Greenlight Re backs Nimbla

Greenlight Re Innovations, part of Greenlight Re , a specialist property and casualty reinsurance company headquartered in the Cayman Islands, has announced an undisclosed investment in Nimbla , a digital managing general underwriter focusing on the small and medium-sized enterprise (SME) credit insurance market.

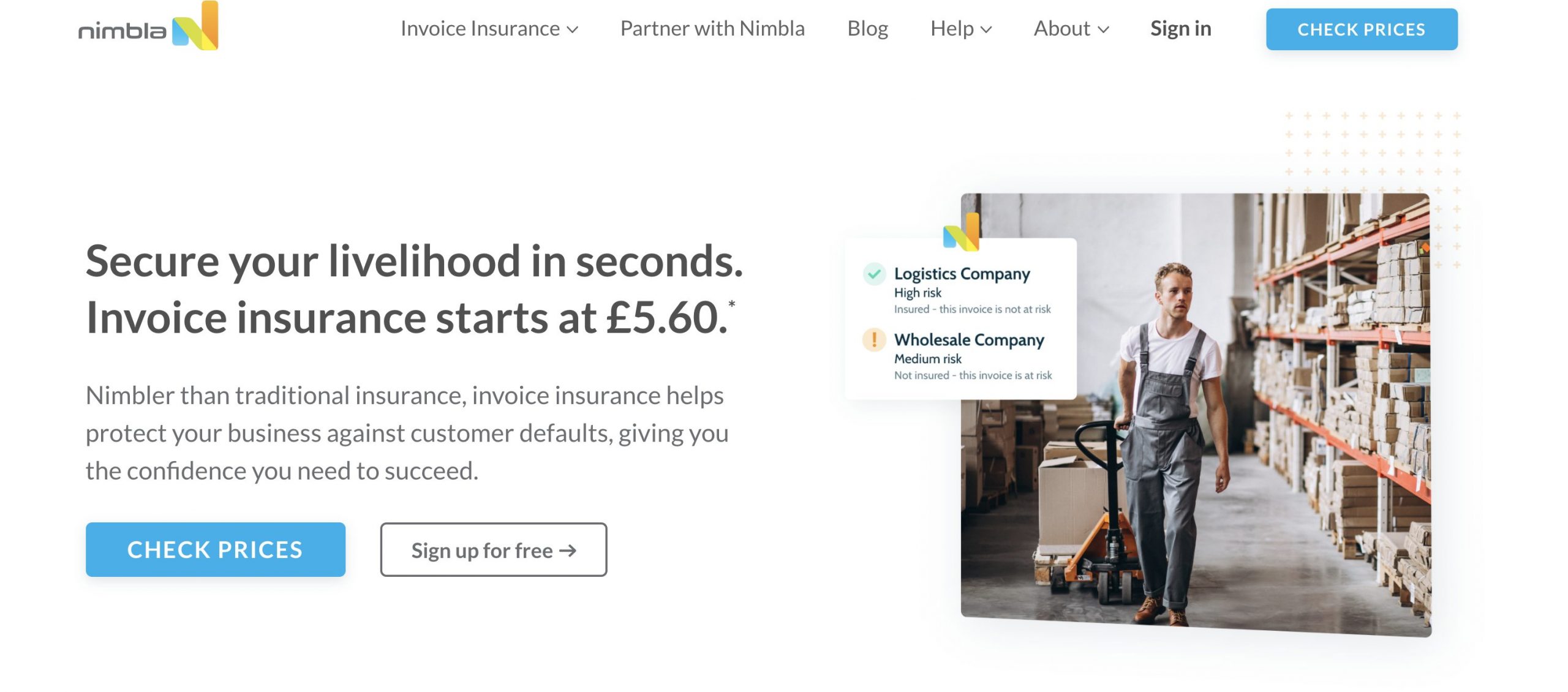

London-based Nimbla was established in 2016 to make sure SMEs get paid. It offers several services such as credit reports, cashflow forecasting, and invoice insurance. The startup’s invoice insurance is an on demand ‘pay as you trade’ trade credit coverage that offers policyholders the flexibility of deciding whether they wish to cover a single invoice or their whole book. Nimbla policies are underwritten by QBE.

“In the current challenging economic environment, trade credit insurance offers valuable protection to businesses. The traditional trade credit underwriting process is cumbersome and Nimbla’s technology has introduced a new level of pricing speed and accuracy to trade credit insurance.” – Simon Burton, CEO at Greenlight Re.

“Nimbla has turned traditional trade credit insurance on its head with single invoice insurance; quote and bind in less than two minutes which significantly disrupts the traditional model. The partnership with Greenlight enables us to widen our reach geographically and build and distribute more complementary products, particularly during this challenging time for businesses. We recently added the ability to insure against credit risks in mainland Europe, responding to the demand from our customers. We have also launched our new API which enables funders to make ‘in the moment’ credit wrapped decisions. This speed and agility are trademarks of Nimbla and our partnership with Greenlight enables us to continue to innovate and be market makers rather than followers.” – Elizabeth Jenkin, CCO at Nimbla.