Mercedes-Benz Services Malaysia ‘Eliminates’ Car Insurance Premium

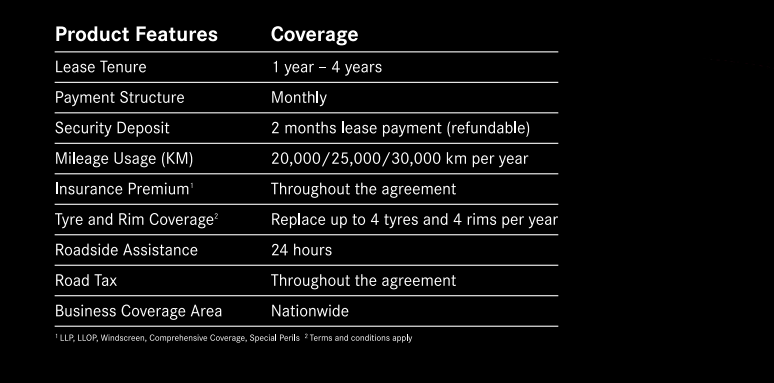

Mercedes-Benz Services Malaysia (MBSM) is bullish on ‘usership’ and bearish on ‘ownership’ . The company launched its latest ‘vehicle subscription – financing solution’ called “Lease2Go” that allows users to drive a Mercedes-Benz over a period of time, minus the commitment of total ownership. Some of the benefits include: (1) the option to drive a new Mercedes-Benz more often, (2) zero down payment, and (3) zero risk of asset depreciation.

“MBSM is constantly developing new ways to translate our customers’ needs into relevant and innovative financing solutions. (With) Lease2Go, we are removing all the unnecessary ownership commitments to give our customers peace of mind, and make it as easy as ever to enjoy driving and upgrading their Mercedes-Benz cars” – MBSM managing director Mike Ponnaz.

Wait there’s more. Lease2Go conveniently packages all costs including insurance premium into a fixed monthly payment. Insurance coverage is offered via Mercedes-Benz Insurance Services that has a partnership in place with AXA Affin and Allianz.

Sounds familiar? It should. Elon Musk is on a similar mission to offer a pay-one-price model that includes both insurance and maintenance for the entirety of the vehicle’s lifetime. His company Tesla is currently testing this business model in Asia. Also, while on the subject of luxury car brands and vehicle subscription services, Cadillac will be offering a similar service. The GM-owned icon will launch a new service to reach Generation X and Generation Y called Book, which will allow members access to their choice of popular Cadillac models for however long they want the model, then the ability to switch to another model. But Book will carry no commitment to lease, finance or buy a vehicle. Coverager reached out to inquire about the insurance component and received the following response: “The insurance premium provided with the Book by Cadillac program is covered in the monthly subscription fee of $1,500. As part of your membership, Book by Cadillac insures vehicles driven in accordance to your membership agreement. Auto liability coverage is provided at $100k per person / $300K per accident / $50k property damage per accident. PIP and UM/UIM coverage are provided where required. If any damage occurs to a Vehicle while in the members’ possession, and that damage is covered by Book by Cadillac, then member will be responsible for paying for repairs up to a $750 deductible.” Unfortunately, no word on the insurer behind the program.