Smallcase Raises $8M

Indian investment platform Smallcase has announced an $8m Series A round led by Sequoia Capital India, with participation from Blume Ventures, Straddle Capital, Beenext, WEH Ventures & DSP Adiko.

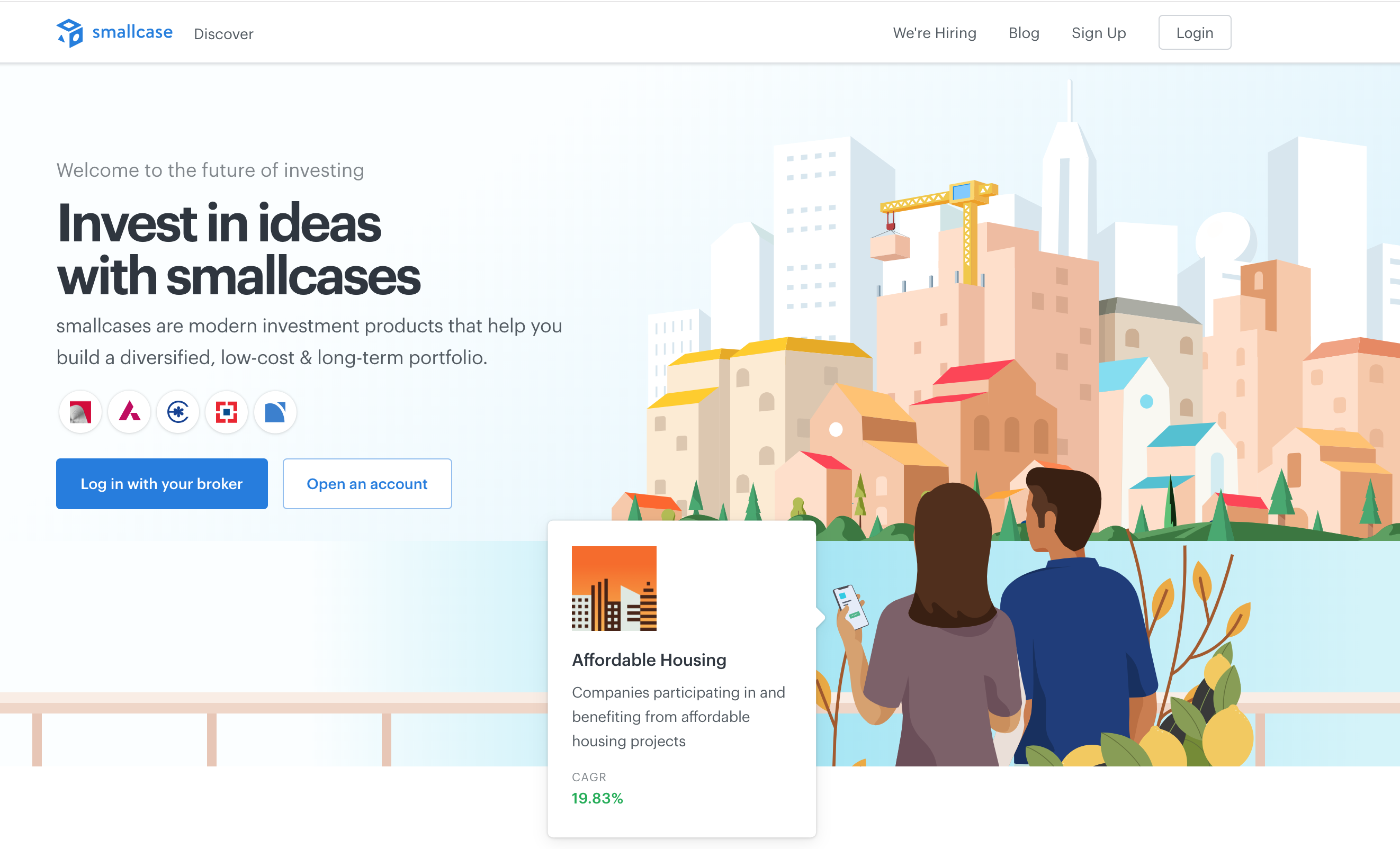

Established in 2015, the company is building a platform for the modern investor to take portfolio exposure to stocks & ETFs. Similar to mutual funds, however, investors hold the stocks/ETFs in their demat account - making it cost-effective and giving complete control and transparency on the constituents to the investor.

Two weeks, ago, it introduced the Publisher Platform, a way for licensed professionals to deliver their portfolio research in a better manner to their clients.

With the new funding, Smallcase is planning to expand to an ecosystem with 3 components: (1) A layer for brokers to allow any demat account holder to invest in Smallcase. (2) A layer for professionals to share their research. (3) An infrastructure for wealth managers and advisory platforms to advise on and enable their clients to invest into stocks & ETFs, via Smallcases, on their platforms.