Fail Fast? First, Understand the Customer

From the Ford Edsel to a facial mask that delivers electric shocks, Sweden’s Museum of Failure offers hundreds of tangible, often amusing reminders that the path to success is littered with many, many botched product launches.

If nothing else, a visit reinforces that innovation is a risky business. Still, insurers can take away an even more important lesson from failed launches. In nearly every case, the creators made a classic mistake: they fell in love with their solution before understanding their products’ underlying problems.

Too quickly assuming what customers want is an easy trap to fall into. What’s harder is stepping back and understanding the root causes of customer behavior by clearly defining not only what customers need, but also what they do not need. Silicon Valley disruptors will often proudly quote (and sometimes misquote) auto manufacturing pioneer Henry Ford: “If I had asked people what they wanted, they would have said faster horses.” Their argument is that relying solely on customer input can impede innovation. While this idea holds some truth, Ford still knew exactly what his customers needed: more efficient transportation. He could place himself in his customers’ shoes, empathizing with their frustration over grindingly slow transportation in the horse-and-buggy era and then devising the best response to that problem: the Model-T.

Know Your Tech, Know Your Policyholder

When it comes to insurance product development, understanding customers’ needs is becoming increasingly difficult. Why? In brief, customers’ needs are evolving faster than ever before, especially in Asia. Rapidly aging populations and a growing middle class mean demographic change that in turn affects customers’ situations and motivations. Further disrupting the industry are lifestyle changes brought about by financial or physical access to new goods and services. Even Japan’s relatively mature market is witnessing an explosion of product innovation according to a 2018 RGA Product Development Survey on evolving policyholder preferences.

Perhaps more importantly, emerging technologies are providing customer service options that few could have envisioned, even a few years ago. For example, the chatbot, a form of artificial intelligence (AI), which already features prominently in other financial services, is capable of rapidly and efficiently managing customer queries in the life insurance industry. In fact, RGA’s 2018 Global Claims Technology Survey shows that while insurers widely recognize the benefits of digitized back-end processes (see Figure 1), only 7% of global life insurers reported using chatbot technology. Even fewer, just 6%, were using wearable technologies to collect health and wellness data on insureds although this technology too could enhance underwriting and claims processes.

Figure 1: 2018 RGA Global Claims Technology Survey – Key Benefits

This survey begs an important question: how can an industry catch up to emerging technologies when its consumers won’t stand still? But don’t be discouraged. 85% of respondents reported implementing or planning to implement AI, wearable, and/or chatbot technologies in a few years.

Know Your Customers’ Preferences and Problems

You can start by thoroughly understanding the impact of your products on policyholders. One of the first projects I worked on at RGAX focused on how insurers could contribute to suicide prevention in the UK. For me, this project highlighted more than just the responsibility insurers hold; it raised the opportunity to create products and solutions that can help people live happier, healthier, and more financially secure lives. The life and health insurance customer journey is, after all, a deeply emotional experience, from the first time an individual considers purchasing insurance to the moment a policyholder navigates the claims process. While we must be responsible in ensuring risks are priced properly, at the same time we must consider the human aspects of product, channel, and process design.

Marketers refer to the purchasing process as a customer journey for a reason: it isn’t an instantaneous event but a trip full of considerations, distractions, and off-ramps. Keeping the customer focused and invested requires us to reexamine our products and processes through the applicant or claimant’s lens. The effort can be transformative, but it can be difficult as well.

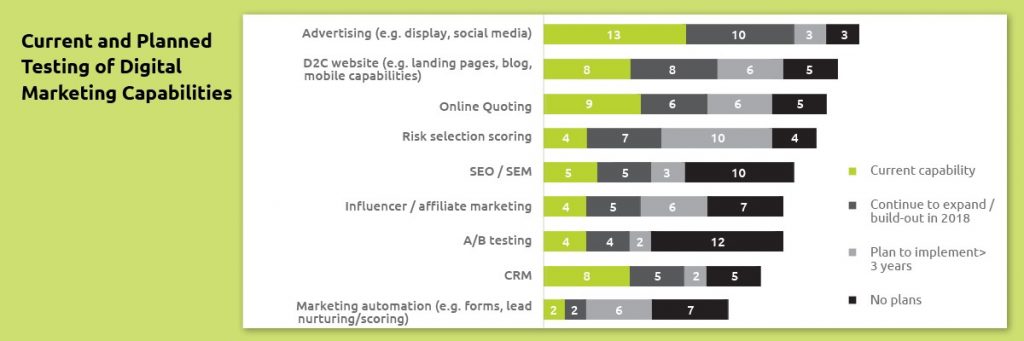

Too often, actuarial needs or compliance requirements, not customer preferences, have driven product development trends. However, only when the policyholder’s problems are fully understood can the team devise a solution. A Digital Distribution Survey that our team conducted found that even small- to mid-sized life insurers were investing in direct-to-consumer web sites, online quoting, and mobile delivery options as a direct result of customer testing with the specific goal of enhancing customer satisfaction (see Figure 2).

Figure 2: RGAX 2018 Digital Distribution Survey

These numbers demonstrate how our customers are constantly evolving and how technology disruption is not going away. Keeping these current realities in mind, RGAX has adapted a design thinking methodology to the life insurance industry. Called a Life Design Sprint, it is a human-centered innovation process comprising a five-phase brainstorming framework to help insurers solve wicked challenges. Certainly, undergoing a Life Design Sprint requires an initial investment of time and resources, but both are easily offset by the priceless achievement of true customer understanding.

To quote another great innovator, Albert Einstein, “If I had an hour to solve a problem, I’d spend 55 minutes thinking about the problem and five minutes thinking about solutions.

Featured Resource: How to Accelerate Innovation in Life Insurance eBook

Get your guide on how to identify and move complex problems forward and champion transformation >>