The digital evolution of the UK automotive retail and insurance market

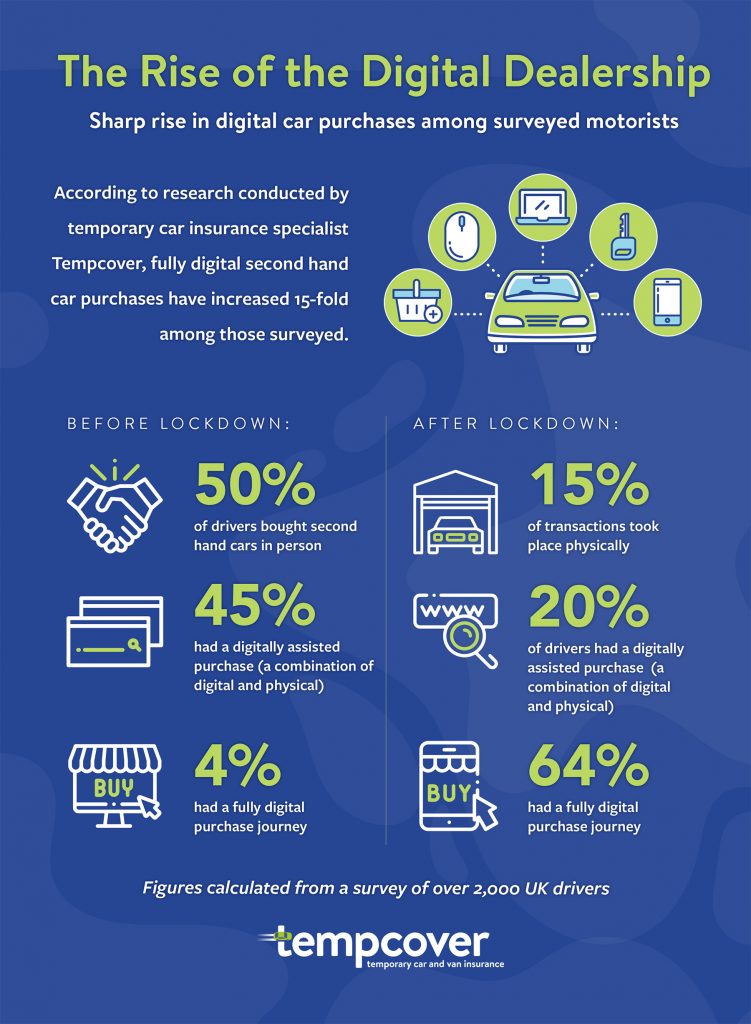

The UK’s lockdown restrictions have fuelled a sharp rise in fully-digital second hand car purchases – a concept that would have seemed unlikely even just a year ago. Tempcover research has revealed that fully-digital second hand car purchases have increased 15-fold among those surveyed.

Prior to lockdown, half of those surveyed (50%) bought second hand cars in person. 45% had a digitally assisted purchase (combination of online tools and an in-person viewing of the car). Just 4% had a fully digital purchase journey, only physically seeing their car after it had been bought.

Since the start of the pandemic, one in six (17%) of those surveyed had purchased a second hand vehicle. Almost two-thirds (64%) of those who made the purchase opted for the fully-digital experience. Digitally assisted purchases came in at 20%. Physical transactions at 15% – no surprise given the ongoing stringent social distancing measures.

When asked if a fully digital purchase journey would benefit the consumer, 57% of those surveyed were in favour. Drivers aged 31 to 40 are most in favour of fully digital transactions, with 64% saying it will benefit the consumer. Drivers aged 61+ are least in favour (44%) and prefer the more traditional approach.

Digital insurance to support the retail shift

Car insurance is also undergoing a digital shift, with some digital vehicle sales including temporary insurance policies as part of the purchase journey. This eliminates the burden of investing additional time and money to find short-term cover or committing to annual cover on the spot. However, it is clearly still a nascent offering, with just 6% of those surveyed stating that a temporary policy was included in the vehicle sale.

When it comes to arranging insurance for their recently-purchased vehicle, there is an equal balance between telephone and online as the preferred method (48% each). Nearly a third of those (28%) said they wait up to ten minutes for their policy to be confirmed. A further 22% wait as long as 20 minutes to get cover. According to Tempcover CEO Alan Inskip, temporary insurance could be more time and cost effective in this situation too.

He said: “With a temporary insurance policy, drivers can obtain fully-comprehensive cover in 90 seconds through an entirely digital process. This fits in line with the evolving consumer purchase trends. It also takes the stress out of searching for annual insurance on the spot and provides the driver with near instant cover so that they can immediately drive their new car. The driver then has the opportunity to thoroughly research the best annual policy to suit their needs. An added benefit is there’s no risk to any existing No Claims Discount, as it’s a separate and standalone policy.”