Jerry is going beyond insurance

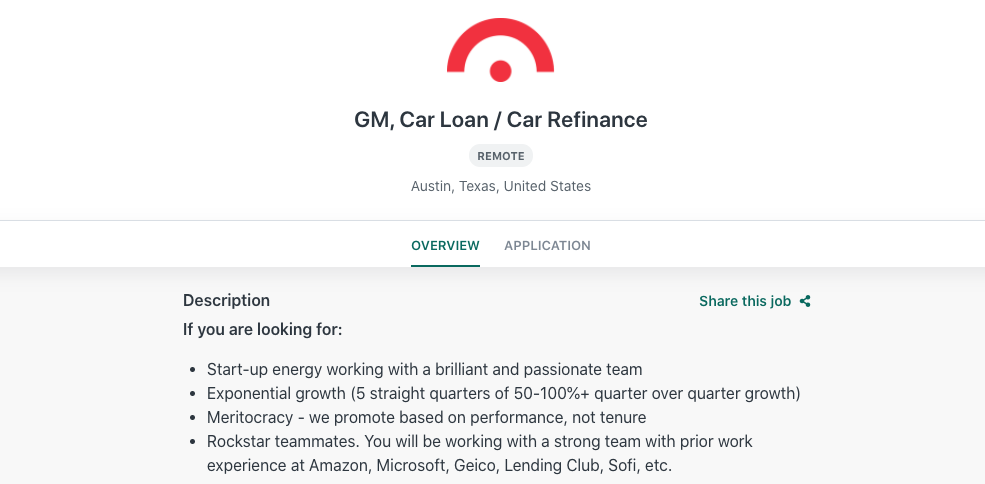

Jerry , the Y-combinator-backed personal insurance shopper that’s experiencing “exponential growth” with 5 straight quarters of 50-100%+ quarter over quarter growth, is launching a new service that goes beyond insurance.

The startup is looking for individuals in New York, Colorado, Virginia, Texas, and California to build out and grow its new car refinancing business.

Founded in 2017 by the co-founder and former CEO of on-demand car repair company YourMechanic, Jerry works with several insurers including Progressive, Travelers, Nationwide, MetLife, Safeco, Mercury, and others.

Since Jerry attracts consumers with a promise of better insurance rates, the company’s commission per customer is on the lower end. With this new service, the company can generate more revenue.

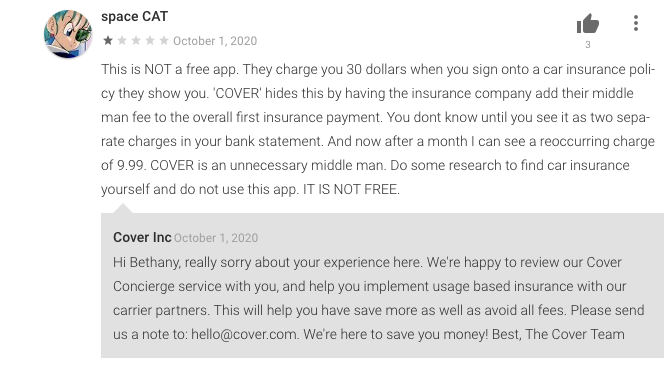

Cover is another company attracting consumers who are primarily interested in saving on their insurance products. Earlier this year, we covered the layoffs that took place after the startup failed to secure a new round of funding. Since then, Cover has added new elements to its business – the most visible one is different financial offers such as credit cards, loans, savings accounts and student loan refinance, where the startup acts as a lead-generator.

But the more meaningful and partially obscured new initiatives is what appears to be a service fee that’s making some customers angry.

We reached out to Cover for a comment about this service fee and received the following response: “Cover Concierge is a service we offer to do the heavy lifting of finding lower rates for our customers, answer questions, modify or renew policies, and continuously shop for insurance for you.”

Finally, Cover is moving towards working with independent agents. It recently hired David Suarez as head of insurance marketing who oversees the sales and distribution of its auto insurance products through the independent insurance agency channel, and if you’re an agent you can get appointed with the company at cover.com/agents.