Radius Bank launches goals-based savings platform

Radius Bank is announcing the deployment of Goalkeeper, an automated goals-based savings solution integrated within Radius Bank’s online and mobile banking channels. Goalkeeper is launched in partnership with Harvest Savings & Wealth Technologies, a provider of integrated savings and wealth solutions for the financial industry.

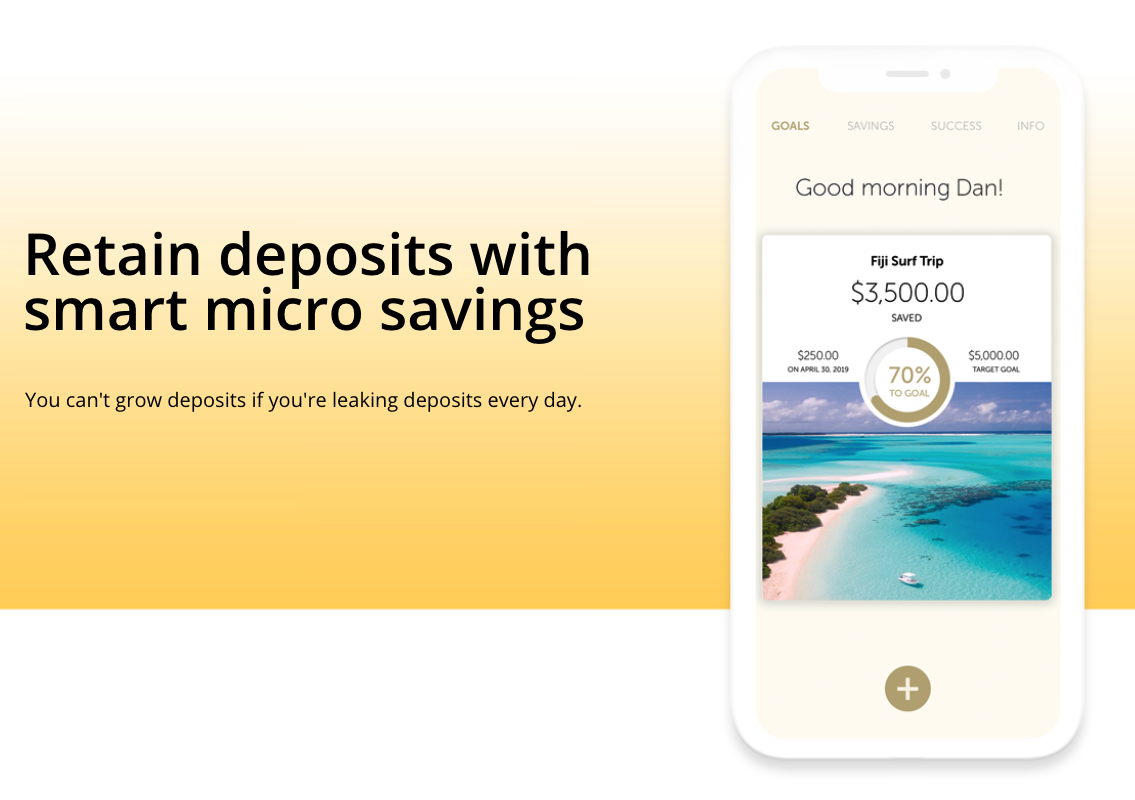

Goalkeeper allows clients to set and automatically fund any financial goal, helping customers take control of their financial health while becoming better savers. Within Radius’ digital banking platforms, customers use Goalkeeper to create unlimited goals, assigning them a name and a picture, setting target amounts, and then selecting an automated savings method. Once goals are created, Goalkeeper will help build customer savings automatically using periodic deposits or a “proprietary algorithm” designed to find untapped dollars for saving.

“The popularity of savings apps have helped consumers do a better job of reaching their financial goals, but these apps oftentimes only serve a limited purpose, thus requiring users to scan multiple apps in order to get a full picture of their finances often at a cost. Integrating Harvest’s technology directly into our digital suite lets our customers get a holistic view of their overall financial wellness, all in one, easy-to-navigate platform at no charge.” – Mike Butler, President and CEO of Radius Bank.

“As the number of consumers using fintech savings tools continues to grow, money will continue to leave banks. Goalkeeper allows banks to effectively combat micro-savings startups, retaining critical deposits, while gaining valuable insight into what their customers are saving for. As a bank industry innovator, Radius Bank saw the opportunity to quickly bring the solution to market, leveraging the power of their mobile banking app, which is already installed on tens of thousands of Radius Bank customer phones.” – Drew Sievers, CEO of Harvest Savings & Wealth Technologies.