KBC wants to be a platform for everyone

After introducing several features to its banking and insurance app, KBC Group “will go a step further” by opening up its mobile app to non-customers which will allow them to use several non-banking services without having to open a KBC account. This will make KBC the first financial institution in Belgium to open up its mobile apps to the public.

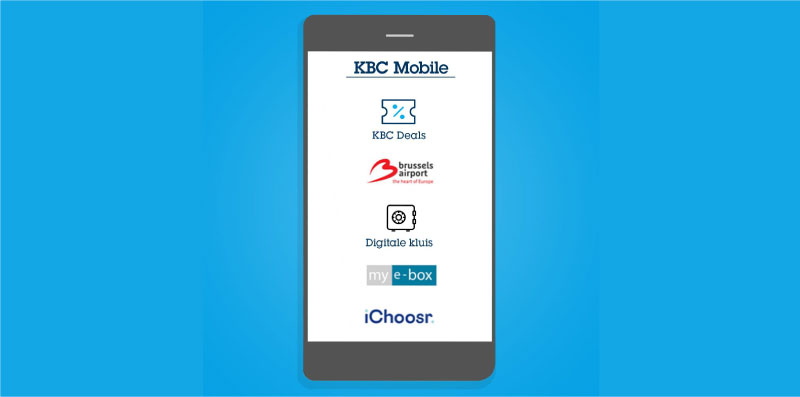

KBC is also launching new non-banking features in the KBC Mobile app. Customers and non-customers alike will be able to sign up for cheaper group purchasing of green energy (gas and/or electricity) via iChoosr, and order passenger comfort service vouchers for Brussels Airport which will allow them to skip the queues for the security checks by purchasing a Fast Lane Pass via KBC Mobile. In addition, the bank is introducing KBC Deals, a cashback reward program with discounted offers provided by national brands and chains as well as local merchants. This solution will be available for non-customers in the spring of 2020.

For Plus Account holders, KBC is launching a digital safe where customers can store all their important data such as documents, passwords, notes and photos. In addition, KBC is also rolling out the Belgian Federal Government’s eBox – a personal, secure electronic mailbox where customers can receive all their government documents in digital form.

“The distinction between customers and non-customers is becoming increasingly blurred. Consumers are looking for the fastest and easiest way to meet a particular need and they only want to see information and services that are relevant and tailored to the way they organize their lives. They expect to have access to a much wider and more attractive package of services, which they want to be able to activate quickly and easily from a single central app, without fuss or having to download 10 different apps. KBC will focus on this heavily in the years ahead. We’re going to develop KBC Mobile into an open platform that is readily accessible to every consumer and adds genuine financial value.” – Karin Van Hoecke, General Manager for Digital Transformation at KBC Belgium.

“We’re witnessing a rapid evolution in what consumers expect from digital services, and not only among our customers. It’s nowhere near enough nowadays simply to offer a basic service for banking and insurance products in digital form: consumers also want the cashback offers they receive from local merchants and big retail chains to be processed smoothly and automatically. The Deals package in KBC Mobile applies these discounts directly, without the consumer having to mess about with paper coupons, discount codes or till receipts. In other words, anyone who signs up for KBC Deals will have a quick and easy way to earn money via their KBC bank account. We’re also going to link the Trooper discount system to our KBC Deals programme, so that customers can opt to donate some or all of the cashbacks they receive to an organisation or charity of their choosing.” – Jo Vander Stuyft, General Manager for Mass Retail Customers at KBC.

Bottom Line: Over one million customers use the KBC Mobile app every day and more than 174 000 of them also use it for the non-banking services.