Guidewire to Acquire Cyence, Signals Good Day for Dowling Capital Management

P&C software provider Guidewire Software and cyber risk platform Cyence announced that the companies have entered into a definitive agreement for Guidewire to acquire Cyence. Guidewire will pay approximately $275 million in cash and stock .

San Mateo-based Cyence, established in 2015 by Arvind Parthasarathi and George Ng, offers a data listening and risk analytics solution combining Internet-scale collection and curation of external data with sophisticated machine learning and risk modeling, which supports insurers’ product management, actuarial, underwriting, and enterprise risk management functions.

“Cyence started applying our data science engine to cyber risk given the significant demand from the insurance industry on what is an existential threat for their insureds. We look forward to joining Guidewire and continuing our mission to enable insurers to enter new markets by insuring emerging risks like cyber. We are excited by the opportunity to power our approach with operational data and policy lifecycle support from Guidewire’s core systems and to join forces with the technology leader serving the P&C insurance industry” – cofounder and CEO of Cyence, Arvind Parthasarathi.

Recall: Cyence has recently raised a $40M Venture round from Dowling Capital Management, IVP, and New Enterprise Associates.

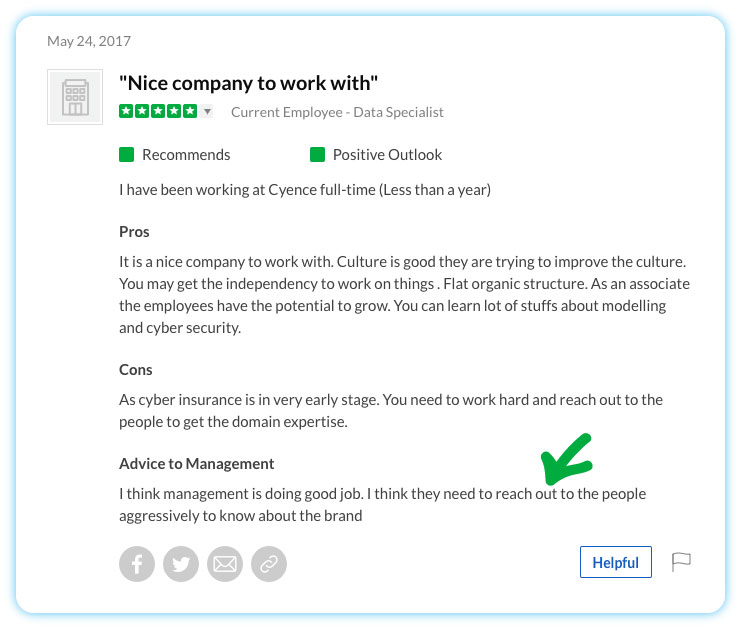

Bottom Line: it no longer needs to reach out to people about its brand.