FOXO to become publicly traded company

FOXO Technologies announced its plans to become a public company via a SPAC merger with Delwinds Insurance Acquisition Corp. The deal would value the combined company at an estimated enterprise value of $369 million.

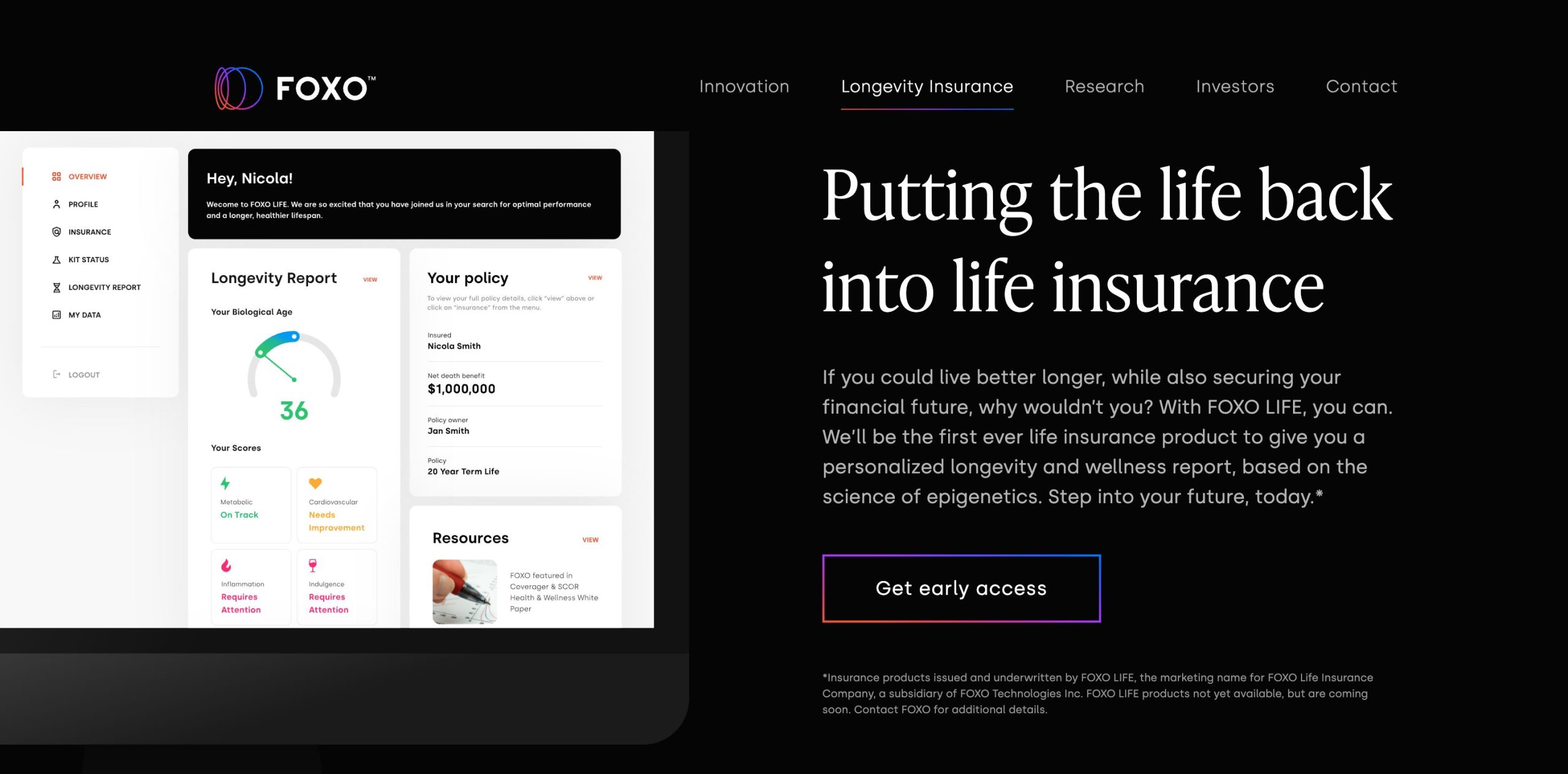

Founded in 2016, the Minneapolis-based company intends to offer life insurance products alongside its FOXO Longevity Report that provides consumers with insights into rates of biological aging based on the ‘epigenetic clock’ developed by Dr. Steve Horvath at UCLA. In addition to the ‘epigenetic clock’, the FOXO Longevity Report™ includes proprietary epigenetic-based wellness measures to inform and support consumer health and longevity.

More briefly though, the success of FOXO will be centered on its ability to commercialize its saliva-based underwriting technology.

More technically, FOXO’s epigenetic biomarker technology is designed to address the same underwriting questions blood and urine specimens address today. FOXO uses micro-array technology developed and supplied by Illumina and machine learning technology developed and supplied by DataRobot to commercialize its epigenetic biomarker technology.

Bottom Line: This year, FOXO intends to launch term life insurance products reinsured by SCOR , which will be sold by its life insurance company FOXO Life primarily through agents who will have access to an accelerated underwriting engine called Velogica (by SCOR).