Qapita raises $5 million

Qapita, a Singapore-based fintech offering equity management solutions, has raised $5 million in pre-Series A funding. The round was led by MassMutual Ventures, with participation from Endiya Partners, Vulcan Capital, East Ventures and others.

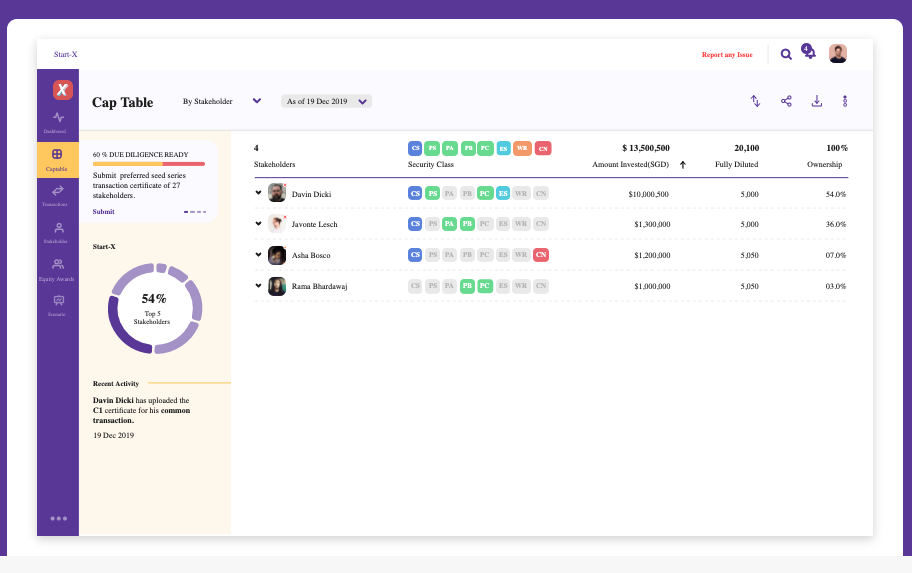

Founded in 2019, Qapita helps private companies and startups record and manage capitalization tables and employee stock ownership plans. Qapita also aims to digitize issuance of equity awards and shares and it plans to use the funding to grow its customer base in India, Indonesia and Singapore.

“Globally, we are witnessing trends that indicate a convergence between public and private markets. Qapita is enabling this in the region through their solution – from cap table and stakeholder management to digital share issuances and liquidity solutions. We believe the team has the right combination of experience, understanding of regional markets and product expertise to deliver on their vision. We are very excited to partner with Qapita and look forward to working with them as they build a category leading company in Asia.” – Anvesh Ramineni, managing director of MassMutual Ventures.

“India and the entire South-East Asia region already have a very vibrant startup ecosystem that is going to grow exponentially in the next few years with large capital inflows. Qapita with a stellar experienced team, customer traction, and marquee relevant investors has real potential to be a leader in the Cap Table, ESOP, and Liquidity Management space. Endiya is a launchpad for great product startups and our association with Qapita is the beginning of an inspiring journey which we are stoked about.” – Sateesh Andra, managing director, Endiya Partners.

Bottom Line: In the space of Carta.