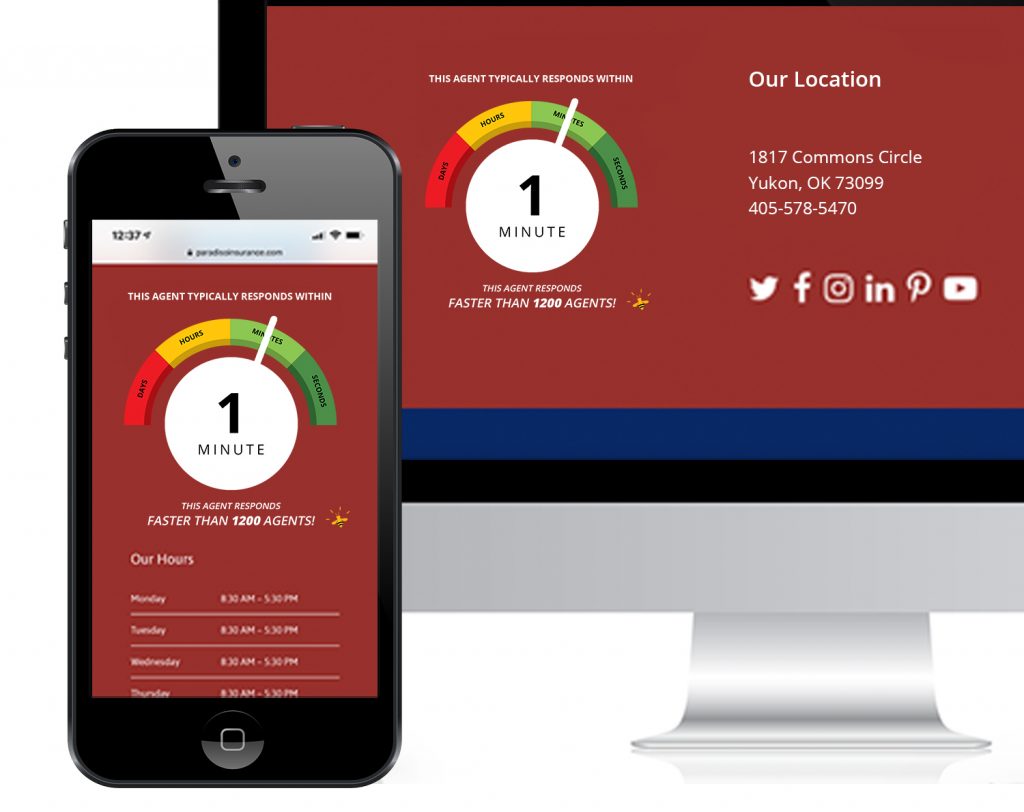

According to Insurance Journal, “insurance shoppers now consider timeliness to be the most important differentiator–above efficiency, professionalism, and knowledge–when purchasing insurance.” The Bee Responsive Bot™® (patent pending in all countries)–a dynamically-generated meter that measures how easily a prospective insurance customer can get an agency representative on the phone–is tackling this problem head-on by showcasing an animated GIF on insurance agency websites and email signatures, as well as their BriteBee.com profile in the near future.

BriteBee’s platform revolves around helping insurance agents overcome the problem of obscurity. “For more than five years, I learned firsthand as an agency owner that if you want to write an online shopper’s insurance policy, you need to be the first agent in communication with them,” says Henson.

What is a Response Tracker?

In a 2018 article titled “60 Seconds Could be Costing You Thousands: Why Speed to Lead is Critical in Insurance Sales,” a source from life insurance company NoExam.com claims that certain studies show insurance agents are 400% more likely to make a sale if they follow up within five minutes of being contacted. Other sources challenges that statistic, indicating that the best sales probability happens in the first 15 seconds of initial contact.

In the digital age, having the ability to gather information quickly is paramount for consumers who are researching online. The BriteBee team is bringing over 50 collective years of experience in the insurance, marketing and technical industries, and amplifying the user experience to better equip agents to take action.

Many are asking, “How does it work?” BriteBee will automatically call participating insurance agents on their main agency line at random dates and times to maintain the integrity of the response tracker. This process takes a matter of seconds and does not interrupt business flow, as it does not require any action from insurance agencies once the call is answered. Over a series of weeks, the bot will record how long it takes for an agency representative (or automated recording) to answer the phone and aggregate an average. The agent’s custom response time bot can be displayed on their website and email signature by copying a simple piece of HTML code found in their BriteBee dashboard.

This customer-centric technology is easily manageable and dynamically generates, meaning as BriteBee collects more data on the agency, the response tracker will factor in the new data and showcase real-time results. This allows information to stay current without demanding unnecessary action from the insurance agent.

![]()

Insurance Agents Can Now Showcase Response Time

Social proof, a term coined by Robert Cialdini in his 1984 book, Influence, is also known as informational social influence. It describes a psychological and social phenomenon, wherein people copy the actions of others in an attempt to undertake behavior in a given situation.

Backed by research, BriteBee believes that, by leveraging social proof, insurance agents have a higher probability of getting more calls to their agency. “This level of transparency is the first of its kind in the insurance space, as well as an opportunity to build credibility among potential insurance customers,” says Henson.

BriteBee’s new Bee Responsive bot will finally provide the much needed tangible customer service data required to convert in-market consumers looking for instant gratification.

Are You An Insurance Agent? Gain Free Access to the Bee Responsive Bot Via BriteBee.com

As the habits of consumers evolve in the digital age, BriteBee encourages insurance agents to remain open-minded to new technologies and “think outside the box” of their typical marketing efforts. BriteBee.com’s new comprehensive directory and online digital marketing platform is fighting for insurance agencies like Paradiso Insurance, M&P Insurance Services, Thomas Baste Insurance Agency, and Patriotic Insurance to appear in highly competitive search queries through strategic digital planning. The Bee Responsive bot is one of many upcoming technologies from BriteBee.com that will accomplish this for insurance agents.

Insurance agents can now gain access to the Bee Responsive bot and learn more by visiting BriteBee.com, or reaching out directly to support via email at support@britebee.com.