N26 Officially Live in the US

N26 is launching its banking app in the US in a staged rollout; the 100k customers on the waitlist will be invited to sign up and have full access to the product.

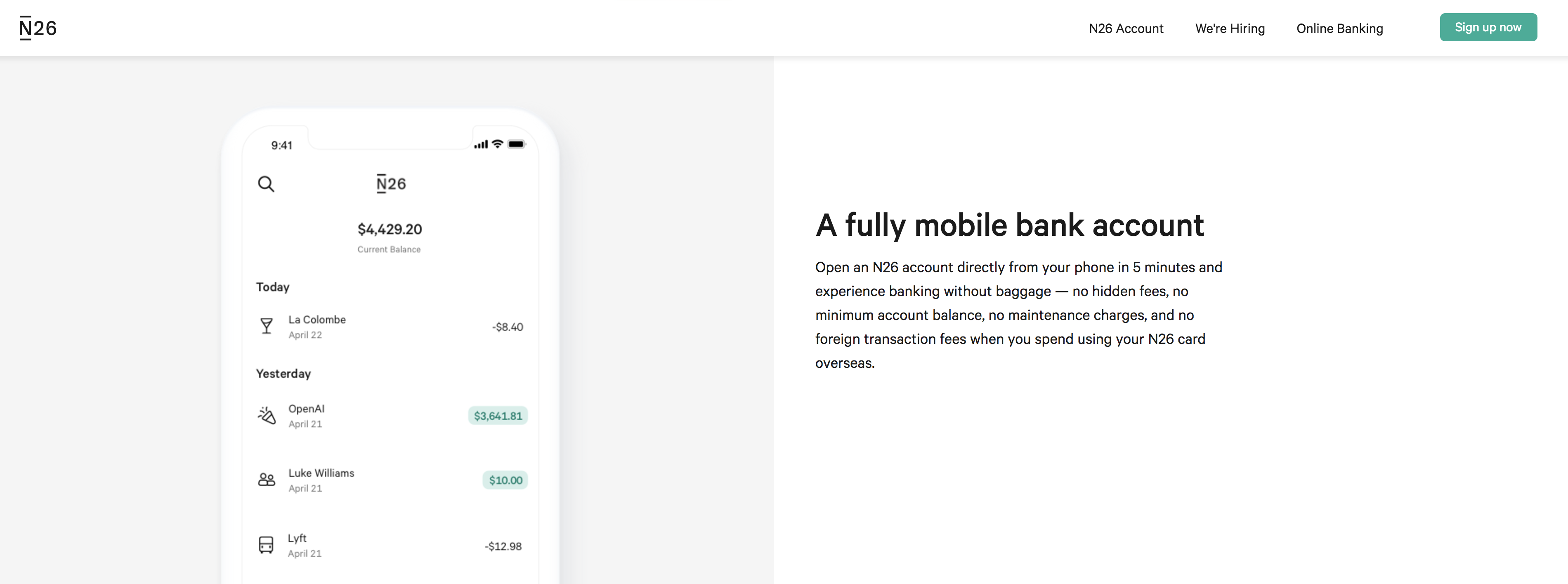

“We’re very excited to bring our experience to US customers. In Europe, we’re loved for our effortless and sleek user experience, with no hidden fees. Starting today, you can sign up entirely from your phone in just five minutes. There are no account maintenance fees or minimum balances required. We will eliminate the frustration of visiting branches, waiting on the phone, and paying fees for basic services that should already be included. We will add even more benefits and features over the summer.” – Nicolas Kopp, US CEO, N26.

Since the initial European product launch in 2015, N26 has reached 3.5m customers in 24 European markets. With a higher than 4.8 rating in the Apple App Store, the app attracts over 10k new users every day in Europe primarily through word of mouth.

The N26 mobile app and debit card include many features that empower customers to take control of their finances. Account activity is displayed in the app in real time, and each transaction is automatically categorized. Customers can also set daily spending limits and lock and unlock their cards, all with a simple swipe in the app. N26 is also ideal for travelers as there are no foreign transaction fees when making purchases internationally.

Each account also comes with Spaces, which are sub-accounts that help people organize and achieve their financial goals. Spaces can be created with a simple click, and users can easily drag and drop money to and from their Spaces. Between beta now and a full public launch later this summer, people on the waitlist will continuously be invited to get access to the N26 app. Over the summer, we will also launch additional perks and two free withdrawals per month at ATMs nationwide. Shortly thereafter, N26 Inc. will introduce Metal, a premium tier account, to US customers.

“The US launch is a major milestone for N26 to change banking globally and reach more than 50 million customers in the coming years. We know that millions of people around the world and particularly in the US are still paying hidden and exorbitant fees and are frustrated by poor banking experiences. N26 will radically change the way Americans bank as it has for so many people throughout Europe.” – Valentin Stalf, cofounder and CEO, N26.

Bottom Line: Planning to expand to Brazil.