Mobile-Optimized Web vs App – The Battle for Value!

We analyzed both to see which worked better for life insurers – and what we found might surprise you!

In this corner … with its ease of access, flexible layout, and long, strong history of building up companies and industries … THE MOBILE-OPTIMIZED WEB!

And in this corner … with its impossibly modern capabilities, digital boldness and ability to place a logo on anyone’s mobile device … THE MODERN APP!

(bell rings)

If you have a smartphone (and Statista finds that 85% of US adults do), there’s a pretty good chance that you’ve visited an app store in the past few days. And if you’re like me, you’ve gotten lost in the incredible number of offerings in those app stores. In addition to the apps we all seem to have – Facebook, Instagram, LinkedIn, TikTok (ok, I don’t actually have that one, but I know a lot of people who do), you can literally find an app for everything! A quick scroll through the apps popular today include games, meditation, household administration, pet care, plant care, a virtual art studio, foreign language instruction – even an app on how to build apps!

Among these cutting-edge digital tools, I was happy to see a growing offering by life insurers, several banks and financial service providers. When even the most traditional of industries can merge with the modern world of learning, servicing and incentive programs, we all benefit. Acorns is a great example – the app invites users (many of whom are millennials and gen Zs) to “save and invest for your future.” It’s a brilliant combination of the old world (formal banking, as we know it today, has its roots in Italy in the 14th Century) and the new that revitalizes those ancient financial principles and makes them relevant to today’s world.

It started me thinking: is it even possible to do business in the world today without having an app?

A few years ago, having a well-designed, functional website was the height of technology – and it was a relatively affordable and practical way to stay engaged, provide information, offer connections, and gather information from website visitors. Life insurance websites have come a long way, adding modern functionality, including the capability of a do-it-yourself “quote and buy” platform in some cases. And the advent of mobile-enabled technology makes it possible for a sophisticated website to adapt to any size screen, adding functional touch sensitive features necessary so that it can be easily navigated on any handheld device. The mobile-optimized website that most insurers have today is an evolution for the life insurance industry! But can even the most advanced website compare with the capability, customizable format and digital ease of a slick, modern app created specifically to appeal to smartphone and tablet users?

To answer that question, it’s worth comparing the pros and cons for both mobile-optimized websites and app development and deployment.

What’s new in mobile responsive web design?

Since we are seeing an ever-increasing number of smartphone users spending an ever-increasing number of hours each day using a handheld device, mobile enablement of a web presence is a must. Beyond making the experience and interactions user-friendly, websites created with mobile-first thinking will rise to the top of Google searches and ratings. As mobile usage has eclipsed desktop, Google now prioritizes mobile capabilities and usability over desktop functionality in its rating and indexing of sites.

With all the options available for mobile-optimized and mobile-responsive sites, and the number of developers/designers who can incorporate these capabilities, there is no reason why any insurer should offer a dysfunctional mobile web presence to the large majority of people who now conduct business through their handheld devices.

While the phrase “website” may seem ironically antique, there are still many things that mobile-enabled websites offer that make them incredibly relevant:

- Immediacy. Type www.(name of life insurance company here).com and you can instantly access information from (name of life insurance company). Again, responsive web design can make this even more instant! Compare that to visiting an app store, signing in, downloading the app, reading through instructions, logging in information about yourself, etc. This immediate access is incredibly important, especially when researching, quoting and buying life insurance. You can even find and contact an agent if you need to!

- Compatibility. Some apps are only for iPhones. Others are only for Android or Google phones. A website can be accessed using any device. No matter where you are – at your home computer, in a doctor’s waiting room, in the passenger’s seat of a vehicle – with good cellular service or WiFi, a well-thought-out website is accessible across devices.

- Shareable content. Highlight a web address, copy and paste it into almost any platform – you can email, share via social media or include it in another website. Easy, right? Now try sharing an app. Hmmmm … nowhere near as convenient, since there’s generally a side trip to the app store involved. As your customers are considering a life insurance purchase, they will probably want to share information and product comparisons with others who will have a stake in the purchase.

- Access. If you are doing any social media marketing (and why wouldn’t you be in 2021?), your website must be functional across devices and easy to navigate. Most people access their social media accounts through a mobile device – and if someone is interested enough in your marketing, they will expect to click a link and be led somewhere – ideally, a website that answers more questions, provides a direct opportunity to get a quote, apply for a policy and buy or be connected with an agent.

- Ease of edits/changes. Changes are a major consideration for insurers across communication vehicles. Rates, regulations and new products are just a few of the areas that have to be constantly updated. The process of editing a mobile-optimized website is much easier than the process for a native app. Native apps have to be recompiled and go through a black box approval process at Apple or Google before they are approved to make it on the store.

Beyond making the changes, the policyholder who turns to a website can simply refresh to get your new information. Web apps just instantly deliver the latest versions of themselves, every time, with no fuss. It’s a meaningful advantage.

In the case of your app, policyholders will have to download the new and improved version. Sure, most mobile devices can be set to automatically download new versions, but that’s not always a guarantee that the latest and greatest is at the user’s fingertips.

These are just a few of the reasons why a website makes sense, especially when it’s optimized for mobile. But, like I said earlier, there’s an app for everything. As apps are gaining in popularity among smartphone users, and the business world in general, does the time and expense of creating an app make sense as part of an overall strategy for life insurers?

The App As a Business Tool

As a quick refresher (from technopedia.com): “An app is computer software, or a program, most commonly a small, specific one used for mobile devices. The term ‘app’ originally referred to any mobile or desktop application, but as more app stores have emerged to sell mobile apps to smartphone and tablet users, the term has evolved to refer to small programs that can be downloaded and installed all at once.”

For life insurers who have already embraced any level of digital technology, the allure of creating an app – and the brand awareness that comes with having your logo on the smartphones of most of your policyholders – is a key business goal. As Capgemini points out, “Development of mobile applications in life insurance is driven by processes required to streamline business functions. Operations, transactions, information, and marketing are the primary areas insurers may invest in as they begin to create mobile applications. Mobile applications in life insurance can enhance productivity and process capabilities, resulting in significant benefits and potential to attract the next generation of customers and enhance relationships with existing customers. It will also improve an insurer’s ability to analyze and understand customer needs and promote the insurer’s brand.”

But what, exactly, can an app do to “streamline business functions” or “enhance productivity and process capabilities?” Let’s dig a little deeper into the elements referenced by Capgemini to see when, where and if an app may be useful and valuable to life insurers.

App Attributes and Applications in the Life Insurance Ecosystem

There is a reason why apps are so numerous and so necessary today – they offer very specific attributes that cannot always be replicated through even the most technologically-sophisticated website. Some of these attributes include:

- Personalization – Modern apps “know” you, and good design allows them to get to know you better as time goes by through AI, machine learning, and links to connected devices like watches and fitness apps. When users are provided with highly personalized content based on their interaction with the app, they have a higher chance of remaining loyal. These users also tend to act as brand ambassadors, as it offers curated vs generic content which can come across as rather robotic or automated. Personalization provides a huge boost to the customer experience, which is the underpinning of all engagement.

- Compatibility with all devices and their built-in features – Apps can be created to work with features already on your device, and those pairings can make for some pretty powerful bonds. Life insurers can offer incentives for referrals to address book connections, offer AI-directed guidance on lifestyle based on photos and even offer instant rewards for healthy behaviors. New GPS-guided technology can allow you to engage when a user is in a location where a cool offer or reminder makes sense. (“You’ve earned a free cup of coffee from Starbucks – do you want to redeem it now?”)

- Ability to send messages directly – Push notifications are the alerts and messages that users can receive regardless of any activity they are doing on their mobile device (as opposed to in-app notifications, for which an app must be opened). Push notifications have changed our world. An app lets a life insurer decide what needs attention and when it needs attention, and then the app “pushes” the information to the insured via the app. The ability to send instant, non-intrusive notifications to users is one of the primary reasons why businesses pursue apps in the first place.

- Capability for immediacy of transactions – Personalized content and push notifications can be powerful action drivers, and an app that makes it possible to complete transactions right at the moment the policyholder is thinking of them enhances these drivers. For this reason, an app is a powerful tool to streamline processes and improve business results. For instance, when you push a notification on checking beneficiary information and then offer the beneficiary information right in the app (vs. a snail mail notice to the policyholder, who then has to log in to the website to take action), you’re providing an actionable engagement, and that leads to a better experience.

Do Life Insurers Really Need Apps?

An article in Forbes laid out the following as the foundation for a useful, valuable app: “A rich experience gives users a reason to download the app in the first place and the incentive to continue using it on an ongoing basis. Simple design, a seamless checkout process, and intuitive navigation will make your app easy and enjoyable to use. Finally, the development of personalized experiences will help keep the mobile app experience relevant and ensure users continue coming back.”

Are you prepared to offer these foundational pieces to support your app – and ultimately, your customers? Here’s how they might be implemented:

During the acquisition process – Modern apps can be linked to an insurer’s underwriting status engine via APIs. The value to the consumer who has an application in-process is that he or she can receive push notifications and updates from the insurer on underwriting status. Additionally, buyers can access the case status on their own, in real time, to see where things are, and possibly to interact with underwriting staff as they wait for the delivery of a policy. It’s like a “pizza tracker” for your life insurance application. Used during acquisition, an app can become a springboard to future engagement efforts.

Immediately after an underwriting decision is made and accepted – Insurers should strongly encourage buyers who have accepted coverage to download the app. At this time, carriers must present the litany of valid reasons why their app deserves to take up valuable real estate on a smartphone. Tech-savvy insurers can, indeed, offer a good deal of value: upon acceptance of coverage offer, an insurer’s app can allow customers to choose initial and recurring premium payments, link their smartwatch to a fitness challenge within the app and receive messages that are relevant and important to coverage. Encouraging these links makes an app more valuable and strengthens the bond between insurer and policyholder.

Throughout the process of ongoing relationship-building and engagement – The use of personalized, curated content, as well as push surveys and fitness or financial challenges solidify the apps’ valuable position on the phone. As your client ages or grows a family, are you providing the education and product marketing tools to help them make their next product purchase (with your company, of course!) that will better secure a financial future? Customized marketing is made easier when you reach your client via an app. This policyholder engagement doesn’t exclude the agent relationship when reminders of agent contact information and the services they provide are presented throughout the app and any leads based on customer actions are fed back to the agent of record to reach out to the policyholder. In fact, this proactive outreach can only improve the agent’s relationship with the policyholder.

While promoting customer service activities – If users don’t open their life insurance app, they may forget about the useful features within the app – that could mean a missed premium payment, important policy requirements or other critical actions. For instance, insurers should proactively let policyholders know a bill is due or overdue via notification. Carriers can also alert policyholders that payment will be made through an autopay arrangement (just in case they need to make sure the funds are in their account associated with the app). Is the customer aware of term conversion privileges? Remind them though your app!

I would not be providing a balanced view if I didn’t mention the one big disadvantage of an app – if it’s not completely useful and regularly (or at least periodically) opened, it will get deleted. When you’re spending the money to develop an app, you’d better have a very good reason why you need it – and that reason shouldn’t just be “because everyone else has one.” I’d recommend referring to the core reasons for life insurers to have an app as presented above. If your technical capabilities and communication lines are not yet able to deliver some of these activities, it might be best to wait until they are. Bottom line here: don’t spend the time, effort and money on a “vanity project”.

In my experience with the life insurance/annuity industry, I have found that traditional websites, mobile-optimized web and apps all have a role to play. Carriers who want to truly offer an omnichannel experience have to provide a rich, meaningful experience through every channel, and each must provide value to the overall customer experience.

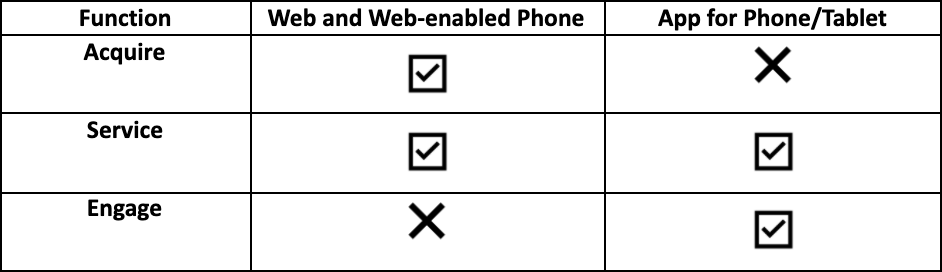

To acquire new policyholders and offer buyers a secure, simple experience, a modern, multi-functional website is a must. And it must easily translate to a mobile device. Since potential policy buyers will be looking for information and asking questions, all information must be accessible from all devices at all times.

To service policyholders, a mobile website and an app will need to work together to provide the fast access and DIY functionality for the ultimate customer-driven servicing. Service depends on having access to information, especially when policyholders are dealing with the relatively complex topic of life insurance/annuities. They will also need the capability to self-drive changes – so both apps and websites will need to be configured with access to live help (via a call center or chatbot, for example).

Post-issue engagement is mostly within the realm of a thoughtfully designed app that offers valuable, personalized information at the right time, based on an understanding of each customer’s individual needs and driven by AI so that the individual policyholder drives the engagement experience.

In the battle between a mobile-optimized website and an app, it’s not an either/or. To fully take advantage of what a digital platform can offer, you need both!