Uniqa backs insurance startup Calingo

Swiss insurance startup Calingo closed its first pre-seed round securing $900k – structured as a convertible loan – from Swiss ICT Investor Club (SICTIC), UNIQA Versicherung AG (Liechtenstein), and 16 additional investors that invested between CHF 20k and 250k. UNIQA will also act as an underwriting partner with Swiss Re acting as the reinsurer.

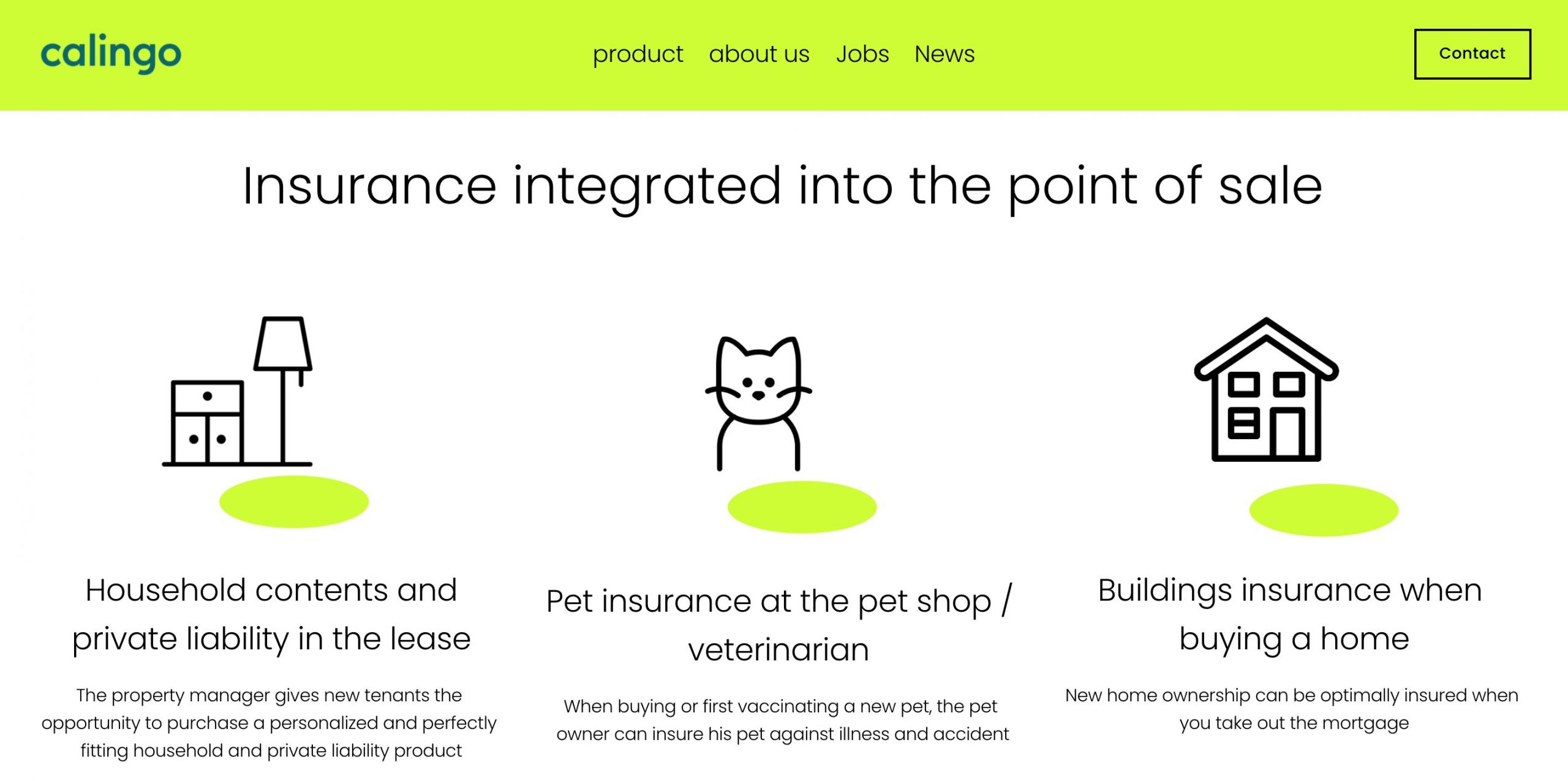

Founded in 2020, the startup is developing a B2B2C business model to distribute pet, home, and renters insurance. It plans to launch its first product – household and personal liability insurance – by Q3 and its distribution partner will be property management company Tend AG.

“It’s always great to learn. And it’s especially great to learn from highly motivated people like Anina, Daniel, Marlo, and Walter from Calingo. We are very excited to support their start-up together with Swiss Re.” – Carsten Abraham, CEO UNIQA Liechtenstein.

“Now is the time to revolutionize the insurance market and offer simple transparent products and real convenience to the end customer. We want to create a world where people no longer have to worry about insurance.” – Anina Lutz, CEO and Co-Founder Calingo.

“We are enormously grateful for the support we have received in building Calingo. The team is highly motivated and we are working flat out towards start of sales this summer.” – Daniel Litscher, COO and Co-Founder Calingo.