Hurricane deductible buy-back insurance program expands to three East Coast states

Vertus Insurance Partners and Zurich North America have expanded the Cat4Home deductible buy-back insurance product to customers in South Carolina, North Carolina and Virginia. The expanded offering comes on the heels of the second most active Atlantic hurricane season on record with 27 tropical or subtropical storms.

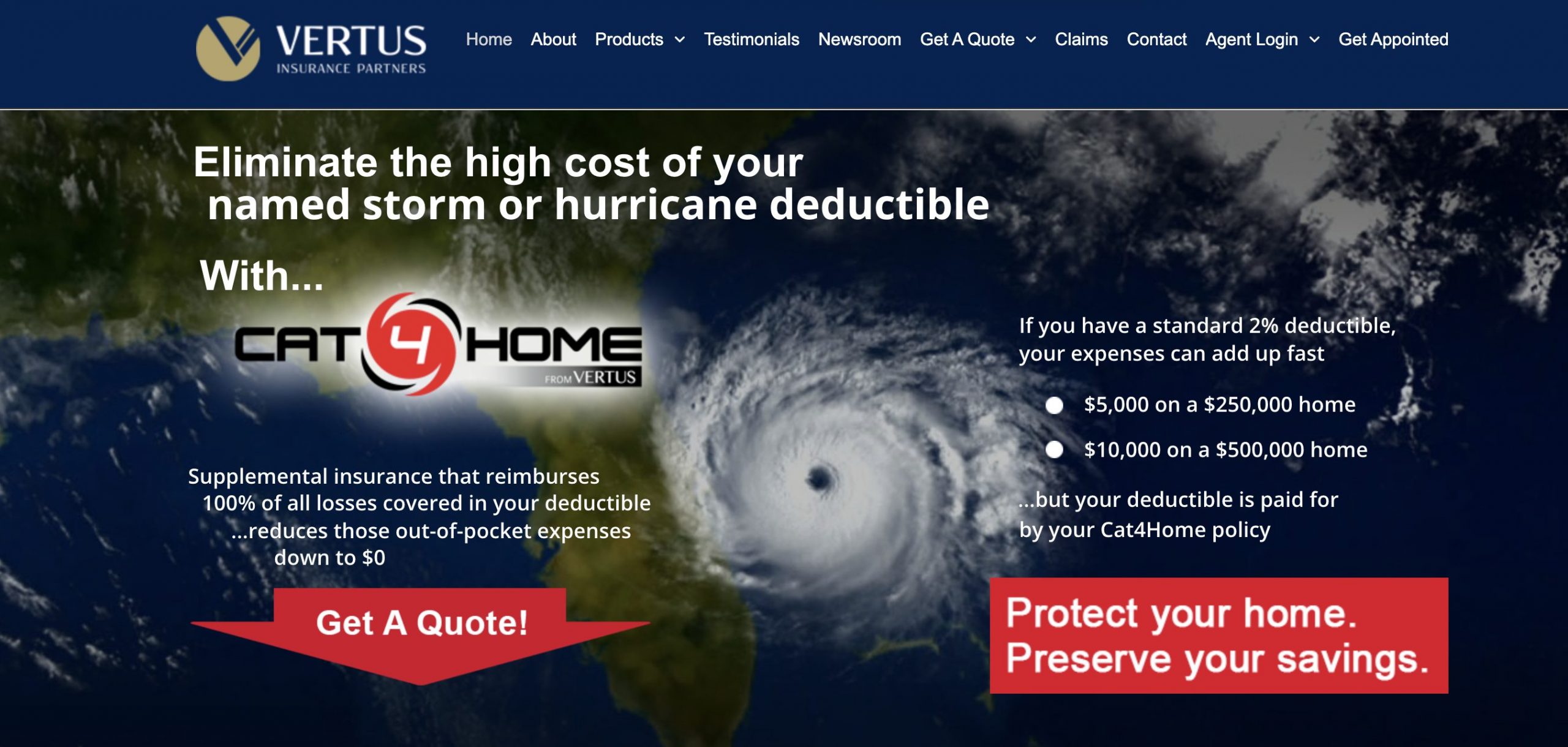

Cat4Home provides a 100 percent reimbursement of the hurricane and named-storm deductible that applies to a customer’s personal homeowners policy in the event of a storm-related claim. The coverage is already available in Florida and Texas.

Homeowners are often unaware of the large financial burden of their storm-related deductibles, which can lead to additional anxiety during an already stressful time.

“After experiencing a hurricane, the last thing homeowners need to worry about is how they will come up with enough money to cover their hurricane or named-storm deductible. At a time when homeowners in coastal, storm-prone states are facing higher deductibles and a greater probability of storm activity, Zurich and Vertus are thrilled to be offering an alternative solution to help them better recover after a disaster.” – Head of Programs for Zurich North America, Greg Massey.

The product is available for homes valued up to $5 million with deductibles ranging from $1,000 to $100,000. Cat4Home can be purchased for hurricanes only or can be expanded to cover all named storms.

“The coastal states of South Carolina, North Carolina and Virginia have been hit by far too many major storms over the years, including Florence, Floyd, Matthew, Isabel and now, Isaias in 2020. When disaster strikes, homeowners are often surprised to discover that they are expected to pay their deductibles out of pocket before their homeowner insurance kicks in. With a standard two percent hurricane deductible or greater, those first-dollar storm damage expenses can add up fast. Cat4Home covers the cost of this deductible, addressing this real-world challenge in a creative and cost-effective way. We are excited to bring this same quality coverage to new markets, giving our agent partners in these important coastal states the tools they need to help their insureds fully protect their homes and their savings.” – President of Vertus, Joe Braunstein.