Lula’s AI Gamble

Our sources indicate that insurtech Lula Technologies is currently in negotiations to divest its poorly managed insurance segment. The prospective acquirer is Nantucket Capital Corp, a San Diego-based MGA established in 2020. The terms of the acquisition include the transfer of the insurance division’s staff to Nantucket Capital.

Founded in 2020, Lula initially emerged as a provider of insurance infrastructure for businesses in the car rental, car-sharing, trucking, and logistics sectors. Post-deal, Lula will scale down to a core team of ~19, a significant reduction from a high of 150 employees the previous year. This divestiture, coupled with layoffs, are significant factors, among others, influencing Lula’s current state of affairs.

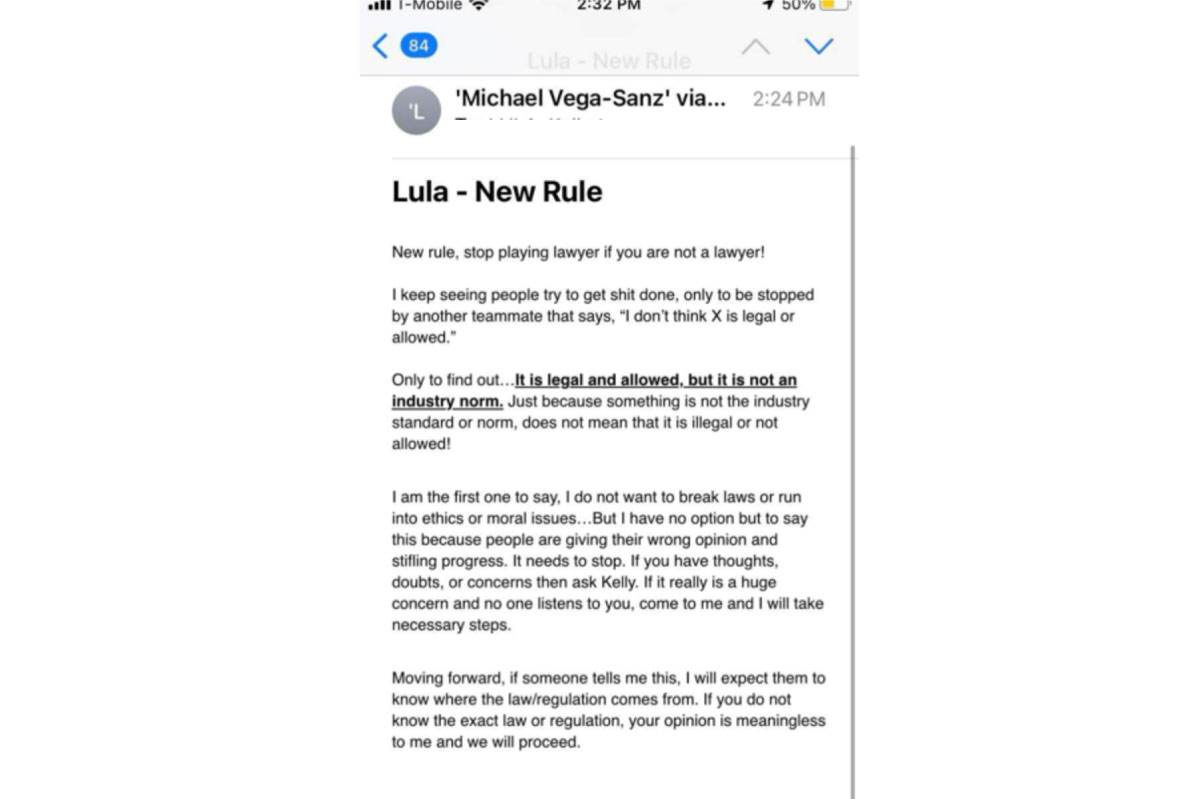

According to Glassdoor, Lula has received a rating of 2.3, with only 27% of reviewers saying they would recommend the company to a friend based on 25 reviews. Glassdoor reviewers paint a picture of a company struggling with leadership challenges. A former senior software engineer shared these insights on November 25, 2023:

- “The company operates in the insurance sector rather than being a tech-focused entity. Lula serves as an intermediary for insurance distribution. They used ChatGPT and Chatbot API to create a customer support AI over a weekend, claiming first in the insurance industry, it seems more like a strategy to boost valuation than a genuine tech initiative. Their tech revenue is nonexistent, in fact, it’s $0, relying solely on insurance sales. The focus on ML/AI is a one-person effort with no substantial revenue generation.

- The founders aspire to emulate figures like Jeff Bezos and Steve Jobs but exhibit characteristics more akin to Elizabeth Holmes. Despite their penchant for wearing black, their tech knowledge and experience are lacking. They initiate projects with unrealistic timelines, disregarding estimates provided by engineers. Midway through development, they frequently cancel projects, causing frustration among the engineering team. The founders, surrounded by non-tech YES-sayers, ignore product and engineering recommendations. The company’s principles are closely copied from Amazon’s leadership principles.

- Lula recently terminated employees at the Palo Alto office, closing it and relocating all tech functions to the East Coast and Eastern Europe. This move aligns with their interpretation of the principle of ‘Frugality,’ although it differs from Amazon’s approach, as Amazon doesn’t outsource to save money.

- The founders take pride in the fact that Lula pivoted twice and fired numerous employees in the past. Strangely, this is openly discussed during onboarding, serving as a red flag for those joining the company.

- Lula offers a low base salary and minimal benefits, with equity provided and a one-year cliff. Other than a 401k match, there are no additional perks. Notably, employees in the Palo Alto office had to purchase their own water bottles, while the Miami office (housing founders and the insurance team) enjoyed daily catered lunches.”

The origins of Lula date back to September 2018, when twin brothers Michael and Matthew Vega-Sanz launched a college-centric car-sharing app. Initially aimed at solving their personal challenge of renting cars on campus, this project eventually evolved into providing insurance infrastructure. “As you can imagine we needed to make sure there was insurance coverage on each rental. We pitched it to 47 insurance companies and they all rejected us,” Michael told TechCrunch. “So we developed our own underwriting methodologies or underwriting tools into the operations and had the lowest incident rate in the industry.” Amid the 2020 pandemic and subsequent closure of college campuses, the co-founders pivoted their focus, transforming their initial concept into Lula, which they dubbed the ‘Stripe for insurance,’ assisting businesses in managing insurance workflows, facilitating background checks, and overseeing insurance policies and claims processing.

Comment

byu/sunsetviewer from discussion

inturo

Lula partnered with several insurers, including Oxford Risk Management Group, which guaranteed Lula’s policies as long as Lula’s loss ratio was under a certain amount. ‘The founders made it very clear that we were to ignore the loss ratio in the name of growth,’ Coverager was informed under the condition of anonymity. ‘And so, we sold to anyone that wanted rental insurance at a discounted price, without doing any due diligence.’ Lula tried improving the loss ratios by starting to do some vetting back around August, but by then it was too late. A statement of endorsement by Shelly Duhaime, an employee at Oxford, is featured on Lula’s website, stating: “At Oxford, risk selection [in] most important when choosing our insured partners, Lula’s underwriting platform and process made that decision very straight forward for us. Oxford will continue to support Lula’s shared mobility platform with new and innovative insuring solutions.” Eventually, Lula’s loss ratio exceeded the limit permitted by Oxford’s contract, resulting in Lula being responsible for paying the claims, according to our sources. All in all, as of November 2023, there is at least one documented instance of a client losing coverage.

Founders Fund and Khosla Ventures co-led Lula’s $18 million Series A round, which also included participation from SoftBank’s SB Opportunity Fund, hedge fund manager Bill Ackman, Shrug Capital, Steve Pagliuca (Bain Capital co-chairman and Boston Celtics owner), Tiny Capital’s Andrew Wilkinson. Existing backers such as Nextview Ventures and Florida Funders also invested, in addition to a number of insurance and logistics groups such as Flexport. NextView Ventures and Khosla Ventures co-led Lula’s $35.5 million Series B round, which included participation from Founders Fund, Financial Technology Partners founder and managing partner Steve McLaughlin, Steve Pagliuca, co-chair of Bain Capital and co-owner of the Boston Celtics, and Nextera Energy. To date, Lula claims $60 million in funding.

The co-founders of Lula are now working to pivot their company into one that sells generative AI to the insurance sector. They’ve introduced GAIL, “a voice powered AI tool that is capable of having human like conversations, built to lower Customer Acquisition, and Support costs.” Allstate, Farmers, Travelers and Nationwide have shown interest in the technology. A source shared with Coverager, that Lula’s product team stated that upon its launch, GAIL was mainly capable of conducting lead qualification tasks. “The value we sold GAIL on was that it could be a full service support representative.” They also tout that it passes insurance exams. In reality, Lula paid someone to sit in on state exams, take pictures of the questions, and feed those questions to GAIL after the fact to train on. Several days ago, Big I announced that Lula is joining the Big “I” Agents Council for Technology (ACT). It remains to be seen how smart GAIL’s technology actually is and whether it can avoid becoming another unwanted AI robocaller, particularly in light of the FCC’s banning of AI-generated robocalls due to their use in scams and misinformation.

We reached out to Lula for a comment.