Step Raises $22.5M Led by Stripe

Step , the new modern-day financial services company built for families and teens, has announced a $22.5m Series A funding led by Stripe, with participation from Will Smith’s Dreamers fund, Nas, Wndrco, Ronnie Lott, Matt Rutler, Kevin Gould, Noah and Jonah Goodhart as well as existing investors Crosslink Capital, Collaborative Fund and Sesame Ventures.

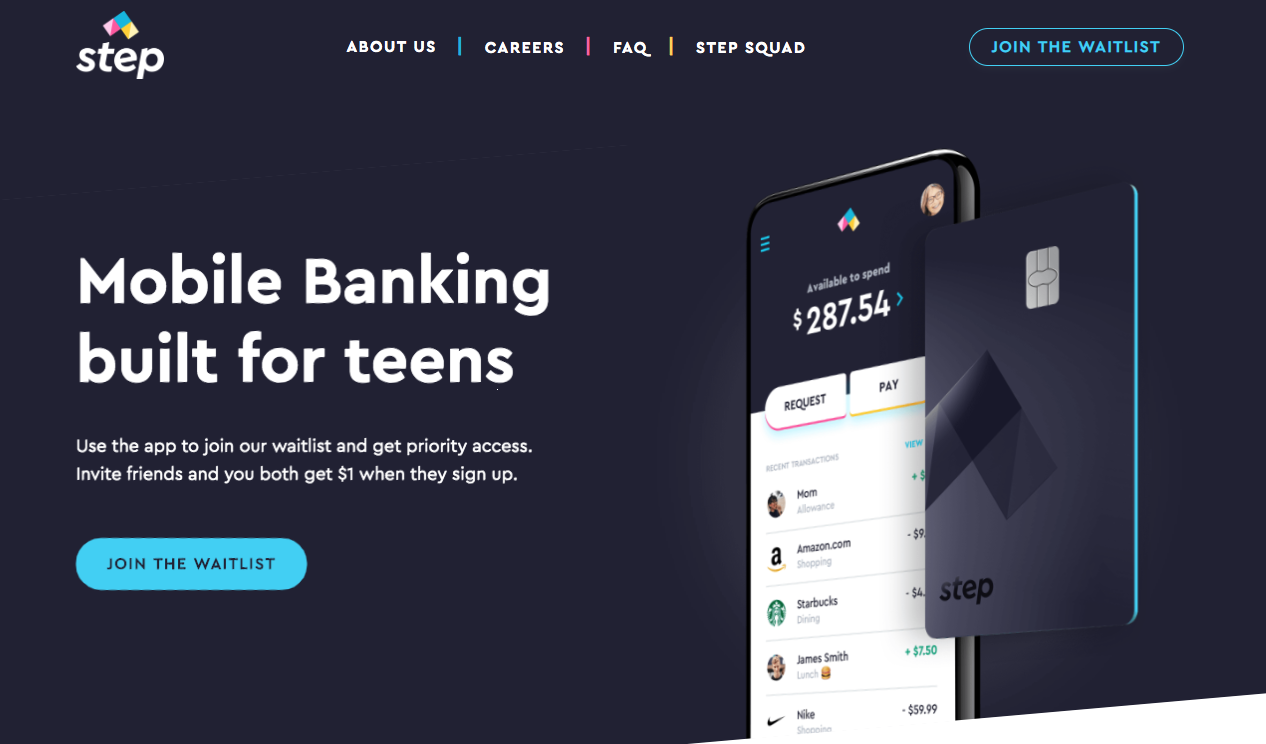

Step has partnered with Mastercard, Stripe and Evolve to launch the all-in-one solution, and it wants to be a teen’s first spending card and first bank account. The Step card is co-branded with Mastercard and its bank accounts are securely held and FDIC insured through their sponsor bank, Evolve Bank and Trust.

“Teens and parents are ready for a seamless mobile banking experience, one meticulously designed for their needs. We’ve partnered with the best in the business to create the right solutions for the next generation. As we move into a cashless era where digital content and transactions fuel our daily lives, the need for innovation in financial services increases. We want Gen Z to be more equipped and educated when it comes to money.” – Step cofounder and CEO, CJ MacDonald.

“Today’s young people are digitally savvy, having grown up with technology as a mainstay in their day-to-day lives. As a result, we also need to ensure that they become familiar with the unique aspects of digital payments including providing education about the various finance and payment products available. Step has taken a thoughtful approach to developing an offering for teens and families that provides that first step in educating and acclimating today’s youth to help them gain confidence and awareness around their finances.” – Mastercard EVP Digital Partnerships, North America, Sherri Haymond.

The Step card is linked to the Step mobile app which enables users to send and receive money instantly, shop online or in-store as well as leverage digital wallet platforms such as Apple Pay and Google Pay. The Step card is integrated with a fee-free, interest-bearing deposit account. Step customers are not required to have a minimum balance and are not charged any hidden or overdraft fees. The Step offering also allows parents oversight into their teen’s spending, providing the opportunity for them to set limits and guidelines as well as have a view into card use.

Additional Step benefits include:

- Deposits: Industry-leading interest on deposits at a current rate of 2.5% with round-up savings capabilities in an FDIC-insured account up to $250,000

- ATMs: Access to a network of 35,000 ATMs nationwide with no hidden fees or ATM fees

- Spending: Controlled spending limits, help building credit and fraud protection; Step offers Zero Liability Protection on all spending card purchases from unauthorized use with no overdraft fees

- Mobile: Real-time budgeting tools as well as transaction and balance tracking

- Parents: Ability to set limits and guidelines as well as visibility into spending

- Digital Cash: Send and receive money instantly on your phone; access it right away

Bottom Line: Waitlist demand exceeds 500k people.