Walnut Insurance raises $4 million

Canadian insurance startup Walnut Insurance announced a $4 million seed round with backing from ATB Financial, NAventures – National Bank of Canada’s venture capital arm, Harvest Venture Partners, Highline Beta, and N49P.

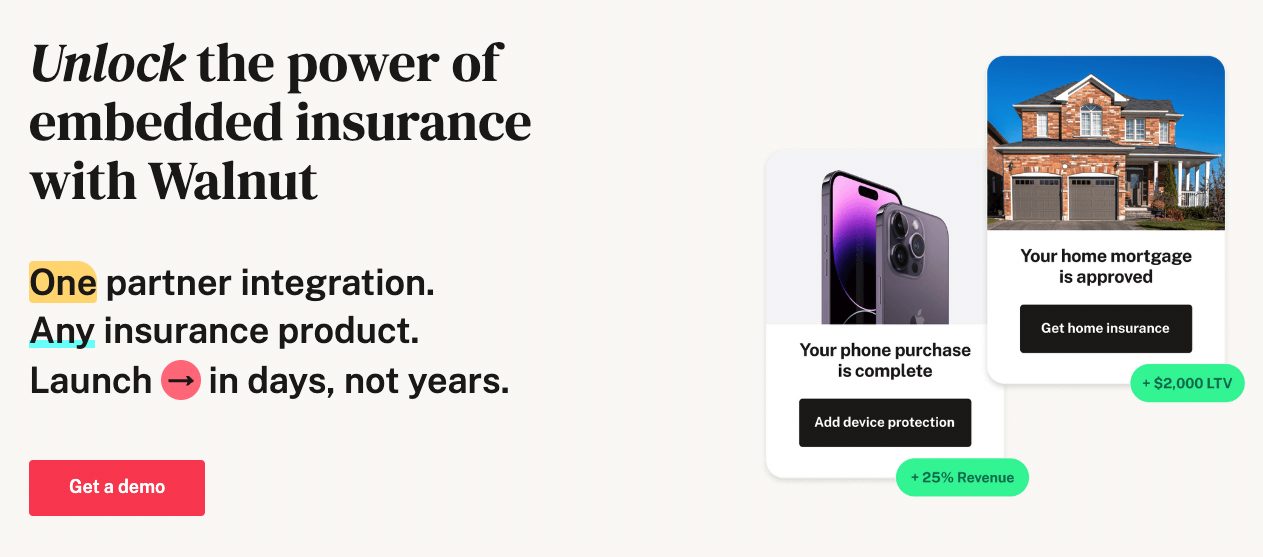

Founded in 2020, Walnut offers partners the ability to embed a range of insurance products. One partner is digital bank Neo Financial, which offers mobile protection to users. Another partner is fintech company Nuula, which gives small business owners access to group life insurance.

“Our seed raise is a testament to the continuing revolution inside the insurance industry. We are empowering partners to be able to offer innovative insurance products to millions of customers without the need for years of heavy investment or diversion of significant resources from other ongoing priorities. Embedded insurance is predicted to be a $3 trillion dollar market and Walnut is well positioned to be a leader in this industry.” – Derek Szeto, co-founder and CEO of Walnut Insurance.

“We’re excited to be partnering with the team at Walnut, and to be a part of building a modern insurance infrastructure that can provide more meaningful and relevant insurance journeys to our consumers,” says Andrew Chau, Co-founder and CEO, Neo Financial. “We see this partnership as a means of more deeply engaging with our users, through a modern and convenient version of a process that has historically been time-consuming and laborious.”

“The insurance industry is ready for disruption and Walnut has built a powerful platform that will close the coverage gaps and create meaningful value for millions of people. The partnerships and distribution channels Walnut has been able to acquire at this stage of their business is impressive and speaks to the need that Walnut’s fintech infrastructure is solving for partners and clients.” – James Povitz, principal at NAventures.