LendingTree announces strategic investment in Stash

Charlotte, NC-based loan marketplace LendingTree has announced a strategic investment in Acorns’ competitor Stash. The investment from LendingTree is part of Stash’s $112 million Series F funding round, which includes funds and accounts advised by T. Rowe Price Associates, Inc. as well as Breyer Capital, Goodwater Capital, Greenspring Associates, Union Square Ventures, and other investors.

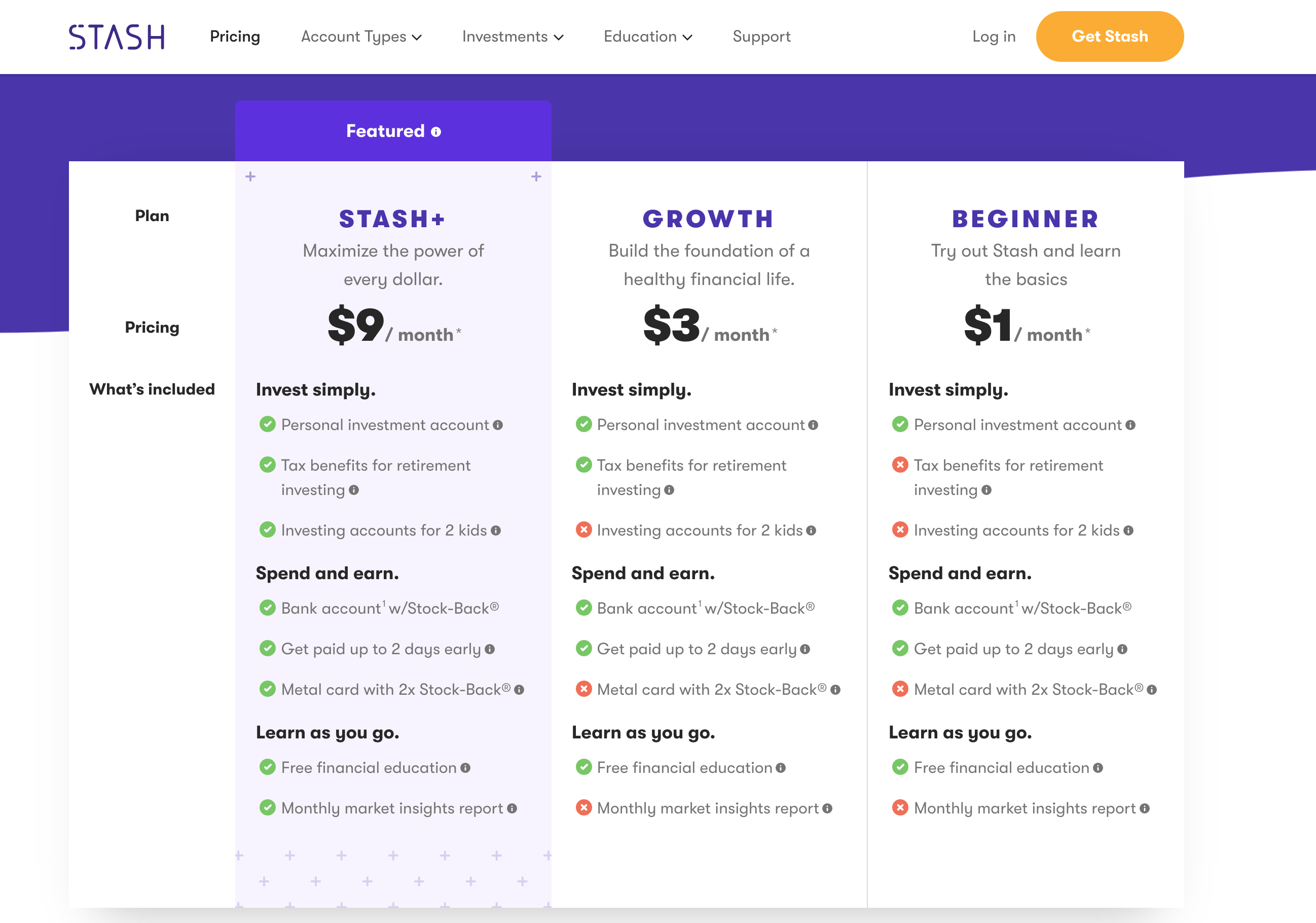

Established in 2015, Stash , which is now a team of over 300 employees, offers several subscription plans starting from $1 per month to help users reach their financial goals via guidance and tools such as automated savings, investments, and banking.

“LendingTree has become increasingly focused on the asset side of the consumer’s balance sheet, and Stash is a pioneer in that space. Stash is fiercely pro-consumer in both its product offering and mission, and we see countless synergies between our organizations. With LendingTree’s customer reach, marketing breadth, and comprehensive credit and debt offerings, and Stash’s focus on education and advice around saving and investing, we can help the consumer and each other. We couldn’t be more confident in our decision to invest in this business and its talented team.” – Doug Lebda, founder and CEO of LendingTree.

“Stash is dedicated to making an impact in millions of Americans’ lives by providing them with advice and coaching along with simple, personalized tools to help shape positive, long-term financial habits. We’re confident that LendingTree’s experience and success in delivering customer-first financial solutions will have a powerful impact on our ability to reach even more people who need a better way to save and invest.” – Brandon Krieg, co-founder and CEO of Stash.

In my opinion, it just a matter of time, before Stash Insurance is introduced.