Tesla needs to follow in the footsteps of Root

Although this is nothing new, we haven’t previously brought it up – non-Tesla vehicle owners in California can purchase Tesla Insurance from the car maker’s broker arm Tesla Insurance Services . Coverage is underwritten by State National.

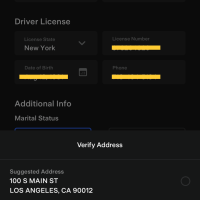

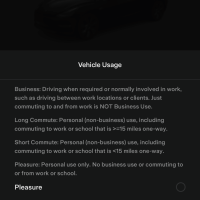

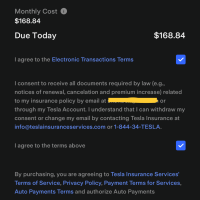

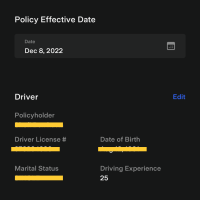

We have the flow:

This is pretty significant albeit has its limitations.

On the one hand, California leads the way in electrification in the US with a much greater proportion of new cars bought that are fully-electric. According to the Office of the Governor of California, close to 18% of new cars sold as of October 2022 were electric vehicles, marking a 127% jump over 2020. If and when Tesla starts to raise awareness of this insurance offering, it might draw customers from competing automakers. It’s a big if, but it stands a chance because electric vehicles often cost more to insure because these vehicles typically cost more than similar gas-only models, and they also cost more to repair or replace.

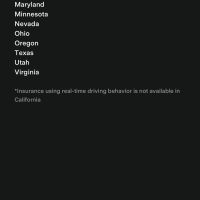

On the other hand, California is the only state where coverage isn’t written on Tesla’s paper and it’s the only state where insurance premiums aren’t based on real-time driving data gathered from Tesla vehicles. That may be the only reason this option is only available in 1 out of the 12 states where Tesla currently offers insurance.

Bottom Line: Tesla needs to follow in the footsteps of Root whose real-time insurance product was shelved when a new distribution play – with Carvana – emerged.