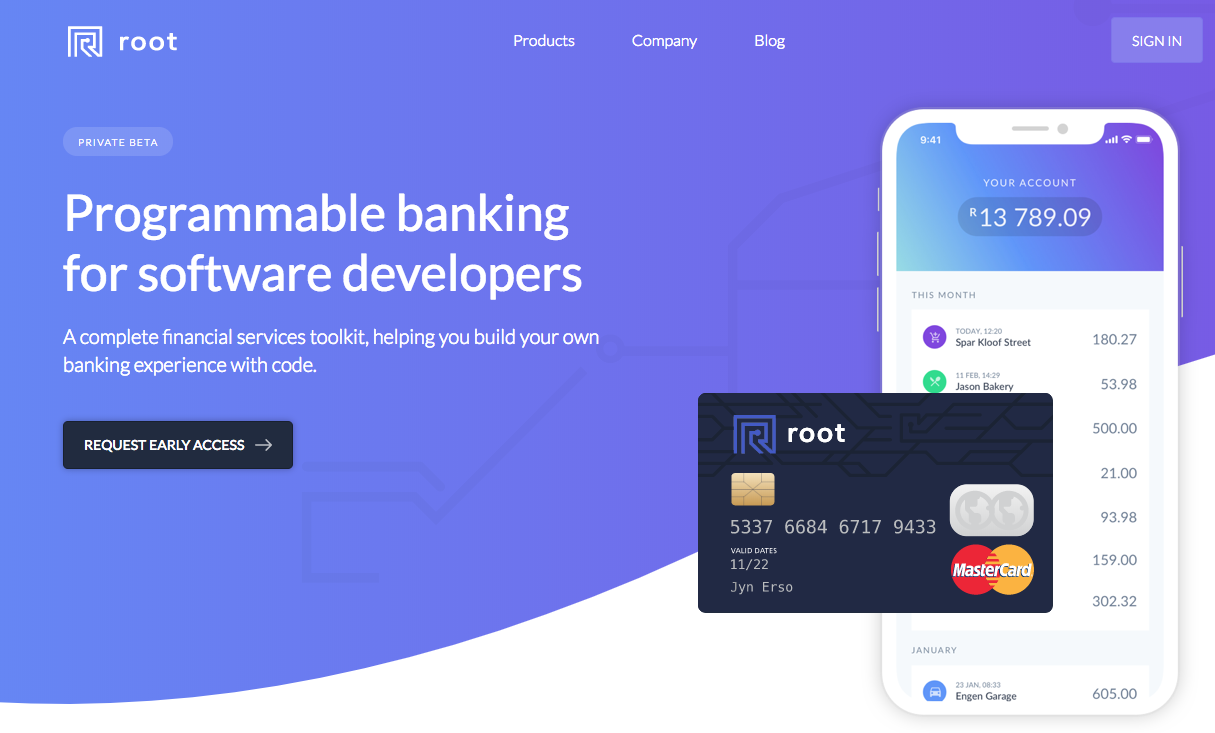

Root Insurance [the other Root] Just Launched

Cape Town-based Root, which offers a programmable credit card with APIs announced the launch of Root Insurance, a new platform API that enables software developers to rapidly prototype and launch digital insurance products into the SA market.

“Root Insurance is like cloud services for the insurance industry. It gives software developers all the building blocks they need to create and launch a fully compliant insurance product in a matter of days. The platform not only reduces costs and time to market drastically, it also takes care of administering the insurance policies – everything from issuing policies to collecting premiums and handling claims” – Root CEO Louw Hopley.

Root is a financial services platform of programmable financial services through APIs. This enables software developers and innovators to prototype, build and launch financial services products, and now insurance, too. It was founded in 2016 and enjoys the partnership of MMI Holdings, which provides it with access to insurance paper.

Earlier this year, Root revealed its first life insurance product called Hero Life, part of MMI Holdings, that offers a low-cost term life insurance product without brokers, call centers, or fat. Their words.

One last thing – Hero Life names Munich Re as a partner.