Bajaj Allianz Life on Fire

Back in Feb., Bajaj Allianz Life introduced Goal Assure, an online-only Unit-Linked Insurance Plan (ULIP) designed to provide investment benefits and life coverage to “life maximizers”, aka the new generation of investors in India.

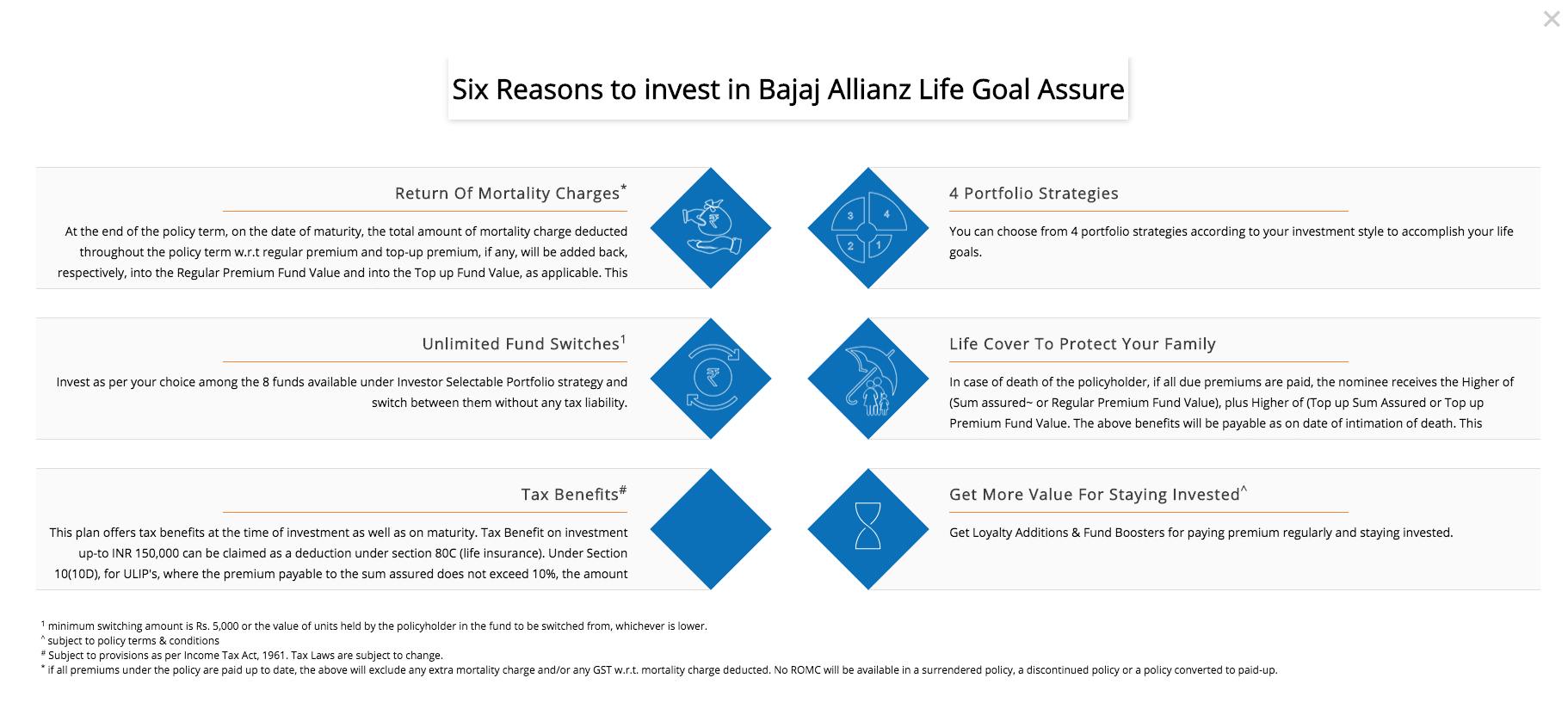

The product offers (1) a Return of Mortality Charges (ROMC), which guarantees that a policyholder will get back the cost of life insurance when the policy matures, and (2) the ability to receive the maturity benefit in installments by staying invested, which is an addition of 0.5% of each due installment.

Fast forward.

According to The Hindu BusinessLine, the product has brought in ₹120 crore since its launch. “The ROMC (Return of Mortality Charges) benefit – a new category created by us – has fired the online channel for us. We now plan to come up with more variations under ROMC and expand the online ULIP market to help customers meet their long-term life goals.”- Managing Director and CEO at Bajaj Allianz Life, Tarun Chugh.

Wait, there’s more. ~70% of the 12,000 policies sold online were sold to people 35 years old or younger. Last, a “significant” proportion of sales came through an aggregator. If we had to guess, we’d guess

What makes new-age ULIPs a flexible investment option? Find out on episode 5 of #TransparentUlips, an interaction between @VivekLaw, Founder, CEO and Editor-in-chief, @themoney_mile and Yashish Dahiya, Co-founder and CEO, @policybazaar pic.twitter.com/48Vwyw0KwT

— Bajaj Allianz Life Insurance (@BajajAllianzLIC) September 3, 2018