Getsafe Takes On Competition With Digital Contents Insurance

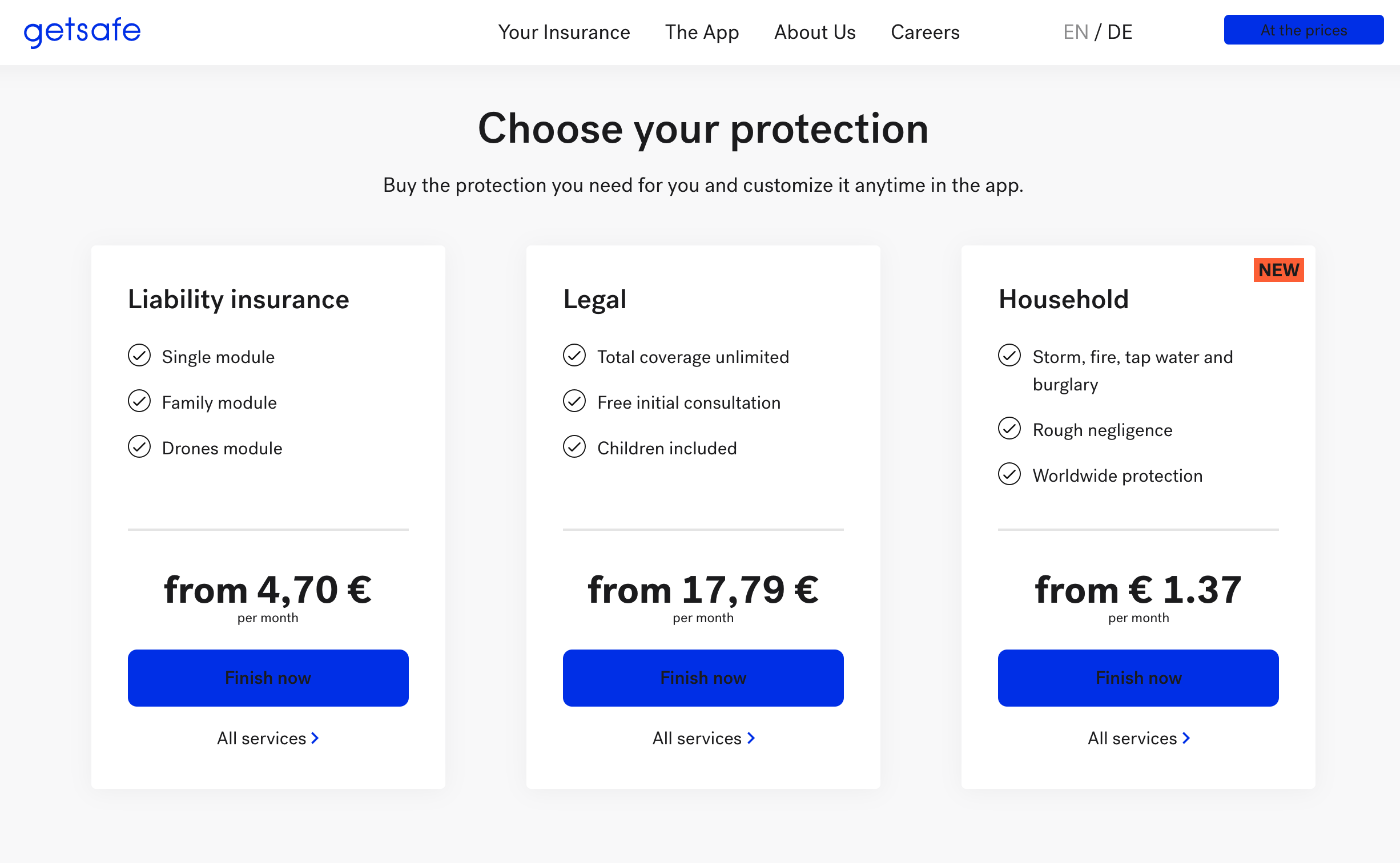

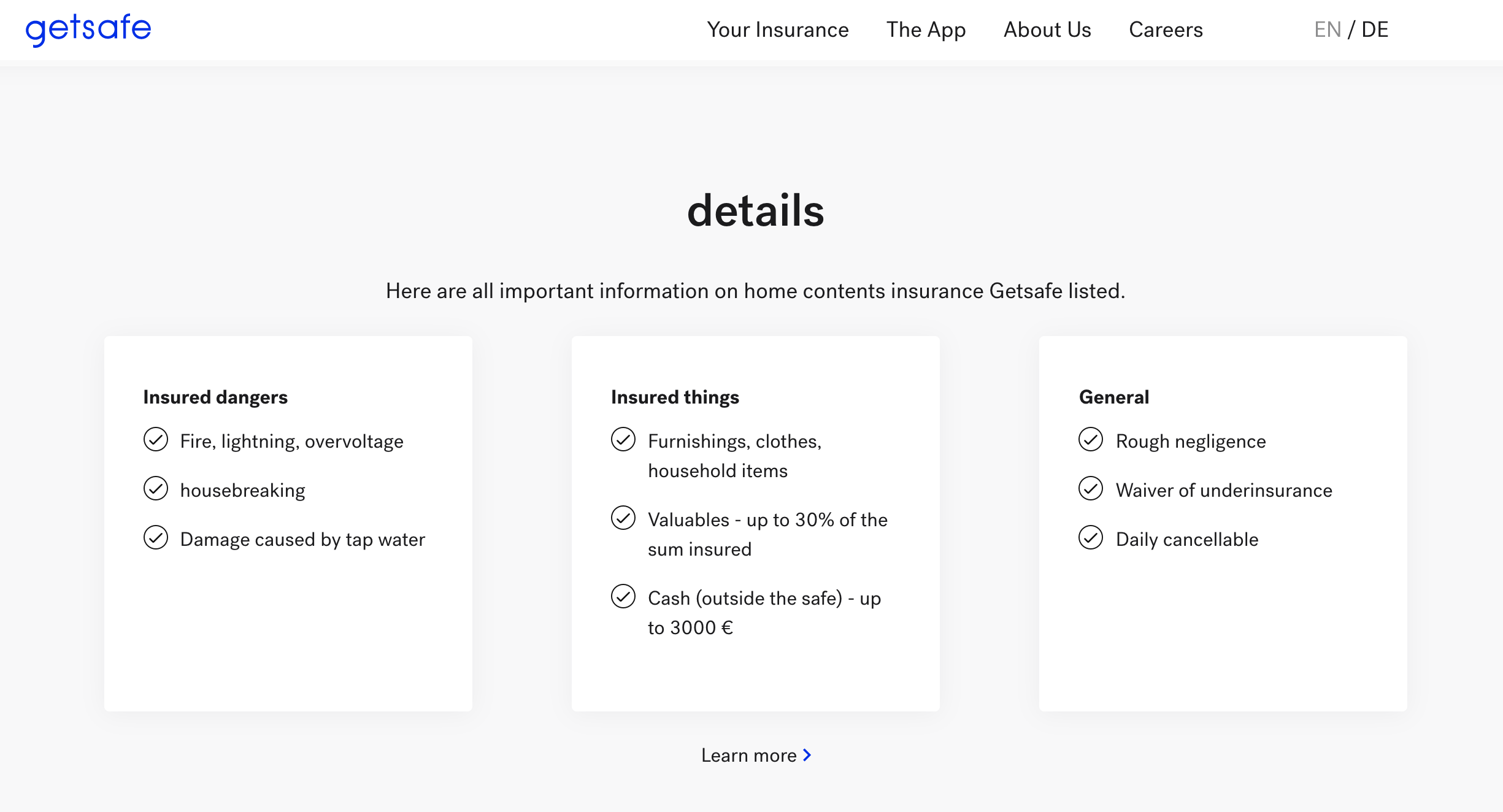

After 60,000 liability policies sold, the Heidelberg-based startup Getsafe is launching a home contents insurance. This addition completes the company’s strategy to cater specifically to insurance starters. At the same time, Getsafe is taking a stand against competitors both from Europe and the United States.

“In the past, many customers have asked us for home contents insurance that works just as easily on a smartphone as Getsafe’s other products . Now the time has come and we are happy to fulfill this wish,” says Christian Wiens, CEO and founder of Getsafe. As with all Getsafe products, customers can buy and manage home contents digitally and flexibly via our app.

“We understand the needs of the Millennial generation better than others” says Christian Wiens. All Getsafe products can be cancelled on a daily basis and claims can be easily reported via the app. This offers young people the flexibility to adapt their coverage to their changing life situation. “Getsafe is establishing a new, uncomplicated, and transparent insurance experience on the smartphone – without long waiting times, phone calls with brokers ora lot of paper”, says Wiens.

As Getsafe’s strong growth is proving, the concept works: Customers are on average 29 years old, and 85% are buying insurance for the first time. As a result, Getsafe currently is the premier insurance brand for Millennials in Germany, with a market share of almost 10% – followed by giants such as Allianz and Axa.

With the launch of the new product, Getsafe is also defending its market share against other insurtech players that are going after the European markets. Christian Wiens explains: “We will offer our products in three more European countries by 2020 and are well equipped to successfully defend our pioneering role against direct competitors from the Europe or even the US.”