What would happen if your college student unexpectedly needs to withdraw from college?

GradGuard’s tuition insurance provides a refund when schools don’t.

Phoenix, Arizona, August 6, 2019 – Nationwide, college families are busy preparing to pay their final tuition bill before arriving on campus. Among the many questions, families of college-bound students are smart to ask is – What will happen to my tuition payment if my child must withdraw from college?

According to John Fees, co-founder of GradGuard™, a leading authority in helping students and their families protect their investment in higher education for over a decade, “The thousands of dollars students and families are paying for college are at risk. As a result, it is a smart move for anyone paying tuition to understand their school’s refund policy and to consider protecting their investment with tuition insurance.”

In fact, a survey of university bursars and health administrators confirmed the vast majority of colleges and universities (about 84%) do not provide a complete refund should a student withdraw after the first few weeks of school. Many schools may refund a portion of tuition through the first few weeks of school, but you can safely assume tuition will likely not be refunded after the 5th week of classes and academic fees are usually not eligible for a refund.

This risk can often surprise college parents. In fact, according to a 2018 College Parents of America survey, only 24% of parents surveyed indicated that the college refund policy was disclosed to them during the enrollment process.

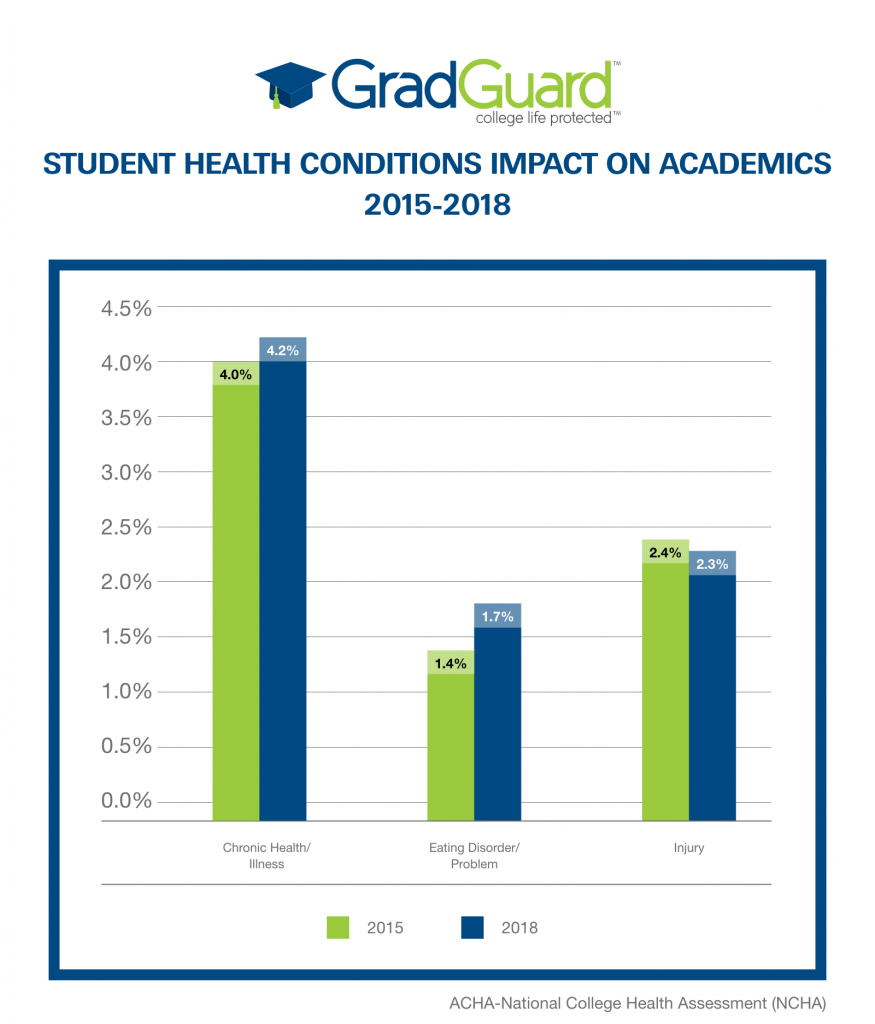

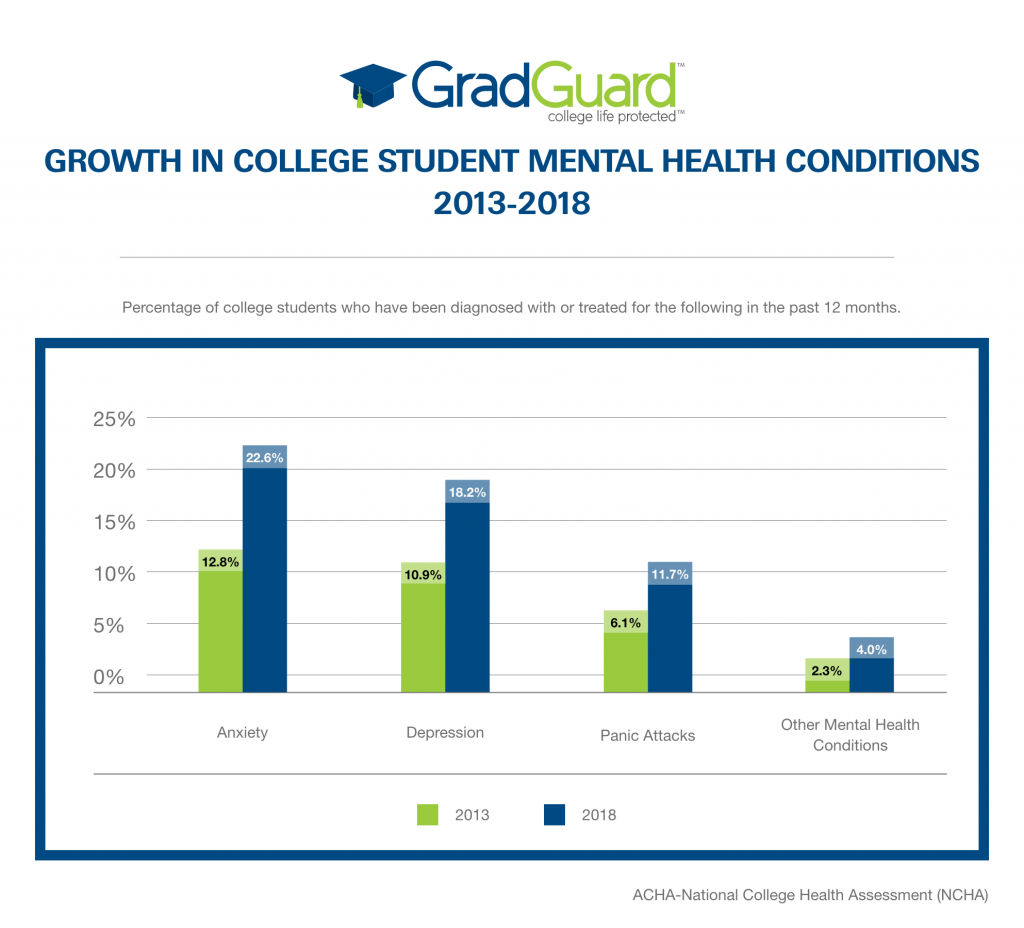

Families are often aware that their college student may be vulnerable to the stress of college life. The National College Health Assessment produced by the American College Health Association demonstrates growth in chronic illnesses and rapid growth in serious mental health conditions during the past five years.

It is important for families to note that student health incidents force thousands of students to withdraw from classes annually without the ability to recover the thousands of dollars paid for classes and housing.

The Top Three Reasons GradGuard’s Tuition Insurance Is A Smart Decision:

- If the school does not provide a 100% refund– Do you know your school’s refund policy? A majority of school refund policies do not extend beyond the fifth week of school, and many don’t refund the full cost of tuition after the start of classes.

- If the student has more than $1,000 of academic expenses– Even if the school provides a 100% refund for tuition, most do not refund academic fees or student housing costs. Many tuition insurance plans provide coverage not only for tuition but also for expenses related to academic fees and student housing.

- If the student or family is taking out a student loan– Student (and parent) loans must be repaid even if a student must take a medical withdrawal. Tuition insurance can be used to repay the balance of these loans or help pay for the next term when the student is healthy enough to return to school.

“With so much money at stake, it is vital that families develop a plan in case their student has to withdraw from school due to a serious illness or injury,” said Mr. Fees. “No matter where a student attends college, families deserve the opportunity to protect their investment in higher education and nearly all students will benefit from securing a minimum level of coverage. Just remember tuition insurance must be purchased before school starts.”

The good news is that college families can protect their investment by purchasing tuition insurance through GradGuard, with rates starting as low as $33.75 for $2,500 of coverage per term.

About: GradGuard™ is an authority in protecting the investment in higher education. By protecting students and their families from the financial risks of college life, GradGuard can help reduce the cost of college and promote greater student success. GradGuard’s modern tuition and renters insurance programs are valuable student benefits available through a network of more than 300 colleges and universities. Since 2009, GradGuard’s insurance programs have protected more than 650,000 students and families. College life is full of risks and GradGuard is there to make sure life stays on track. For more insights on #collegelife follow on twitter and Instagram @GradGuard

Inquiries:

Carlton Hawkins, Marketing and Corporate Communications

602-954-6306

This content is intended for informational purposes only. For current product information and terms and conditions, please visit GradGuard.com. The actual coverage for Gradguard products will be based on the terms and conditions of the benefits. Insurance coverage is underwritten by Jefferson Insurance Company (NY, Administrative Office: Richmond, VA), rated “A+” (Superior) by A.M. Best Co. Plans may not be available to residents of all states. AGA Service Company is the licensed producer and administrator of this plan and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage because of the affiliation between AGA Service Company and Jefferson Insurance Company.