Swiss Re to consider options for iptiQ business

Swiss Re announced today that following a strategic review, it will withdraw from the iptiQ business and consider options for the different entities.

“The market environment today is vastly different from the one when iptiQ was created. Given these changed conditions and Swiss Re’s strategic priorities, we’ve concluded we are not the best owners of this business going forward,” Swiss Re’s Group CEO Christian Mumenthaler said.

iptiQ is Swiss Re’s digital B2B2C insurance company, enabling partner companies to offer life and non-life insurance products under their own brands. The company operates in ~10 countries in Europe, Australia and the US with more than 900 employees. Last year, iptiQ reported 2.7 million policies, $1.1 billion in written premiums, and a loss of $247 million – in line with Swiss Re’s guidance – which stated that the business was on track to achieve its 2025 break-even target.

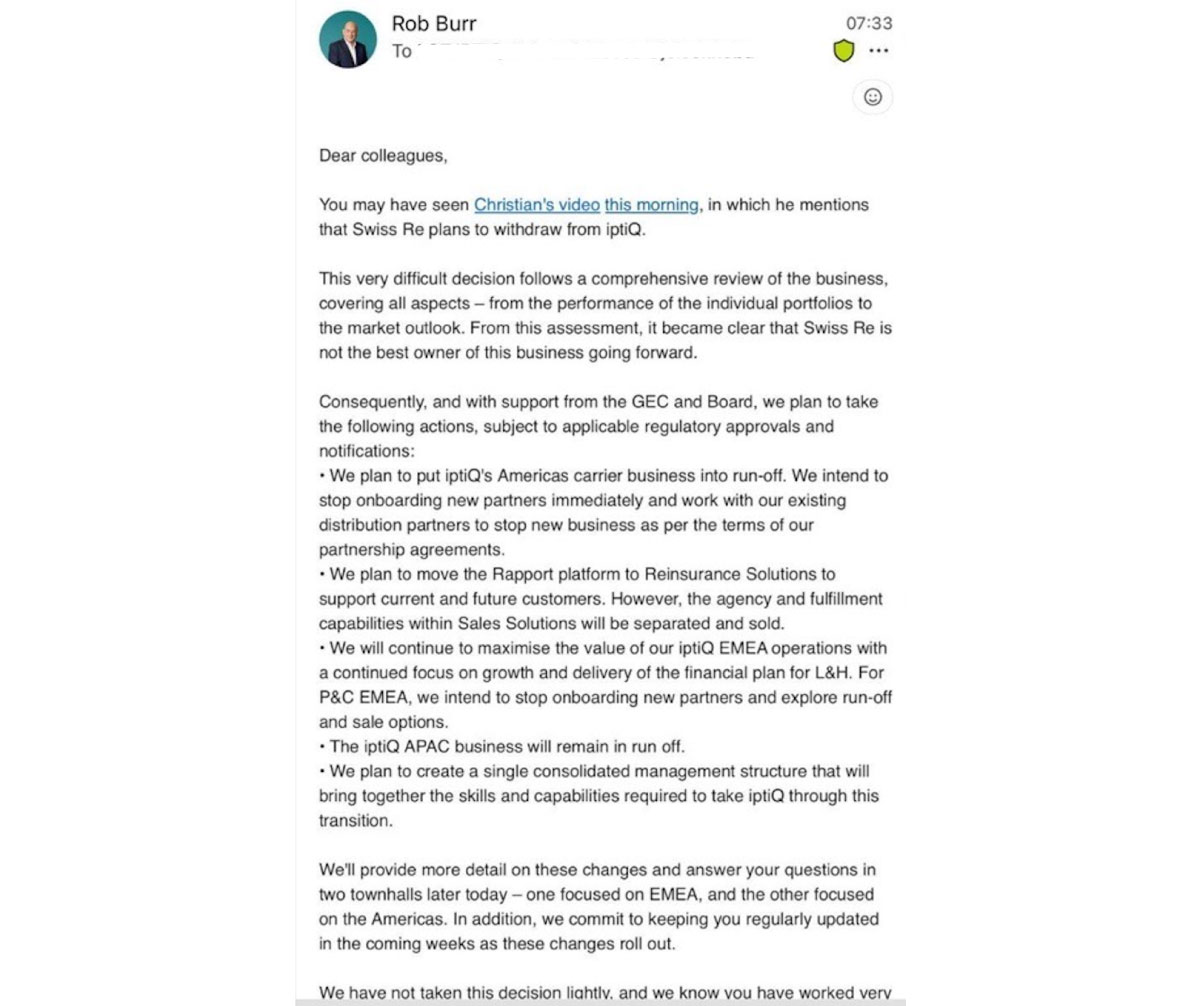

In an email obtained by Coverager, iptiQ CEO Rob Burr outlined plans to put iptiQ’s Americas carrier business into run-off, stop onboarding new partners, and halt new business with existing partners. The plan includes moving the Rapport platform to Reinsurance Solutions, selling the agency and fulfillment capabilities, maximizing the value of iptiQ EMEA operations for L&H, and exploring run-off or sale options for P&C EMEA.

One notable iptiQ partner in the US was Assurance IQ, which shut down last month.