The Zebra: A Prophecy That Came True

In a recent press release, auto insurance marketplace, The Zebra, announced it has raised $40M in a Series B round led by Accel Partners, bringing its total funding to date to ~$63M . The funding will be used to expand product functionality, add new lines of insurance, grow both staff and partnerships and make “substantial investments in brand-building and other marketing efforts to establish The Zebra as a household name.” Also, it is welcoming Keith Melnick, former president of travel metasearch engine KAYAK as its CEO, replacing Adam Lyons, which will assume the role of ‘chairman’. Last, according to Forbes, revenue has grown 80% year-over-year but the company is not yet profitable.

I added context and proof-checked. Below.

1. The Founders

Joshua Dziabiak. Founder and COO.

Adam Lyons. Founder, president and chairman.

Jordan Messina. Cofounder/ Python Guy.

Cal Leeming. Cofounder. Created an MVP during the incubation phase, which went on to secure $17M in Series A.

2. The Landscape

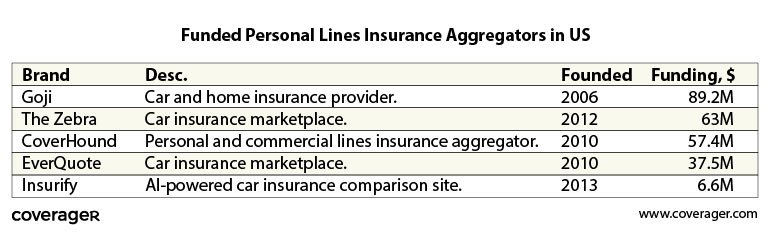

The Zebra initially made headlines when Mark Cuban invested in the startup, which launched in 2012. It plays in the same playground as these aggregators; to name the most funded brands:

BTW, speaking of Mark Cuban, he is also an investor in Metromile, which explain why the two are partners.

3. On its KPI

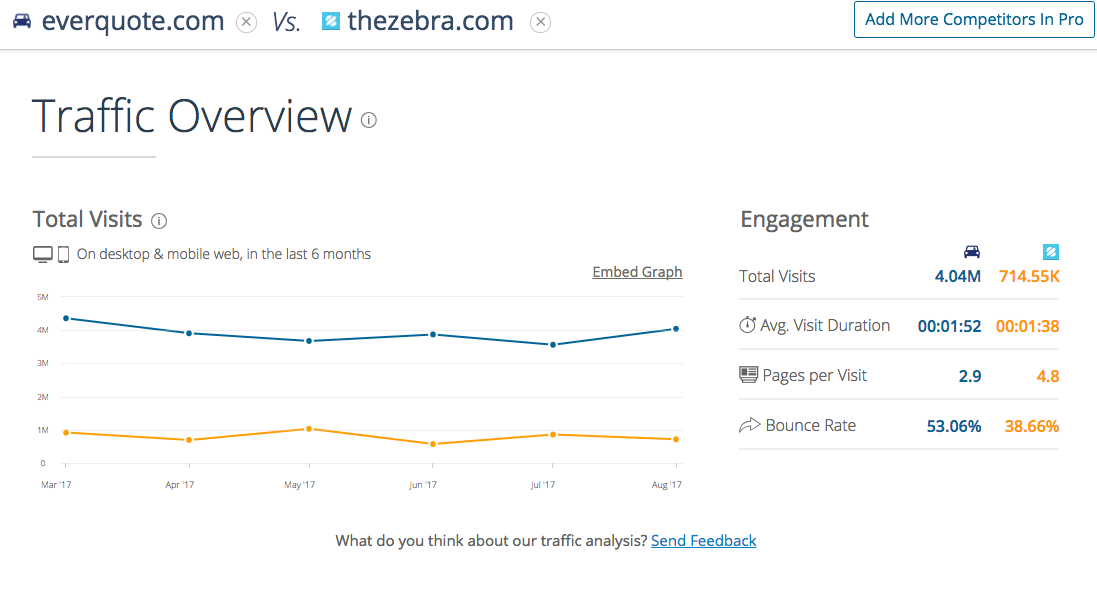

According to The Zebra, it “is the most visited car insurance comparison site in the U.S., providing millions of insurance quotes every month.” However, according to Similar Web, EverQuote, the other car insurance marketplace, enjoys a bit more traffic.

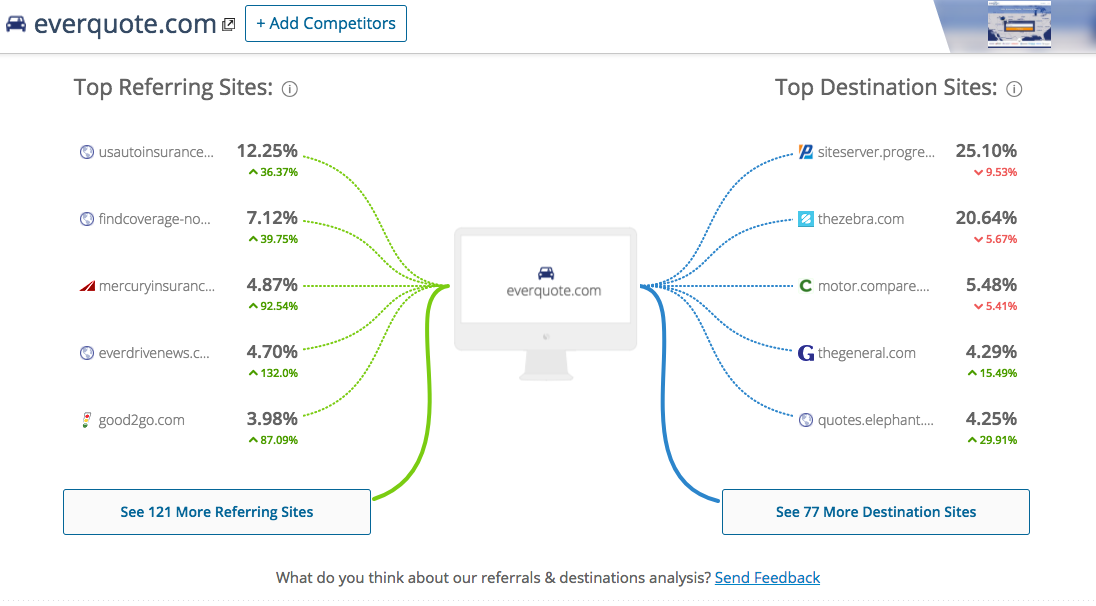

BTW, speaking of EverQuote, they may have a partnership in place with The Zebra, as they send traffic to their site:

4. On its Value Proposition

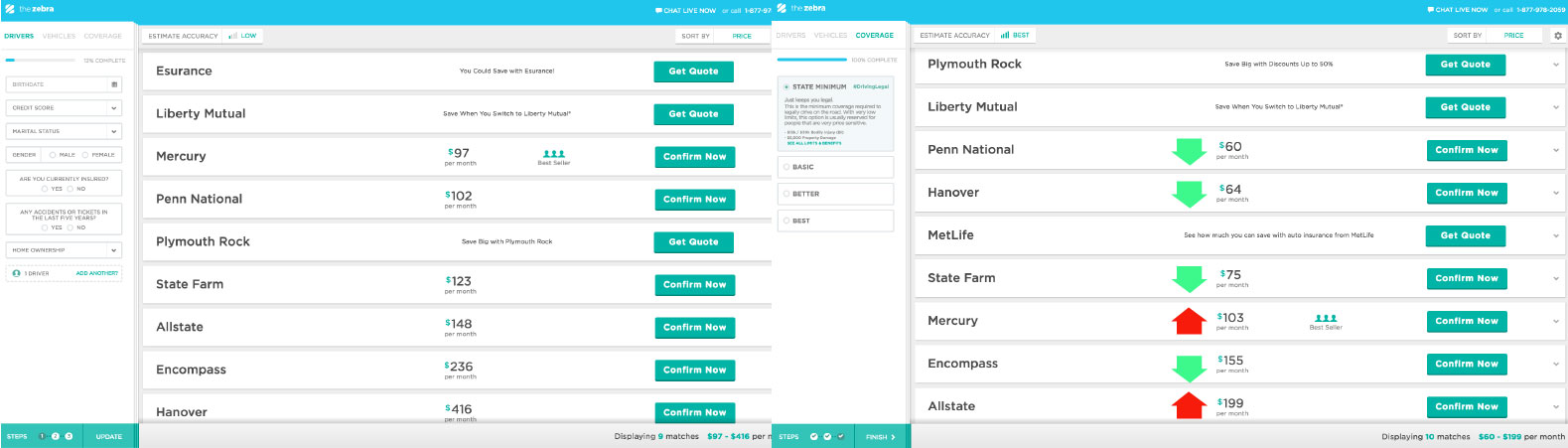

“It searches more than 200 auto insurance companies in seconds to give consumers the choice and simplicity they need to find the right coverage at the right price.” Well, this part is true. Partially. You can compare quotes in seconds….to later confirm in minutes. The Zebra’s welcoming UI instantly fires back quotes with ‘Low’ to “Best’ accuracy rates, with an unrecognized premium pattern as premiums can increase or decrease as you enter more details:

Yet none of this really matters as shoppers can’t purchase coverage via this flow. They either have to wait on Agent X to give them a call, or are directed to the insurers’ website to firm up their quote.

5. Op-Ed

“There’s an opportunity in insurance to build the go-to digital brand for comparison shopping, just as we’ve lived through from the beginning with what KAYAK did for travel. The Zebra team has the product-first DNA and momentum to pull this off, and we’re thrilled to partner with Keith Melnick – who we worked with on KAYAK for over a decade – and the whole The Zebra team to help make this vision a reality” – said John Locke, a Partner with Accel.

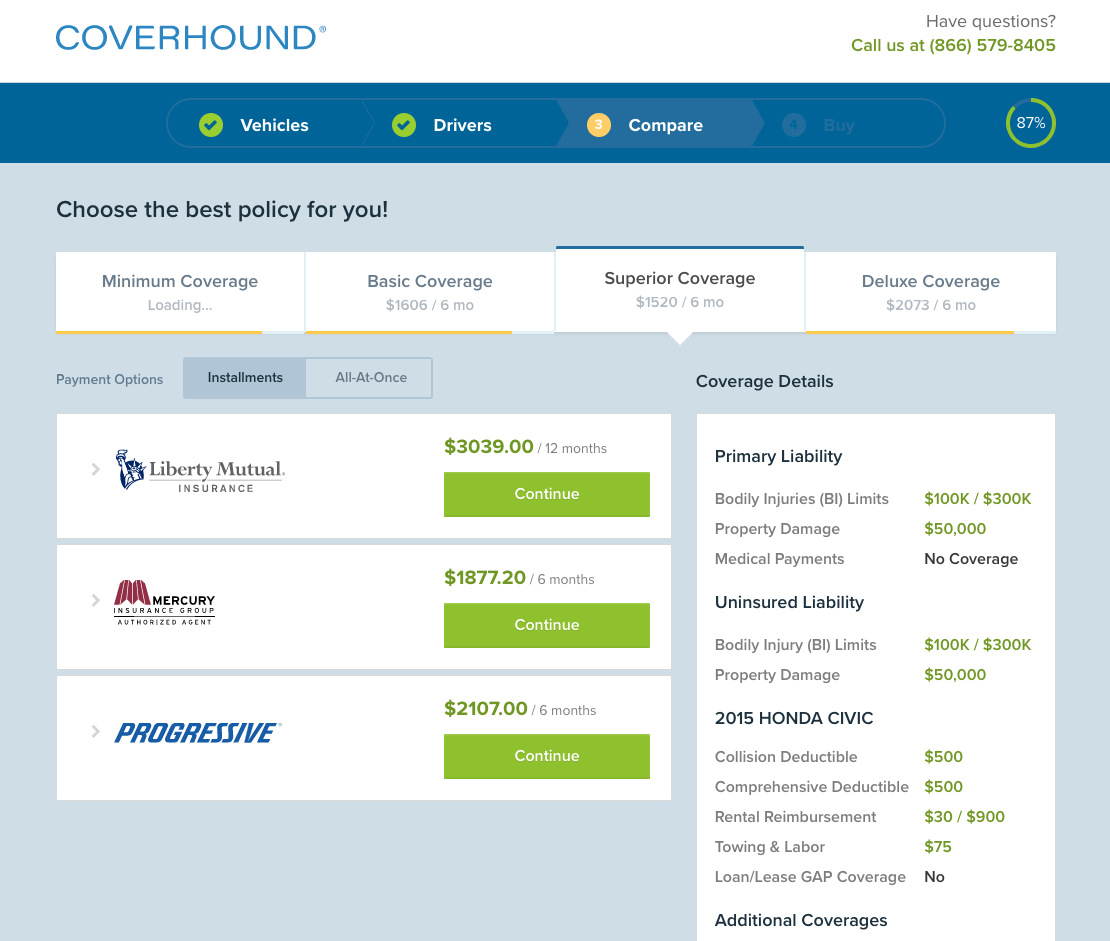

Yes, there’s an opportunity. It’s called CoverHound (to name one). It allows for quote comparisons and purchase of coverage via the same flow, which makes it more likely to honor the prices it shows on the screen.

Bottom Line: The Zebra constantly refers to itself as the Kayak for auto insurance. Today, with the addition of Keith Melnick, former president of Kayak, The Zebra got a little bit closer to becoming the Kayak for auto insurance. There’s still a long way to go.

Fun Fact. Martin Davila, which at one point was a Business Consultant at The Zebra, is now the founder and CEO of EnsureFirst, a startup that looks to “bring the 21st century to an outdated insurance industry” via an insurance fulfillment chatbot.