The Power of Neutral

I have more things to say than I actually say. I wasn’t always like this and the change happened in my senior year of high school when a wise teacher told me that not everybody cares about what I have to say. As you can imagine, this was a hard punch to the gut and 23 years later I’m still trying to figure out the thing I said that broke the camel’s back.

Today, I will say what I have to say.

More progressive than Progressive

At a time when insurance initiatives have an average lifespan of a hamster, you have to admire Progressive’s long commitment to telematics. “We saw something on usage-based insurance 20 years ago, way before the technology was there,” said Susan Patricia Griffith, the company’s CEO in 2017. Progressive’s first telematics program was called Autograph, which consisted of a GPS transponder, a cellular communication system, and a small computer. In the words of Griffith, “it was clunky, it was big, it was expensive.” The program cost Progressive $500 per vehicle and it charged customers a $65 setup fee and a $5 monthly fee. In April 2000, the insurer stopped selling new Autograph policies and in July 2001 it stopped servicing all Autograph policies. In 2004, Progressive rolled out TripSense, a simpler and cheaper solution that plugged into the vehicle’s OBD port. ~5 years later, the insurer launched MyRate and shortly after it introduced Snapshot.

Anurag Shah, the CEO and co-founder of Aureus Analytics, displays an important mantra in his Twitter profile – TLDM (talk less, do more). Before Root became the main telematics talker, Progressive was the most vocal player in the field, but are they talking more than they’re actually doing? As of 2019, Progressive had close to 15 million auto policies and during its Q1 2020 earnings call it revealed that the Snapshot program has “hundreds of thousands” of daily monitored drivers across the country. These figures amount to a 3-4% penetration rate.

According to 2020 data from SimilarWeb, Progressive’s Snapshot Android app was downloaded ~794K times compared to 1.732M downloads for State Farm’s Drive Safe & Save Android app. State Farm’s Android app (powered by Cambridge Mobile Telematics) also leads the way when it comes to reviews with ~39K reviews (4.2 star rating), while Snapshot (powered by TrueMotion) counts ~7K reviews (4 star rating). And judging by their websites, State Farm makes more effort to promote its telematics program as it clearly displays it in the homepage while Progressive does not.

Last November, Progressive was asked about the innovator’s dilemma of putting more emphasis on telematics-based scoring and pricing. Here is the ‘no answer’ answer provided by Griffith:

“Yes. I talked a little bit about that when I talked about the virtuous cycle in terms of when you have a segment, you innovate, et cetera, and you do that. I think that insurtechs are serving a great purpose in terms of ease of use. And it would be I think easy to be able to or nice to be able to, I should say, start without having legacy systems. That said, we have them, we work around them, but we don’t say, okay, we’re just going to be here in time and try to work around. We’re constantly innovative — innovating from a technology perspective, ease of use perspective. And we believe that part of our DNA is really innovation. We’ve been first in a lot. I won’t go into naming that, and we don’t intend to change that.

And the great benefit that we have that the insurtechs don’t is the cost of acquisition. And for us, we’re going to continue to hone on in — hone in on that. And that’s why we were able to increase our policies, 2.5 million in 1 year. That’s the reason we’re able to do so and make our target profit margins, which are also very important. We have shareholders that are — that own us because they know we’re committed to our 96th grow as fast as you can. We don’t have the availability to say we’re going to test things regardless if we make money or not. So we’re very innovative. We’re always going to do everything we can to make a profit, is one of our core values, and we’re able to leverage our size to have lower acquisition costs.”

So, despite finding a way to be personal in an industry of averages (see image below), it seems that Progressive is more focused on averages driven by telematics data than marketing car insurance in a more personal way.

This leads to the ultimate question: Is telematics a data play, a marketing play, or both?

There is one more noteworthy piece of information before we move on to our next telematics topic. The Snapshot iOS app currently has just 1,088 ratings while State Farm’s Drive Safe & Save iOS app has 84,400 ratings. Is Progressive resetting app ratings with new version releases?

The root of the problem

Claude Hopkins, THE ad man before Ogilvy, writes in his book to not under-estimate the intelligence and the information of people who count their pennies. We previously highlighted the brilliance of Root’s growth strategy for the sake of an IPO, however, when you lie at scale the truth may come knocking faster. When Root came to realize that it needs to offset some of its marketing expenses, it abandoned the promise of only insuring good drivers by introducing ‘Day one,’ which offers immediate coverage for up to 60 days while drivers take the test drive. Now, the Columbus-based insurer is putting another bandaid on a bullet wound by hiring inside sales agents who can sell coverage over the phone – a new option as currently coverage can only be obtained digitally. According to a Root spokesperson, this new option is due to folks calling the company for coverage, but when one of the job requirements entails meeting and exceeding monthly sales goals and metrics, we believe there’s more to it.

The obvious explanation for this move is that Root is looking to improve its conversion rates. In 2020, Root’s website received over 10M visits and its Android and iOS apps were downloaded over 2.5M times. Compare these figures to the company’s Q3 2020 report where it disclosed 322,423 auto policies in force and you can understand that conversion rates have room for improvement.

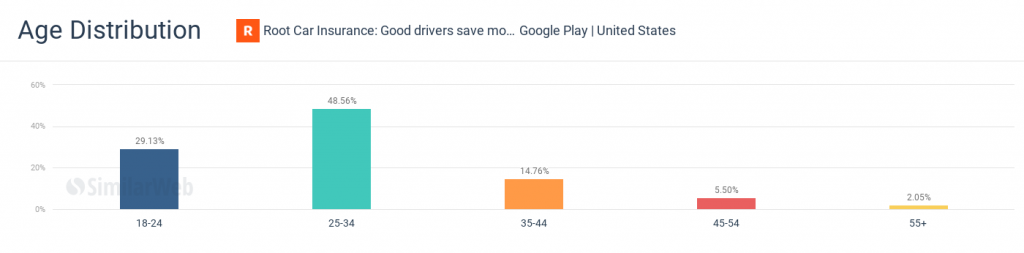

There may be another explanation. Here is a look at the age distribution of Root’s Android app users:

According to this data, almost 78% of downloads came from people under the age of 34. Some insurance experts would argue that a car insurer with a younger customer base may have a harder time keeping claims under control. One obvious solution is to increase premiums but while some insurers can get away with rate increases, Root cannot as it lured drivers with the promise of better rates. This leads us to the second option – acquiring older customers who may present lower risk.

If I’m interpreting this ad correctly, it seems that Root is looking to target seniors, and as you know, some seniors prefer to interact over the phone.

Root has a real challenge ahead of them and a way out of this mess starts with transparency.

The Zebra will give you a headache

In a recent interview, The Zebra’s CEO told me that they deliver insurers a better ROI than Google. If I were to make the case for Google (you shouldn’t advertise on Google), then I’d argue that unlike The Zebra, the search engine giant isn’t encouraging consumers to compare car insurance on its platform using a variety of ads.

Currently, The Zebra is hiring a Senior Product Manager – User Retention who will be tasked with “the exciting opportunity of creating sticky and innovative experiences that entice people to use The Zebra frequently.” As you may already know, The Zebra generates revenue in two primary ways – selling insurance through its in-house agency and receiving a fee for redirecting online shoppers to partner sites. With the latter, The Zebra doesn’t enjoy recurring commissions and the name of the game is frequency. The company wants shoppers to compare insurance frequently so it can generate many one-time fees off of them and that is not in the best interest of its insurance partners who are hungry for some loyal customers.

The power of neutral

“Human nature is perpetual. In most respects it is the same today as in the time of Caesar.” – Claude Hopkins, My Life in Advertising and Scientific Advertising, 1923.

I’ve been reading Hopkins’ book and if you’re into strategy, marketing or sales, you should read it too. Here are two pieces that prove that not much has changed since the late 1800s/early 1900s.

“People will do anything to cure a trouble, but little to prevent it. Countless advertising ideas have been wrecked by not understanding that phase of human nature. Prevention offers slight appeal to humanity in general.”

“Many have advertised, “Try it for a week. If you don’t like it we’ll return your money.” Then someone conceived the idea of sending goods without any money down, and saying, “Pay in a week if you like them.” That proved many times as impressive.”

We’ve said this before and we’ll say it again – focus on the setting and don’t be tricked into believing that you’re dealing with a new kind of customer. So, what does the setting look like? Well, after the Robinhood-GameStop saga, it is becoming clear that the setting is leaving consumers with two not so great choices – pay a premium for quality or become the product of the company that offers you a free product.

They say that insurance supports the economy. It’s time for insurance companies to take charge and build a new setting that’s powered by the neutral nature of insurance. As Hopkins said, “I did not sell Cotosuet [insurance], did not talk Cotosuet [insurance]. I sold pie cards and schemes, and Cotosuet [insurance] went with them.”