Insurance for a Rainy Day

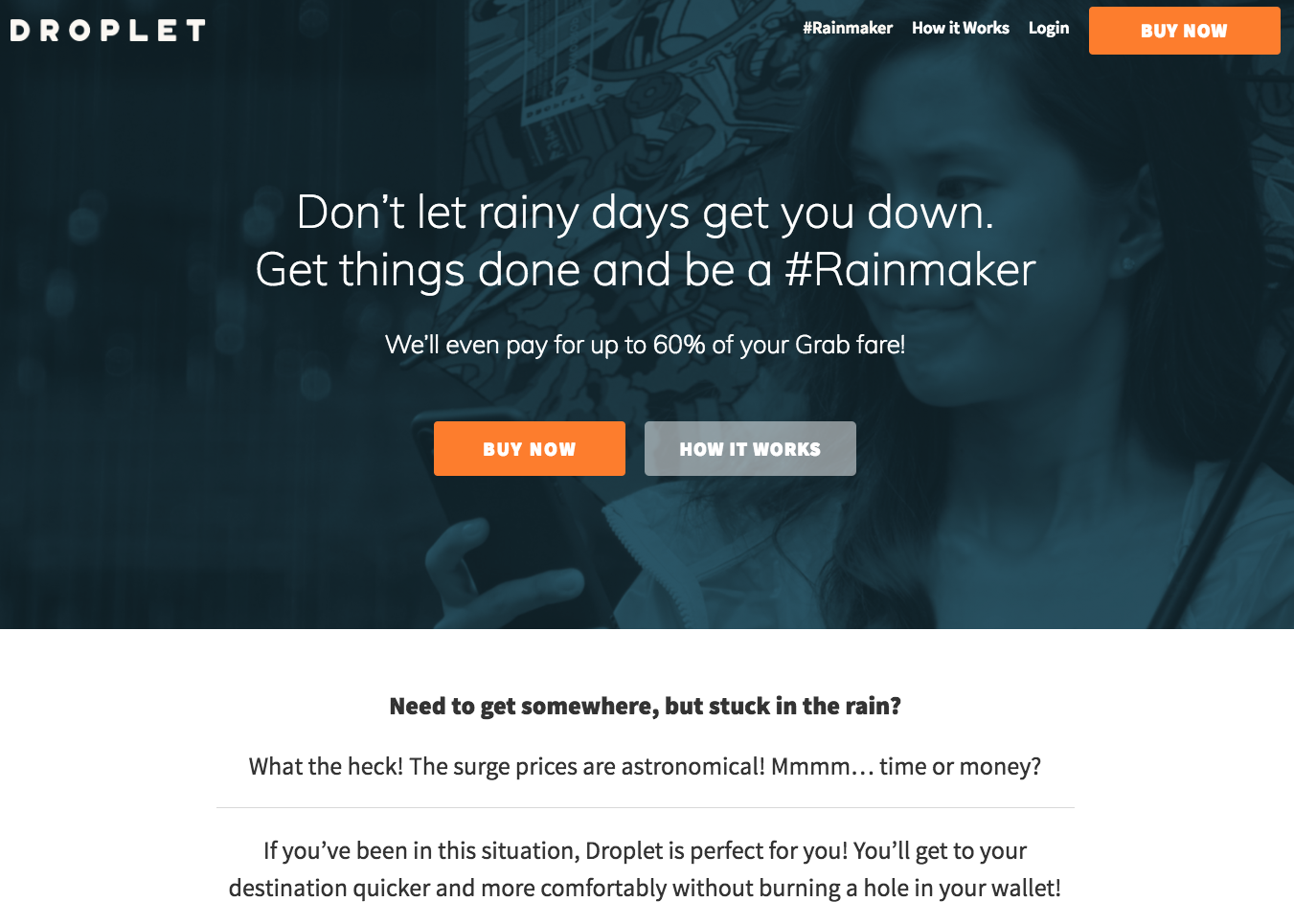

In Singapore, where an average of 167 days of rainfall can be expected a year, Income announced the launch of Droplet, a “lifestyle-inspired insurance,” which offers coverage against surge pricing due to rain when booking a ride on ride-hailing platforms.

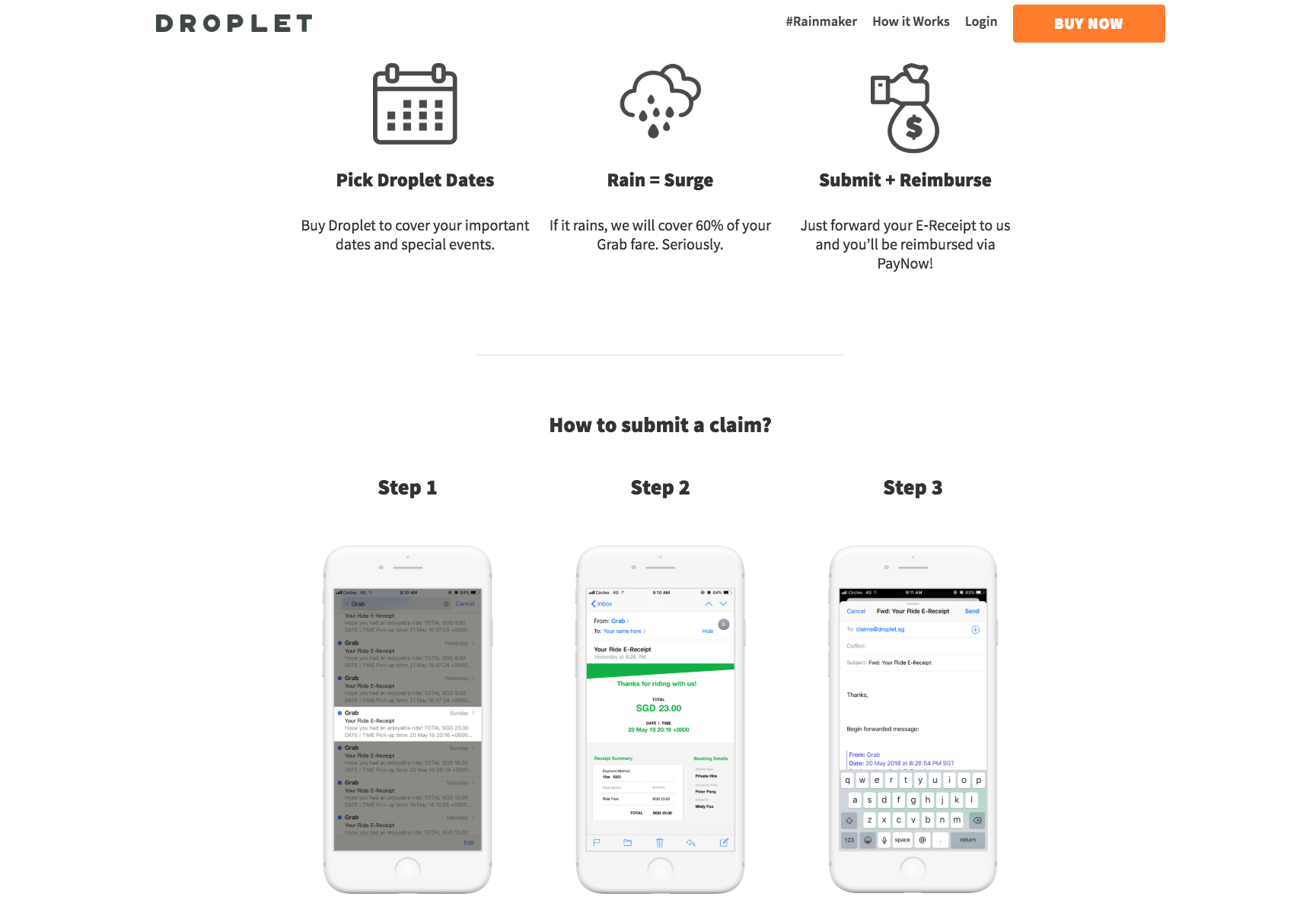

Currently offering coverage for Grab users with plans to extend coverage to other ride-hailing platforms, Droplet offers a pay-out of up to 60% (up to a maximum of $50 per day) of the trip fare and/or cancellation fee for booked rides where it was raining at the point of pick-up. To get coverage, consumers will have to purchase the “rainsurance” at least a day in advance, and to help consumers make informed decisions, real-time weather forecast is available at the point of purchase. Droplet premiums vary according to when consumers purchase the coverage – those who purchase closer to the days that forecast rain are likely to pay a higher premium compared to those who purchase in advance.

Droplet is also set to launch #RAINMAKER – a website featuring “a collection of authentic stories from real life Rainmakers.”

“Insurance is traditionally known as a means of protection from financial loss. It is primarily used to hedge against uncertain loss. Increasingly, we are taking inspiration from modern lifestyles and exploring opportunities where we can apply this principle of hedging to address consumers’ pain points via innovative insurance solutions. With something as ubiquitous as rain and surge pricing, we expect Droplet to influence the way in which consumers use and embed such an insurance in their daily lives.” – COO of Income, Peter Tay.

Bottom Line: Rainvow comes to mind.