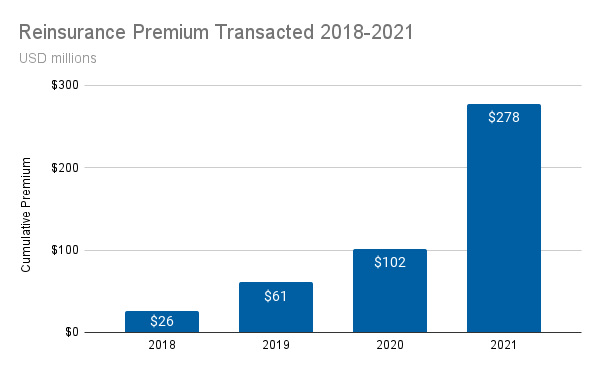

Tremor Announces Record $175 million Reinsurance Premium Transacted in 2021, 400% Marketplace Revenue Growth

Tremor Technologies, Inc., the leading online reinsurance pricing and placing platform, is pleased to announce that its marketplace has transacted $175 million of reinsurance premium in 2021 and has achieved exciting marketplace revenue growth of over 400% year over year. Since 2018, over $275 million of reinsurance premium has been transacted on the Tremor marketplace. While the market has continued to harden overall and traditional reinsurance placements struggle, Tremor has had its best quarter yet delivering required capacity for challenging placements well ahead of renewal dates with record numbers of participating reinsurers.

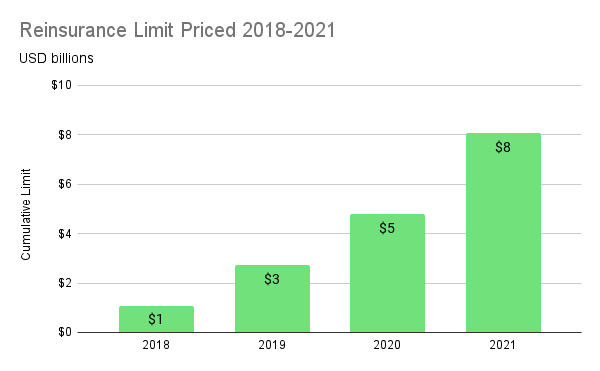

Since launching its marketplace in 2018, more than $8 billion of reinsurance limit has been priced with over 120 reinsurers, Lloyd’s Syndicates and ILS funds.

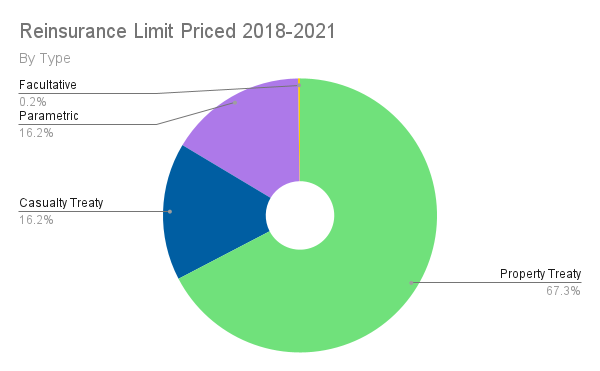

As Tremor has grown, the types of reinsurance it has priced and allocated has diversified. While initially transacting Property Treaty business, the company has rapidly grown into other types of reinsurance, whereby over 16% of limit priced to date is from Casualty treaty placements with a similar percentage being Parametric placements including Industry Loss Warranties (ILWs).

The company has also entered the Facultative market, helping to price and allocate sophisticated syndicated placements. Additionally, Tremor has entered the Retrocessional market, pricing and allocating a number of Retro placements across type and structure.

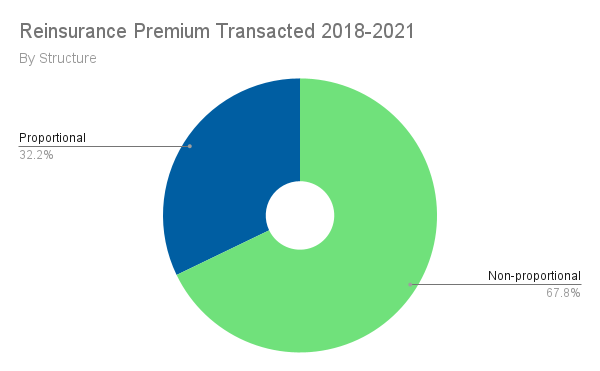

In addition, the platform is now transacting both proportional and non-proportional reinsurance structures across Treaty and Facultative placements. While in its first two years the company predominantly priced and allocated multiple layer per occurrence Excess of Loss reinsurance placements, the company has evolved its technology so that it is now able to as easily price and allocate a complex quota share placement as it is able to effortlessly price and allocate a property catastrophe excess of loss tower.

For example, proportional business has grown rapidly in 2021 and the company sees an enormous opportunity to help insurance companies improve price discovery to find optimal ceding commissions, loss corridors and profit sharing structures simultaneously on-platform.

To date, the marketplace has sent out over 2,100 underwriter participation invitations to authorize capacity and has made 193 capacity allocations with an average placement duration of just 2.3 days from quotes to signed lines. A typical reinsurance placement on Tremor has an average of 42 cedent-approved participating reinsurers, the number of reinsurers and specific reinsurers are dictated by the cedent on a per placement basis.

2021 has been a breakout year for the company, both from a business perspective and a product development perspective. As the pandemic has proven that risk can be transacted remotely, sophisticated online trading platforms like Tremor are perfectly suited for the permanent, new way of working – but taking it to the next level. Tremor is delivering a fit-for-purpose marketplace to suit modern risk transfer. Relationships will continue to be important, brokers will still play a role, but make no mistake, the pandemic has forced the market to modernize and there is no going back. Tremor’s results speak for themselves – the rapid growth of faster, better and more competitive reinsurance placements powered by data and modern market structure.

“We achieved perfect product-market fit earlier in the year with Tremor Panorama, our next generation marketplace, and we’ve continued to enhance from there – launching a wide range of on-platform features during 2021 while tripling our client base and quadrupling our revenue. I’m very proud of the talented team at Tremor, and grateful for the opportunity to serve the market of insurers and reinsurers to dramatically improve price efficiency with our modern market model for risk transfer,” said Sean Bourgeois, Tremor Founder & CEO.

During 2021, Tremor completed its first significant casualty placement, a European cedent placement and several loss making renewals all in a hardening market. “Some had suggested that Tremor could only work in a soft market for commodity programs – we have always stated that Tremor brings the most competitive market regardless of market conditions, whether programs are loss making or not, whether the placement is a property catastrophe placement or a complex, multifaceted casualty quota share – 2021 has allowed us to prove that Tremor is simply a better market model in every dimension, “ continued Bourgeois.

Tremor is looking forward to continued, rapid client and revenue growth for 2022 as it continues to build value-added features and capabilities. In addition to further refining its market features, the company is looking forward to tackling contract wording automation, catastrophe modeling integration, payments, claims notifications and more in the coming quarters. “We are just getting started – transacting reinsurance is going to look completely different in a few short years – far more price and cost efficient – and we are proud to be leading the way,” stated Bourgeois.