Highlights from The Hanover’s annual shareholder meeting

The Hanover held its Annual Shareholder Meeting on May 14, 2024, led by Chair Cynthia Lee Egan and CEO Jack Roche. Key highlights include:

- CEO’s Opening Remarks:

- CEO Roche emphasized the significant changes in the world, presenting challenges and opportunities for the industry and the company. Key points included the evolving risk landscape, the need for improved risk analysis methods, understanding new customer demands, and embracing new risk mitigation capabilities. “We are in exciting and unprecedented times as the world around us goes through systemic changes, presenting new challenges and opportunities for our industry and for our company. The risk landscape is clearly changing, requiring all of us to elevate our games and think of new and better ways to analyze risk, manage our portfolios, understand new customer demands and preferences and embrace new capabilities to mitigate and prevent risk.”

- Financial Performance:

- The company reported a pretax operating income of $795.7 million, excluding catastrophes.

- Strong start to 2024 with a 2.3% increase in net premiums written and significant renewal price increases across various lines.

- Strategic Focus:

- Despite market challenges, Hanover remained focused on being the premier P&C franchise in the independent agency channel, investing in distinctive agency partnerships, specialized products, and a customer-driven approach.

- Expanded distribution by adding new agent partner relationships in new or underrepresented markets. “Meanwhile, we continue to expand our distribution, selectively adding new agent partner relationships, most often in new or underrepresented markets for us, and we increased the number of agents who write more than $5 million in annual premiums in multiple lines of business with us.”

- Specialty Business:

- The Specialty business was highlighted as a key element of The Hanover’s value proposition, representing a robust and profitable growth engine and contributing to the diversification of the overall business mix.

- Technology and Risk Mitigation:

- Enhanced technology capabilities with advanced tools for large property assessments, including infrared thermography, AI risk evaluation tools, and drone programs to identify and mitigate potential hazards and vulnerabilities related to weather risks.

-

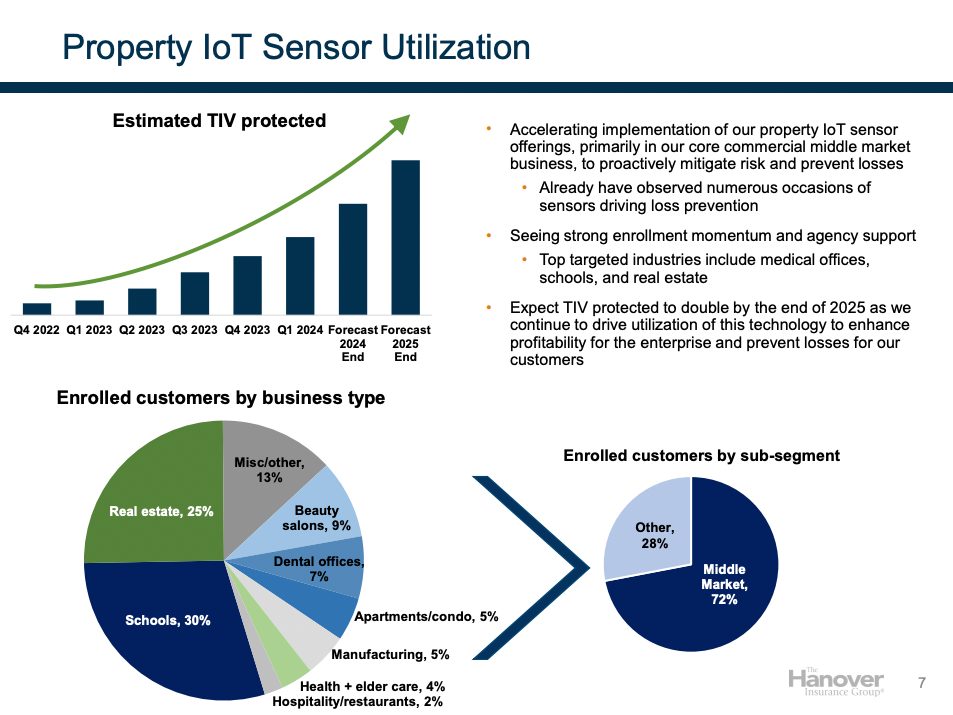

- Deployed over 10,000 water and temperature sensors across all business lines, resulting in numerous instances of loss prevention and mitigation. The data collected is expected to help in effectively working with policyholders to build resiliency. “We believe we have achieved scale and have enough sensors deployed to collect data and recognize trends, geographic risk profiles, types of system failures and more. We believe this data will enable us to work even more effectively with our policyholders, providing guidance on how best to build resiliency in the years ahead.”

- This IoT initiative is seeing strong adoption in schools and real estate. The protected TIV is expected to double by 2025.

- The Shareholder Meeting followed an earnings call for Q1 2024 held on May 2, 2024. During the call, the company reported that its TAP sales platform’s national rollout for the BOP business is now complete. The company is actively working on adding the workers’ compensation line of business to the platform, which will support new business growth in that area. Additionally, Hanover is expanding the use of APIs to enhance the TAP sales reach by efficiently connecting to additional sources of business and adding targeted products to its specialized offerings.

Get Coverager to your inbox

A really good email covering top news.Related Posts