Hybrid Distribution: The Future of Life Insurance Sales

We live in a hybrid world. Many of us are back to the office on a “hybrid” basis, i.e., a few days working from home, a couple days in the office. We drive hybrid cars, and we run our businesses in a hybrid cloud. Hybrid has become a harbinger of a more flexible future, and now it’s come to life insurance, namely in distribution.

We live in a hybrid world. Many of us are back to the office on a “hybrid” basis, i.e., a few days working from home, a couple days in the office. We drive hybrid cars, and we run our businesses in a hybrid cloud. Hybrid has become a harbinger of a more flexible future, and now it’s come to life insurance, namely in distribution.

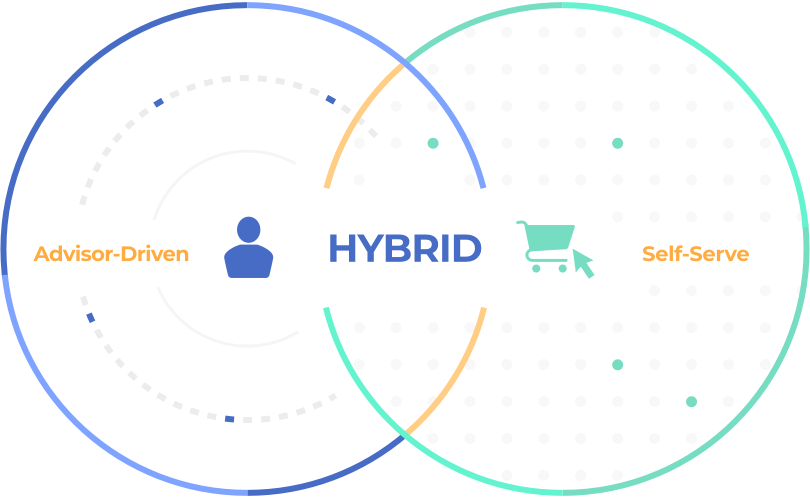

Hybrid distribution (HD) of life insurance products ensures a flexible, seamless experience for both advisors and consumers, for advisor-driven and direct sales – engaging when, where, and how needed – to convert leads into policies. It’s a buyers’ journey that shifts back and forth between advisor- and consumer-directed interactions, many of which are digital.

What’s in a name?

Omnichannel, multichannel, “phygital”…there are a lot of terms for this phenomenon, but most of them infer separate sales channels. But our traditional understanding of these individual channels is changing, and hybrid, which really means “all of the above,” is the way forward. It’s not enough to offer consumers just a great digital experience – that’s increasingly table stakes.

Today, consumers want to have a relationship with brands. Brands that aren’t engaging, that aren’t building these relationships on an ongoing basis, are going to struggle to stay competitive. Likewise, advisors also want relationships with the brands they engage with and represent – and not just affiliated agents. Insurers need to build relationships and engagement with any and all advisors licensed to sell their products. This is accomplished by delivering a great advisor experience – of course – but also by supporting productivity…streamlining and automating routine processes, providing digital tools that make it easier and faster to bring consumers from lead to in-force policy.

What does it look like?

HD is about delivering a modern buying experience, supported or not. It’s how the incumbent industry can compete with the digital upstarts – and tech giants – that are making moves into life insurance distribution. Consumers already have relationships with Google and Amazon. If the incumbent industry is to remain relevant, we need to combine a digital playbook with our decades of experience delivering financial security.

For consumers, we have to remove the complexity of insurance products and make the experience of shopping for, and learning about, life insurance products engaging and simple. For Advisors, we need to make it easy to interact with clients in real-time, to answer questions, to offer support, and to add value, as well as streamline internal processes for selling life insurance products. For carriers, we have to adapt, and we have to adapt quickly.

Just as high definition improved our experience of sight and sound, hybrid distribution, the next HD, will improve our experience of life insurance, as consumers, as advisors, and as distributors of life insurance products. To learn more, please visit: https://www.breathelife.com/life-insurance-hybrid-distribution/