Startup Bind raises $105M in Series B funding

Minneapolis-based on-demand health insurer Surest announced a $105 million Series B funding round.

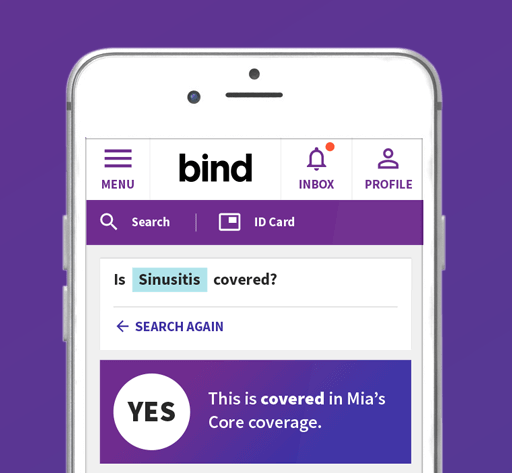

Bind believes people deserve to see treatment options and compare costs in advance of care, so they can make informed choices that meet their personal needs and conditions. With its entirely new model of health insurance design, Bind gives people something they’ve never experienced with health insurance—cost certainty and coverage flexibility without the barrier of a deductible or coinsurance.

“To break the cost curve for both employers and employees, we went all-in on building a health plan that provides the tools needed to see cost and quality comparisons, as well as treatment path options across conditions. And we removed unnecessary affordability barriers, like deductibles and coinsurance. Bind has proven when people have cost clarity, they buy more effective and efficient care—and that makes health care more affordable for everyone.” – Bind CEO, Tony Miller.

The proceeds from this round will be used to rapidly accelerate the company’s growth and expansion associated with its recent announcement that its personalized health plan will be offered on a fully-insured basis to employers with more than 50 employees, launching immediately in the state of Florida. Bind expects to serve more than 30 states with its fully-insured offering by year-end 2021.

Bind operates its self-funded Administrative Services Only platform nationally for dozens of employers, including Best Buy, Culligan, Lumen, and Medtronic. Enrollment in Bind grew eight-fold from 2019 to 2020. With its continued customer growth and industry-leading Net Promoter Score, enrollment is expected to double from 2020 to 2021. Earlier this year, Bind was named to the CB Insights Digital Health 150 list, representing the 150 most promising private digital health companies in the world. Bind was also named in the top 15 on Modern Healthcare’s Best Places to Work in Healthcare 2020 list.

“It has been rewarding to see Bind progress from an idea of leveraging data and technology to create a next-generation insurance design into a platform that is gaining market traction with employers, including several of our health system partners, and with members, who give the company a high Net Promoter Score for illuminating treatment paths with clear prices.” Managing Director of Ascension Ventures, a Bind investor, Ryan Schuler.

In September, Bind released data that shows its health plan outperformed risk-adjusted industry benchmarks; total cost (combined employer and employee) of Bind was 23% lower than the average benchmark and 11% lower than the highly managed benchmark. The results show that higher member engagement and better health plan design can lower costs for employees and employers.