The 2024 update to the Insurance API Index is finally here!

A quick recap: the Insurance API index tracks commercial insurance carriers with API-enabled products and serves as a reference for brokers and technology partners on which carriers are at the forefront of insurance technology.

The past 2 years since we launched the first ever Insurance API index have witnessed continued, rapid growth in the number of carriers with digital capabilities and commercial API-enabled products. Since our 2023 update, the number of carriers with digital capabilities have grown ~50%, and the number of commercial API-enabled products have grown ~45%

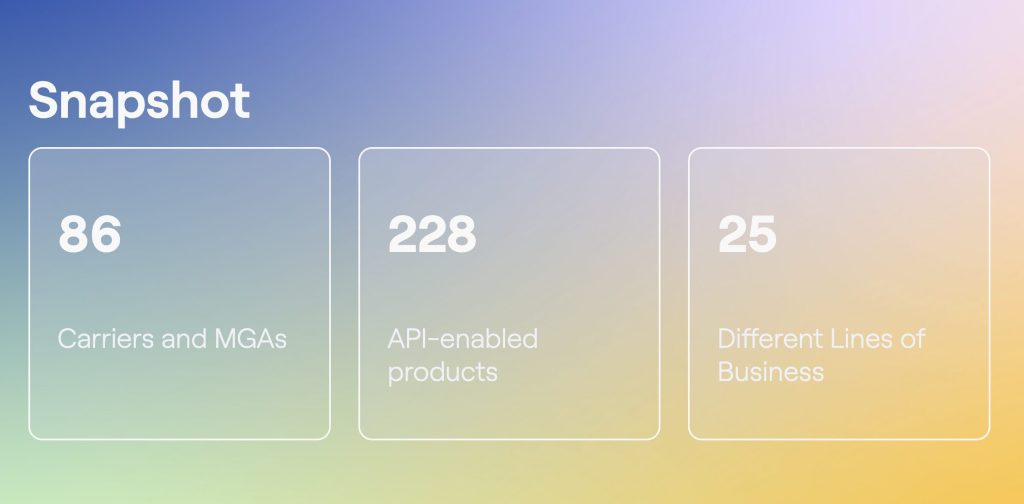

There are now 224 API-enabled products across 85 carriers and 24 different lines of business on the index. Since our spring 2023 update, we’ve seen…

Increased digitization in excess and surplus lines

As the excess and surplus (E&S) lines market continues to boom, carriers have also ramped up their digitization efforts on this front.

Market research suggests that E&S premium growth continued in 2023 off of its record-breaking base in 2022, reflecting a ~14.6% increase, with commercial liability and commercial property growing at ~10% and 32% respectively. The 2024 outlook suggests a similar upward trajectory as insurers seek more flexibility in rates and terms to ensure adequate coverage for higher risk, particularly associated with extreme climate change.

Binding authority, in addition to traditional brokerage and retailers, comprises a large portion of how E&S risk gets placed. To reflect the continuing digitization effort in this space, we added the delineation between binding authority and traditional brokerage products into the index.

Currently, 28 carriers are offering general liability and 27 offering package (property) binding authority APIs, and we expect more carrier to come in the near future.

Number of API-enabled Cyber lines grew at ~32%, driving continued digitization of Specialty Lines

We continued to see a large increase in the number of API-enabled products within cyber at ~32% since spring ‘23, driven by new carriers added to the index. Cyber is also often the first digitization effort that carriers undertake: out of the 24 carriers that have Cyber API, ~33% have it as their only API-enabled product line at the moment.

Furthermore, Cyber insurance remains one of the markets that faces the largest protection gap, estimated at 90%, indicating more headroom for underlying product growth and digitization growth.

Conclusion: insurance technology innovation poised for a period of sustainable growth and innovation

The growing index reflects the broader investment in insurance technology, ranging from early experimentation with GenAI to innovations within the fast-growing space of embedded insurance.

While insurtech funding has seen a decline of ~18% QoQ in Q1’24 from its previous heights, median deal size has increased ~19% YTD compared with ‘23, suggesting that the industry is heading toward a more sustainable phase of investment, where investors are more selective with their bets but still willing to put faith in where they see robust opportunities.,

Carriers on the index are prioritizing innovation and delivering on customers’ increasing need for ease of access. As an example, Tokio Marine HCC – Cyber & Professional Lines Group (CPLG), a member of the Tokio Marine HCC group of companies based in Houston, Texas, launched its self-quote-and-bind broker portal in October, 2023.

“For years, we have been digitally distributing our Cyber product and truly believe that, if you’re focused on growing in the small-business space, transacting effectively is the key. Our quotes, both via API and our in-house Broker Portal, are backed by sophisticated underwriting technology, predictive analytics, and non-intrusive network scans which deliver both a great experience and highly competitive terms. Brokers can self-quote and bind in minutes, enabling efficient, flexible transactions. At CPLG, we are committed to doing business how our brokers want to do business.”

– Kelly Bailey, Director, cyber product & technology innovation at Tokio Marine HCC

Herald is excited to continue being part of the ever-evolving insurance technology landscape and support our partners from brokers to carriers alike along their digitization journey.

If you are a carrier or MGA enabling connectivity via API, please contact us to be included in this list. We’d love to hear from you and we’d love for others in the industry to know what you’re building.

At Herald, we’re building a new infrastructure for commercial insurance. We are empowering carriers to deliver on their vision of becoming digital innovators. Our API platform provides a single point of connectivity from which carriers seamlessly and cost-effectively reach their full distribution ecosystem. We’re integration experts with a laser-focus on building API infrastructure and expanding the digital reach of carriers we support.

If you are a broker or technology provider looking to engage with your carrier partners via API, contact us to learn how we can help you connect to carriers that matter to you and dramatically accelerate your product development timelines.

If you’re just interested in learning more about Herald, visit our website or feel free to email us at hello@heraldapi.com. Follow us on Twitter and LinkedIn to stay up to date.

Finally, if you haven’t already done so, check out the Insurance API Index itself!