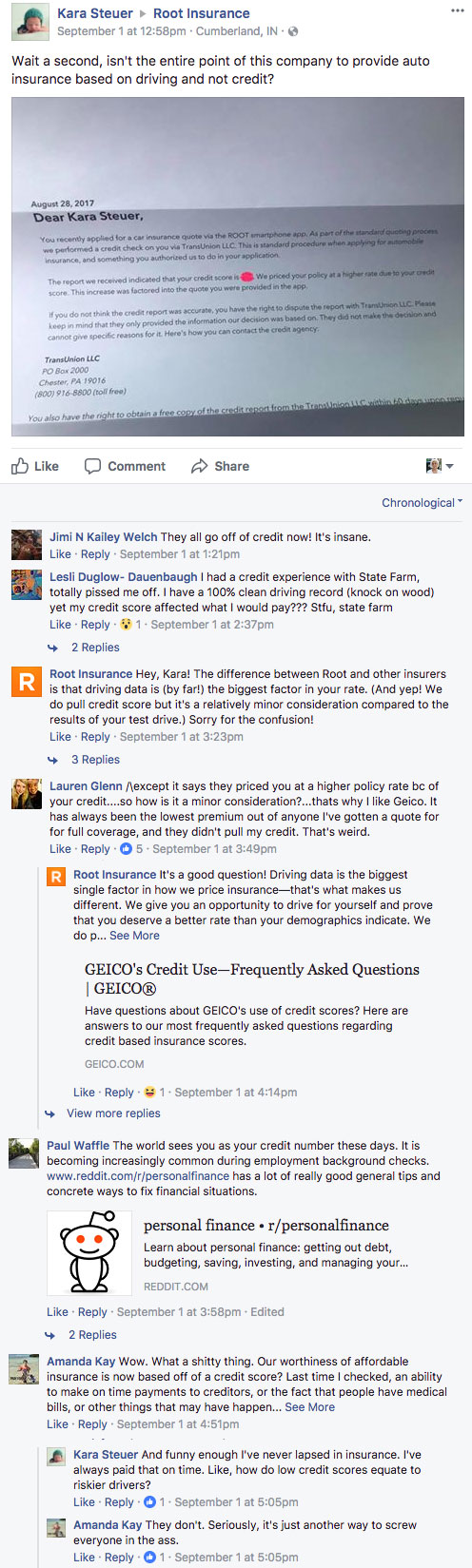

Kara Steuer vs. Root on Use of Credit Scores to Price Premiums

https://www.facebook.com/joinroot/posts/1589166531136110

And Kara has a point. Root’s landing page emphasizes it being a modern car insurer that offers fair premiums, based on how one drives. But here’s what else the website says (under FAQ): What is Root? Root is the first insurance company founded on the principle of Fundamental Fairness. They are an insurance company that creates new, personalized products that give good drivers the protection they deserve, at the rates they deserve. Also, what info do they collect? Root gathers personal information from prospects and from outside sources for business purposes. Some examples of the information they collect include name, phone number, home and email addresses, driver’s license number, marital status, and family member information. Also, they maintain records that include, but are not limited to, policy coverages, premiums, and payment history. They also collect information from outside sources that may include, but is not limited to, one’s driving record, claims history, and credit information. The problem is, credit scores are rarely synonymous with ‘fair’:

https://twitter.com/King_Breezy_B/status/906946374813585408

https://twitter.com/lcuiaa/status/906682016816680960

https://twitter.com/tiffers1993/status/905949042215075840

In its response back to Kara, Root explained that driving data is “by far!” the biggest factor in its rates, to which Kara responded that it should take a hard look at its marketing then, adding “My credit score literally has nothing to do with how I drive so why am I punished by it?”

BTW, in a blog post from Feb. 8, 2017, titled “10 Reasons You Could Be Paying Too Much for Car Insurance”, Root goes on to say how “poor (or average) credit still means higher rates.” One can see why Kara was confused.

Speaking of credit scores, On Sept. 7, Equifax reported a security breach that may have compromised 143 million customers’ personal data, including Social Security numbers, birth dates, addresses and driver’s license numbers. The consumer credit reporting agency found out about the hack on July 29. Yet it dragged their feet reporting the incident. And that’s not even the worst part. According to Bloomberg, Equifax is likely underinsured and Beazley is on the hook .

PS. Did you know that companies like Carpe Data provide alternative data sources to reduce insurers’ dependability on credit scores?