Mastercard and HealthLock to protect consumers from healthcare fraud and billing errors

MasterCard is working with HealthLock to combat medical bill fraud, claim errors and overcharges.

Consumers who link their insurance accounts to the HealthLock platform can monitor all healthcare claims in one place and benefit from automated reviews to potentially help reduce expensive medical bills and reverse claim rejections.

The partnership will initially open HealthLock’s analytics-backed healthcare services to US-issued HSA and FSA Mastercard cards, with plans to expand to other programs later in the year. In addition to the core, no-fee service, Mastercard cardholders receive a 90-day free trial of HealthLock’s premium service and preferred rates for subscriptions.

Recent data shows that medical overbilling, fraud and abuse cost Americans an estimated $325 billion1. Breaches of health records by fraudsters and subsequent malicious activity have risen to more than 59 million2 cases in 2022, up from 40 million in 2020.

“Mastercard has deep experience in combating fraud and a relentless approach to innovation in data security. This partnership with HealthLock offers millions of our cardholders in the US the knowledge that their medical data is safeguarded, and their healthcare payments and claims are accurate and secure.” – Ajay Bhalla, president, cyber and intelligence at Mastercard.

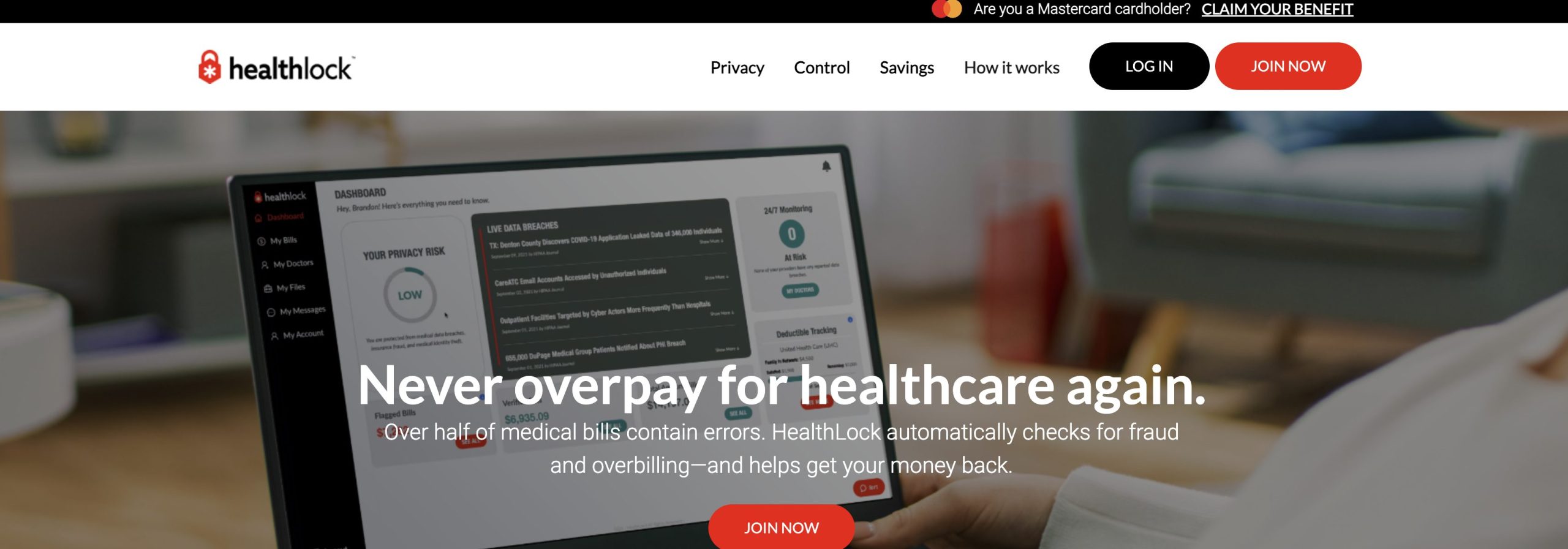

HealthLock’s platform helps consumers audit every single medical insurance claim and keep them organized through a user-friendly dashboard.

“More than half of medical bills contain errors. The healthcare system is increasingly complex, chaotic and costly. For the last 10 years, our mission has been to make healthcare simpler and more secure. This partnership with Mastercard enables HealthLock to ensure millions more people don’t have to pay more than their fair share.” – HealthLock CEO Scott Speranza.