Scor white paper on the underwriting engine of the future

In a special white paper termed “Underwriting, Automation and the Customer Journey”, the folks at SCOR discuss the use of underwriting engines defined as decision making systems that “focus on the customer journey and help drive sales and gather data at the same time as reduce cost and risk” .

My takeaways, below.

1. Customers are increasingly comfortable with the “idea” of underwriting but want a better experience

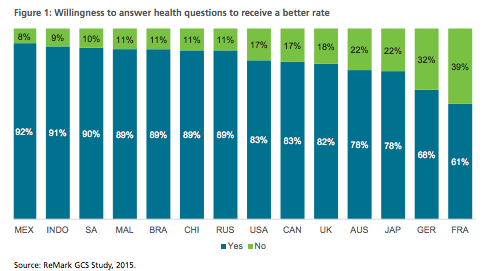

Despite what some may think, customers across all major life insurance remain quite open to underwriting and are more willing to disclose information about their health as shown by the figure below. Do note Germany and France, where consumers are a bit more reluctant to share personal intel. Bottom Line: customer behavior is driven by geography, which plays a big role in underwriting .

2. Automating underwriting without focusing on the customer experience yields poor results

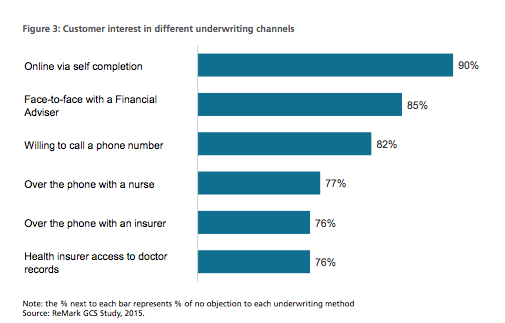

The underwriting process needs to be better integrated with the customer journey to allow customers to (1) begin quoting from their preferred channel, (2) avoid ambiguous questions, and/or unnecessary wait time. And while most customers prefer to receive answers at the point of sale, that’s not to say that any one channel makes another channel irrelevant, as can be seen by the figure below.

3. The adviser perspective on underwriting is a critical third lens alongside customer and insurer views

Advisors play a key role in driving the application process and have many shared interests with customers when it comes to a simplified application process and a clearer set of underwriting questions. This is where things get a bit interesting. According to the white paper, advisors look for automation solutions to improve the customer journey while insurers mainly look to deliver these solutions to cut down costs; a gap worth closing.

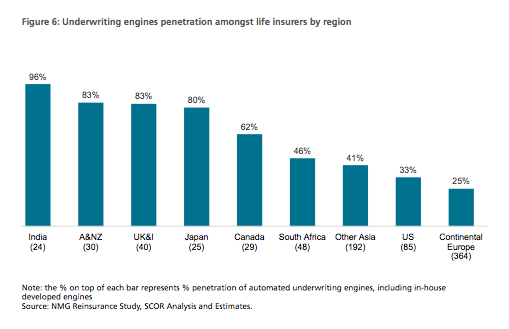

4. While demand for underwriting engines is accelerating, over 50% of life insurers globally do not own an engine

Note: high costs is the number one reason for the lack of adoption of underwriting engines.

5. The reinsurer’s key strength is as a strategic engine partner

According to the white paper, successful reinsurers will balance their role as risk management partners with their role of acting as technology providers that offer regional development resources . To learn more and access the full report, click here.